Key Points:

- After a two-year wait, FTX begins repaying creditors with claims under $50K, including 9% annual interest. Payments processed via BitGo and Kraken will reach recipients in 1–3 business days.

- Next payout rounds are set for April 11 and May 30, with larger claims (over $50K) scheduled for Q2 2025.

- Part of FTX’s $17 billion reorganization plan, effective January 3, 2025, marking significant progress in crypto’s biggest bankruptcy case.

The estate of bankrupt crypto exchange FTX has officially started distributing cash through the first round of FTX creditor payouts, more than two years after Sam Bankman-Fried’s trading platform collapsed.

Read more: FTX Creditor Payouts Update As Initial Funds Are Allocated

Future FTX Creditor Payouts Scheduled for 2025

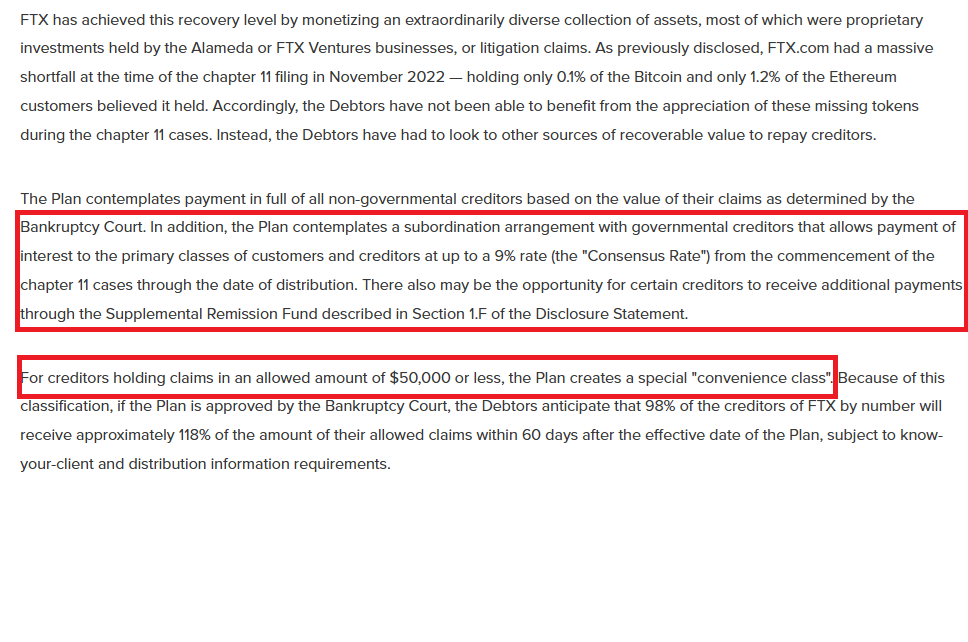

In a May 7 statement, the “Convenience Class” — those with claims of $50,000 or less — who will be the first to benefit, receiving full repayment plus 9% of the accrued annual interest since November 2022.

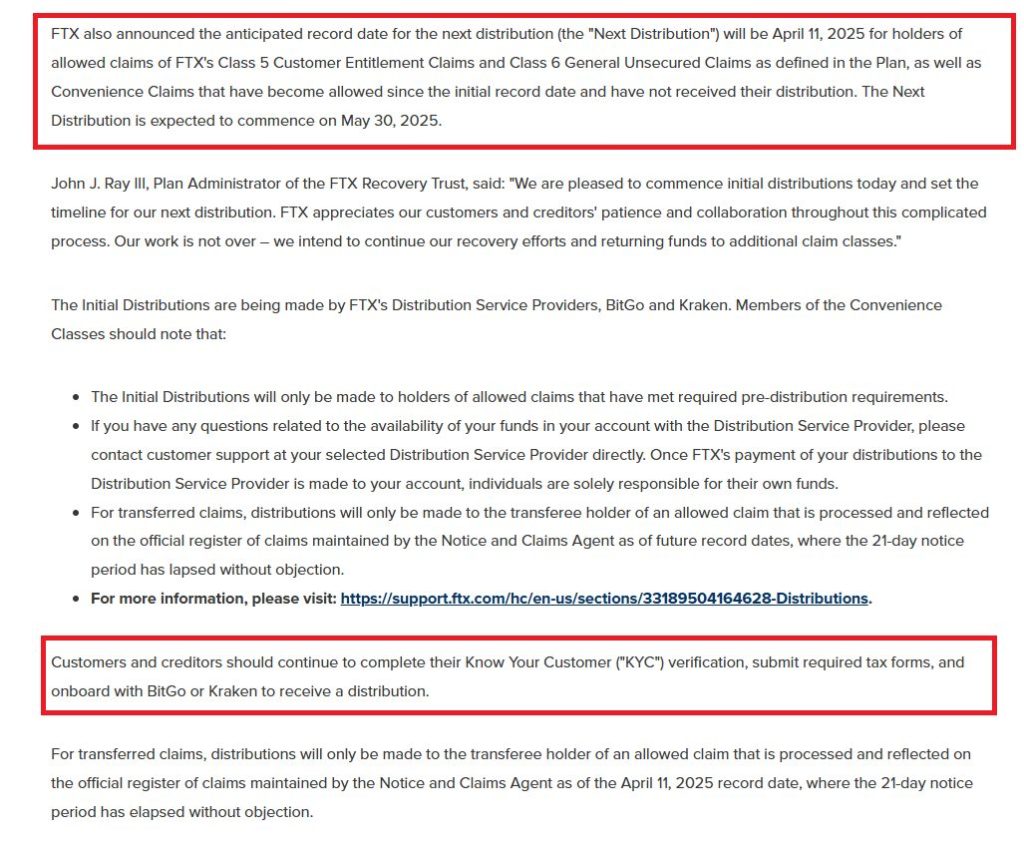

According to a statement from the estate on Tuesday, recipients should expect to see funds in their accounts within one to three business days. The initial FTX creditor payouts are processed through leading crypto firms BitGo and Kraken.

The estate has also announced future distribution dates: the next round of FTX creditor payouts is scheduled for April 11, followed by another on May 30. Eligible creditors must complete KYC verification and submit required tax forms to receive payments. Those who miss the deadline can still qualify for future FTX creditor payouts in later distribution phases.

FTX Starts Creditor Repayments With $7B Initial Distribution

In a May 7 statement, FTX creditor payouts for creditors with claims exceeding $50,000 will begin in the second quarter of 2025. In total, FTX plans to distribute $17 billion, with $7 billion allocated for the first phase.

These repayments are part of FTX’s reorganization plan, which took effect on January 3, 2025. The plan marks a significant milestone in FTX’s efforts to recover assets and resolve its prolonged bankruptcy case. This latest development brings hope to many awaiting FTX creditor payouts, signalling positive progress in one of the largest collapses in crypto history.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |