Bybit, one of the world’s largest cryptocurrency exchanges, fell victim to a massive security breach on February 21, 2025, resulting in the loss of more than $1.4 billion worth of digital assets.

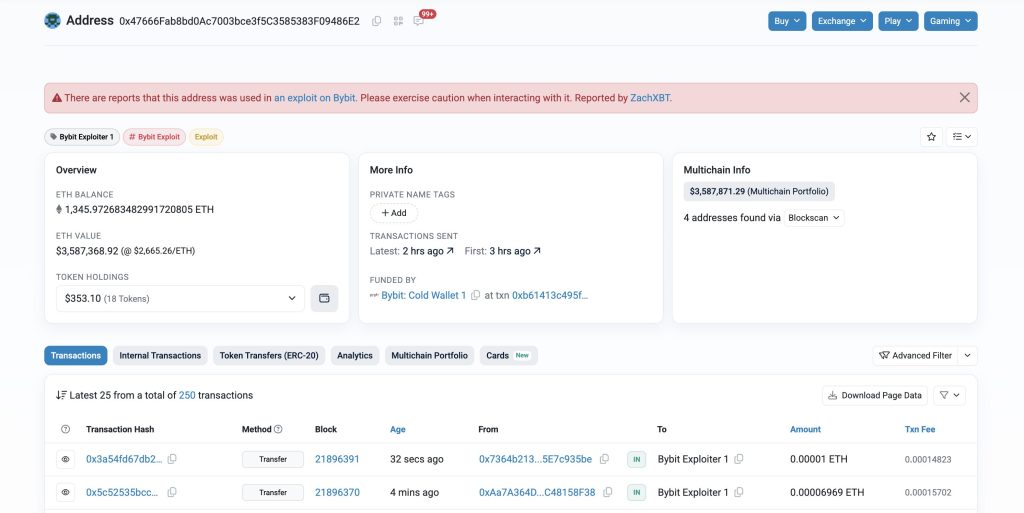

Initial reports of the hack emerged on X, with on-chain analysts identifying unauthorized withdrawals from Bybit’s hot wallet.

Ether Prices Drop as Market Reacts to the Bybit Hack

CEO Ben Zhou confirmed the Bybit hack, marking one of the largest crypto thefts in history.

Blockchain activity indicated that the attacker had been liquidating the stolen assets, primarily Ethereum (ETH) and staked Ethereum (stETH) through decentralized exchanges in the hours following the Bybit hack.

Research firm Arkham Intelligence verified the outflow, estimating that approximately $200 million worth of an Ether derivative had already been sold.

Despite the scale of the breach, Zhou assured users that Bybit had sufficient reserves to compensate affected clients.

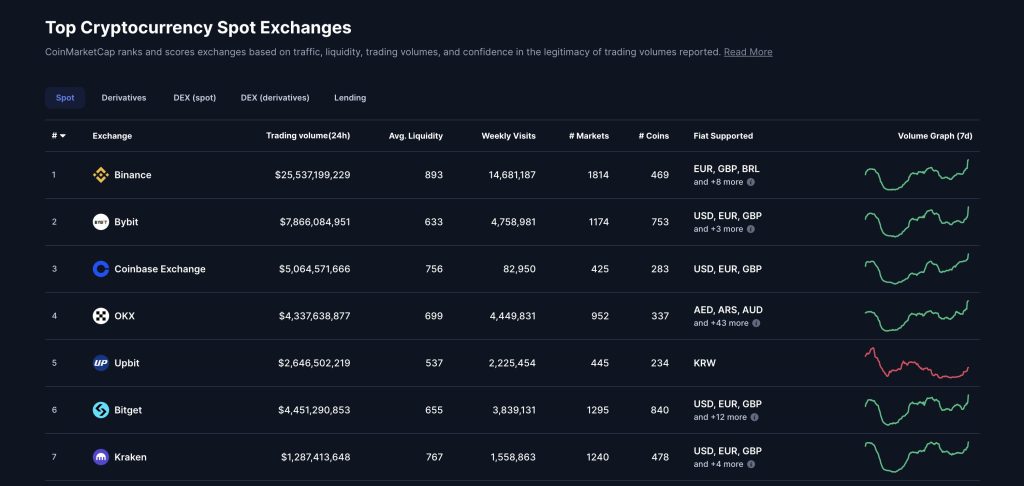

Founded in 2018 and headquartered in Dubai, Bybit is a major player in the crypto trading space and is second only to Binance in terms of trading volume, according to CoinMarketCap data.

The hack sent shockwaves through the crypto market, causing Ether prices to drop over 1.9% daily as investors reacted to the news.

The Biggest Cryptocurrency Crash of Centralized Exchanges

The Bybit hack has been described as the largest-ever crypto heist, surpassing the $611 million stolen from Poly Network in 2021. Bloomberg reported that the blockchain security firm Elliptic and cybersecurity expert Rob Behnke have both characterized it as one of the most significant breaches in digital asset history.

The attack is part of a broader surge in cyber threats targeting the crypto sector. The first weeks of February saw a rise in security breaches, including social media exploits affecting Solana-based decentralized exchange Jupiter and former Malaysian Prime Minister Mahathir Mohamad.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |