Key Points:

- Arbitrum DAO proposes deploying 7,500 ETH to non-native projects for ecosystem growth but is facing criticism for neglecting native projects.

- The proposal will enter the Snapshot voting phase on February 27, with possible revisions if it fails based on community feedback.

A new investment proposal from the Growth Management Committee (GMC) of Arbitrum DAO has ignited debate within the community.

The plan, which involves deploying 7,500 ETH to external decentralized finance (DeFi) protocols, has drawn criticism for overlooking native Arbitrum-based projects.

Arbitrum DAO’s Investment Plan Faces Community Scrutiny

Under the proposal, 5,000 ETH would be allocated to Lido’s liquid staking protocol in exchange for 5,000 wstETH (wrapped staked ETH) tokens. These tokens would then be deposited into Aave V3 on Arbitrum, aiming to encourage lending and leverage incentive programs linked to Lido, Aave, Renzo, and Kelp.

An additional 2,500 ETH would be invested in Fluid, a lending protocol on the Arbitrum platform. Expected yields include a 4.54% return on wstETH deposits and a 1-2% yield on Fluid allocations, which also aims to enhance liquidity within the ecosystem.

Proponents of the plan argue that the selected DeFi protocols offer stability, conservative returns, and growth opportunities for Arbitrum’s ecosystem. However, detractors claim the strategy neglects native Arbitrum projects, potentially limiting the platform’s development and competitiveness.

The proposal is set to enter the Snapshot voting phase on February 27. If it fails, the GMC has indicated a willingness to incorporate community feedback and present a revised plan in the coming weeks.

RWA Investments and Governance Shifts in Arbitrum DAO

Arbitrum DAO also continues expanding its investment footprint in real-world assets. On February 18, the community approved allocating 35 million ARB to various stable assets.

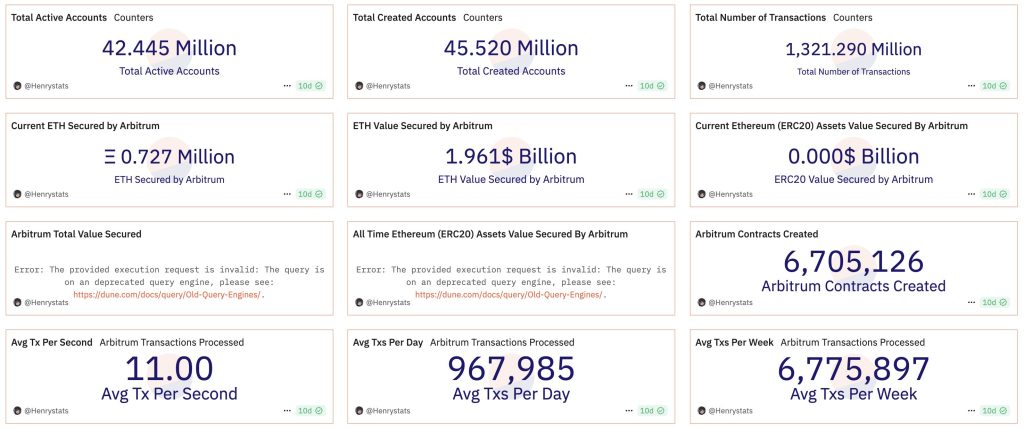

Arbitrum remains one of Ethereum’s leading Layer 2 solutions, processing an average of nearly 1 million transactions daily. Governance decisions are made through the Arbitrum DAO, where ARB token holders cast votes, with one ARB equating to one vote.

Recently, Lobby Finance, an organization dedicated to integrating lobbying into DAO decision-making, has become the leading delegate in the governance of Arbitrum.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |