Key Points:

- Pump.fun AMM Development could disrupt Raydium’s dominance on Solana, driving RAY token down by 22% in 24 hours.

- The platform is also tightening security, blocking Bybit hackers from laundering stolen funds through meme coins.

Pump.fun’s new AMM could challenge Raydium’s dominance on Solana, impacting RAY token price and liquidity flow.

Pump.fun AMM Development could challenge Raydium, impact RAY token prices, and disrupt Solana’s liquidity. Read about its security updates against Bybit hackers.

Pump.fun AMM Development Threatens Raydium’s Position

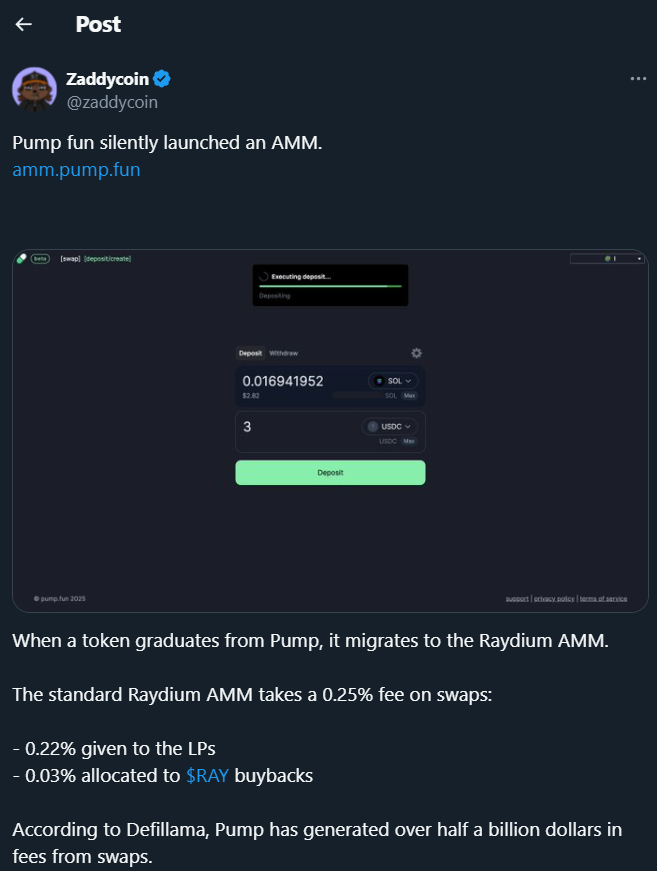

Meme coin launchpad Pump.fun is reportedly testing its automated market maker (AMM), potentially replacing Raydium as the go-to liquidity provider for newly launched tokens. According to on-chain sources, a test version of amm.pump.fun has been spotted, sparking speculation that Pump.fun aims to reroute liquidity away from Raydium.

At present, tokens graduating from Pump.fun migrate to Raydium, which charges a 0.25% swap fee—with 0.22% allocated to liquidity providers (LPs) and 0.03% used to buy back RAY tokens. However, if Pump.fun fully deploys its AMM, it could retain swap fees within its ecosystem, maximizing revenue and controlling liquidity flow.

The impact on Raydium has been immediate, with RAY plunging over 28% within hours of the rumor spreading, now trading around $3.1. This suggests traders anticipate a decline in Raydium’s fee-based revenue should Pump.fun redirect swap volumes to its AMM.

Pump.fun’s AMM Model and Potential Fee Adjustments

Industry analysts predict that Pump.fun’s AMM might introduce higher swap fees of 2-3%, alongside a token reward system for its community. The platform has already amassed over $509 million in transaction fees since its launch and a proprietary AMM could solidify its dominance over Solana’s meme coin liquidity.

Raydium has long benefited from Pump.fun’s growth, as projects pay 6 SOL (around $950) to migrate their tokens to its liquidity pools. However, Pump.fun’s latest move suggests an intent to directly capture trading volume and fees, reducing Raydium’s market share.

Despite Pump.fun remaining silent on an official launch date, the test AMM’s integration with its existing infrastructure hints at an imminent rollout. Traders and developers alike are now closely watching how Pump.fun structures its fee system—whether it undercuts, matches, or surpasses Raydium’s.

Pump.fun Takes Action Against Bybit Hackers’ Money Laundering Attempts

Beyond AMM development, Pump.fun is also cracking down on money laundering via meme coins, following the $1.4 billion Bybit hack. On-chain sleuths identified a hacker-linked wallet using Pump.fun to create a token named QinShihuang, which quickly amassed $26 million in trading volume—raising red flags about illicit fund movements.

Pump.fun responded swiftly, blacklisting and removing QinShihuang from its platform to halt potential money laundering activities. Despite these efforts, the hacker’s addresses continue deploying multiple meme coins, complicating enforcement.

Bybit has acknowledged Pump.fun’s proactive security measures, applauding the platform for protecting the crypto ecosystem. Meanwhile, Circle, Tether, and various exchanges have frozen over $42.89 million in stolen funds linked to the hack, showing a coordinated industry effort to curb illicit activity.

While Pump.fun’s AMM development could reshape Solana’s meme coin economy, its crackdown on suspicious transactions signals a more security-conscious approach. The coming weeks will be crucial in determining how Raydium adapts to this potential disruption, and whether Pump.fun’s liquidity shift sets a new standard for Solana’s decentralized finance (DeFi) landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |