Bybit’s ETH Reserves Hit 100%, Deposits and Withdrawals Back to Normal

Key Points:

- Bybit’s ETH reserves reach nearly 100% after the February 2025 hack.

- Normal deposit and withdrawal operations resumed with enhanced security measures in place.

- User confidence returns as the ETH price stabilizes at $2,724.75 by February 24.

Following a massive $1.4 billion hack on February 21, 2025, cryptocurrency exchange Bybit has restored its Ethereum operations to near-normal status. The company implemented emergency measures, acquiring 446,870 ETH to stabilize reserves.

Bybit official X account confirmed that deposits and withdrawals have resumed regular function, with reserves approaching 100%. While the initial breach caused ETH prices to drop 8%, the market has shown signs of recovery as Bybit’s security measures prove effective.

Bybit’s ETH Reserves Are “Close to 100%”

On February 21, Bybit, a well-known cryptocurrency exchange, experienced a notable security breach attributed to North Korea’s Lazarus Group. The cyberattack resulted in the theft of over 400,000 ETH, with an estimated value of approximately $1.4 billion, from the exchange’s reserves.

In the aftermath of the breach, Bybit observed an unprecedented withdrawal surge, amounting to $5.468 billion, reflecting users’ concerns regarding the security of the platform.

In immediate response to the breach, Bybit implemented measures to secure emergency liquidity through various avenues, including loans, deposits, and the acquisition of ETH. As part of these efforts, the exchange managed to obtain around 446,870 ETH, valued at approximately $1.23 billion.

We’re close to 100% on our ETH reserves, and deposits & withdrawals are back to normal. Through it all, the crypto community, our partners, and our users have shown unwavering support—thank you.

Bybit stated

Despite the challenges faced, Bybit’s recovery initiatives were effective in maintaining operational stability. CEO Ben Zhou affirmed that the exchange’s reserves were adequate to cover all user funds, aiming to reassure clients about the continuity and security of their assets.

Ethereum Price Volatile After Bybit Breach, Recovers to $2,860

The news of a significant security breach at Bybit triggered sharp fluctuations in the Ethereum market. Following the announcement on 21 Feb, Ethereum’s price fell from $2,845 to $2,614, observing an 8% decrease.

As Bybit implemented emergency measures in response to the breach, market sentiment began to stabilize. Although Ethereum experienced a recovery of 8%, bringing the price back to $2,860 at 23:00 (UTC) on 23 Feb, Ethereum is trading at $2,709 as of this writing.

Bybit Hack Exposes $1.5B Loss to North Korean Group: Summary

On February 21, 2025, Bybit, one of the world’s leading cryptocurrency exchanges, experienced the largest hack in cryptocurrency history, resulting in the theft of over $1.5 billion in assets.

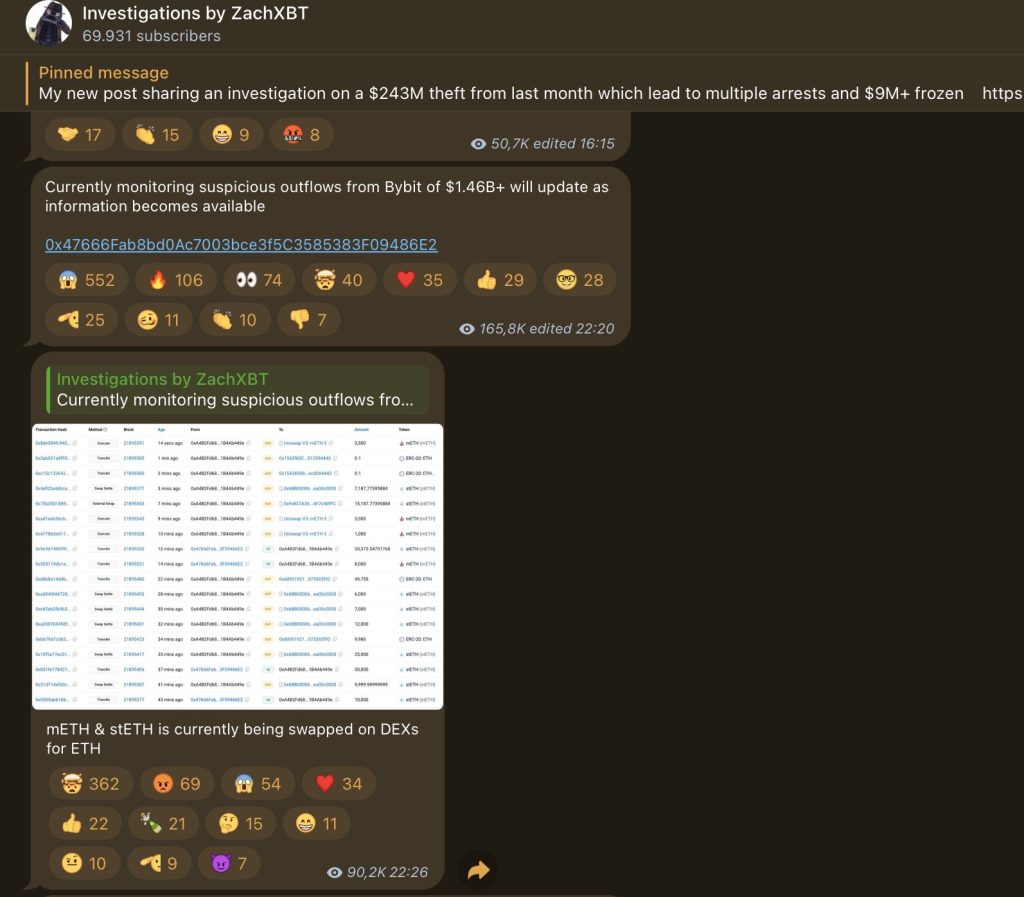

The breach was initially detected by crypto analyst ZachXBT, who reported suspicious withdrawal activity involving more than 401,346 ETH, along with a variety of staking tokens being transferred swiftly from the platform.

The attackers employed sophisticated techniques, including spoofing the software interface to deceive the Bybit trading team into making unauthorized modifications to the smart contract logic of the exchange’s cold wallet.

Following the incident, Bybit’s CEO, Ben Zhou, confirmed the security breach, prompting further investigation. ZachXBT’s subsequent analysis traced the cyberattack to North Korea’s Lazarus Group, identifying 39 wallet addresses associated with the incident.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |