Key Points:

- Su Zhu-backed OX.FUN is accused of withholding a $1M USDC withdrawal, sparking allegations of insolvency and manipulation.

- The exchange claims JefeDAO violated trading rules by engaging in an oracle manipulation attack.

- The controversy has triggered a 55% crash in OX token value over the past month, raising fears of a liquidity crisis.

Decentralized exchange OX.FUN, backed by Three Arrows Capital co-founder Su Zhu, is under fire for freezing a $1M USDC withdrawal by NFT artist collective JefeDAO. Allegations of insolvency, extortion, and market manipulation have fueled speculation about the exchange’s financial stability.

The Su Zhu-backed OX.FUN controversy highlights growing concerns over decentralized exchange solvency and governance. As DeFi adoption rises, disputes like this raise critical questions about fund security, exchange transparency, and the risks of relying on native tokens for liquidity. With the SEC and Japan’s FSA increasing regulatory scrutiny on DeFi platforms, the outcome of this dispute could set a precedent for how decentralized financial platforms handle fund withdrawals.

Su Zhu-backed OX.FUN Accused of Withholding User Funds

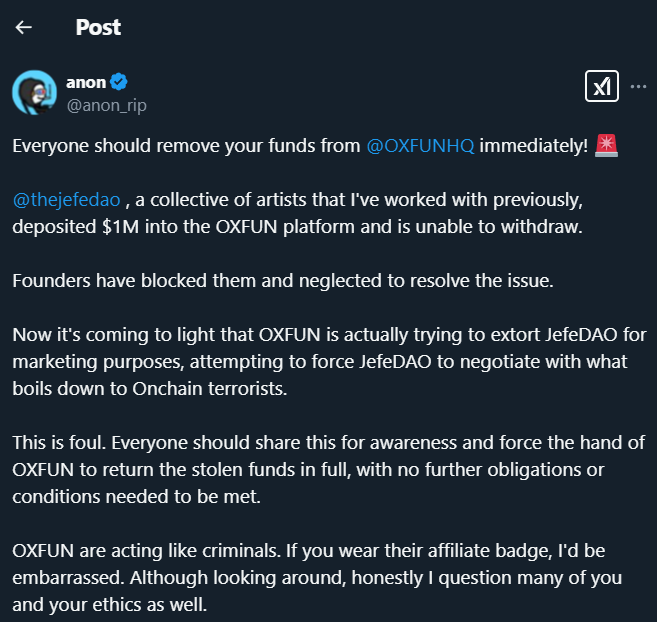

OX.FUN, a decentralized exchange (DEX) specializing in derivatives trading, has come under scrutiny after JefeDAO, an NFT artist collective, alleged that the platform blocked their $1 million USDC withdrawal.

JefeDAO claims that OX.FUN’s founder, Nicolas Bayle, attempted to coerce them into deleting negative posts about the exchange in exchange for the gradual release of their funds.

The dispute escalated when JefeDAO refused the offer, publicly labeling OX.FUN as a scam. The allegations triggered a wave of criticism from the crypto community, with many users condemning OX.FUN’s actions and warning others to avoid using the exchange.

Su Zhu-backed OX.FUN Denies Accusations, Claims Market Manipulation

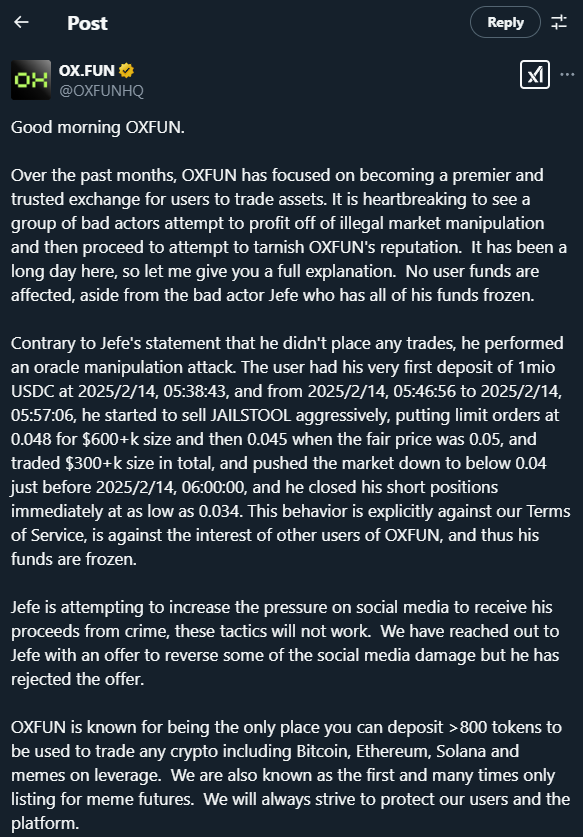

In response, Su Zhu-backed OX.FUN released a statement denying insolvency concerns, asserting that “all withdrawals are processing normally”.

The exchange further alleged that JefeDAO engaged in an oracle manipulation attack, explaining that the artist collective placed large limit orders below market value, and then closed short positions for a profit. OX.FUN claims that this violated its trading rules, justifying the fund freeze.

JefeDAO, however, refuted these allegations, stating that their trades were legitimate and accusing OX.FUN of using social media pressure as an excuse to avoid processing withdrawals. The controversy has fueled speculation about the exchange’s financial stability.

OX.FUN Faces Liquidity Concerns as OX Token Crashes

As the situation unfolded, Coinbase’s head of product, Conor Grogan, suggested that OX.FUN’s reserves mainly consist of its own OX token, rather than stable assets like USDC. According to Grogan, if the platform were to process JefeDAO’s withdrawal, its USDC balance would drop to nearly zero, raising fears of a potential liquidity crisis.

The controversy has taken a toll on OX’s market value, with the token plunging over 30% in the past 24 hours and over 55% in the last month.

While OX.FUN insists user funds are safe, but the growing concerns over the exchange’s solvency and transparency have put its future into question.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |