Key Points:

- Metaplanet’s Bitcoin Investment reaches 2,235 BTC after acquiring 135 BTC for $12.9 million at an average price of $96,000 per coin.

- Despite market volatility, the firm maintains a 10% unrealized profit, keeping its average BTC purchase price at $82,000.

- Metaplanet’s stock has surged over 4,600% since adopting Bitcoin as a treasury asset, outperforming major equities in Japan.

- The company targets 10,000 BTC by 2025 and 21,000 BTC by 2026, leveraging capital markets to fund acquisitions.

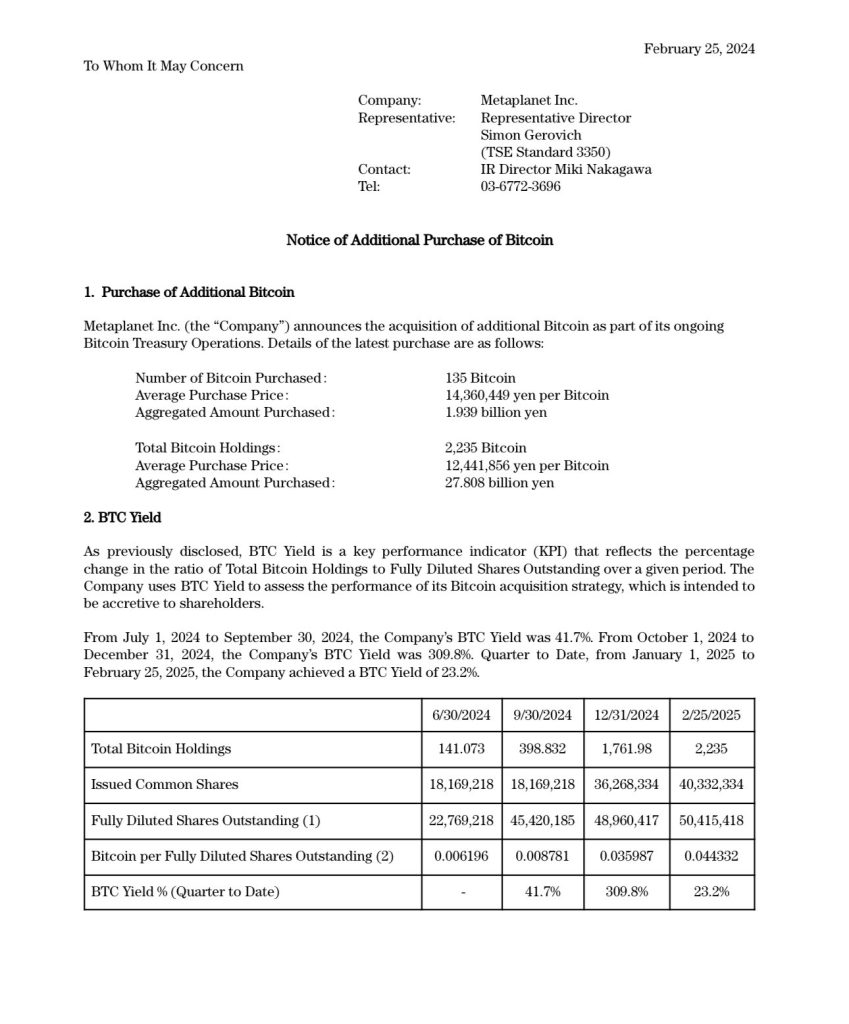

Metaplanet continues to expand its Bitcoin holdings, acquiring 135 BTC at $96,000 per coin for a total of $12.9 million. Despite short-term price volatility, the Tokyo-listed firm now holds 2,235 BTC as part of its long-term strategy to solidify its position as Japan’s leading Bitcoin-focused public company.

Metaplanet’s aggressive Bitcoin accumulation mirrors a broader corporate trend of diversifying into digital assets amid economic uncertainty. The company’s stock has skyrocketed since its strategic shift, reflecting investor confidence in Bitcoin as a hedge against inflation and currency devaluation. As Japan faces rising national debt, Metaplanet’s continued BTC purchases highlight its commitment to leveraging digital assets for financial stability.

Metaplanet Bitcoin Investment Surges with 135 BTC Purchase – A Strategic Move for Future Growth

Metaplanet, often compared to MicroStrategy, has strengthened its Bitcoin reserves by acquiring an additional 135 BTC for 1.9 billion yen ($12.9 million). The company now holds 2,235 BTC, valued at approximately $199.8 million at current market prices.

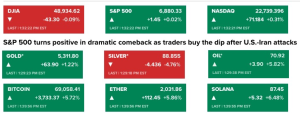

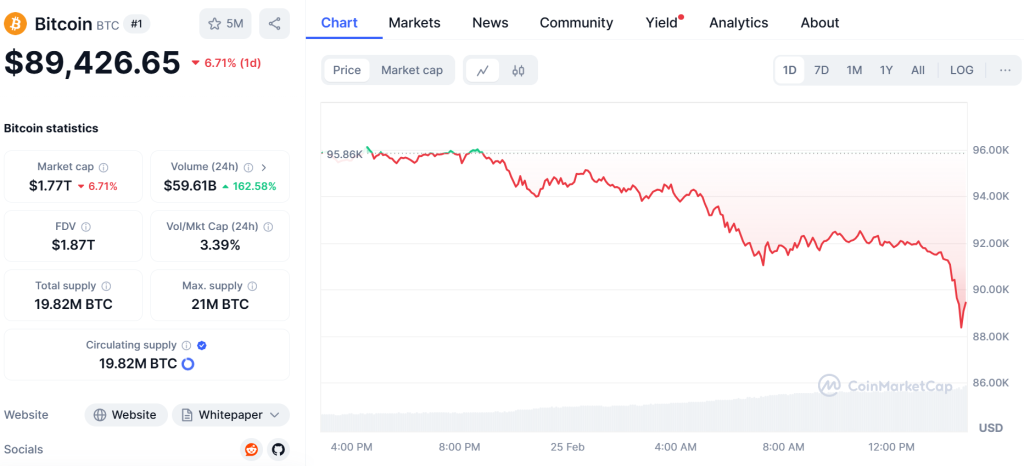

While Bitcoin briefly dipped to $91,000 following U.S. political uncertainty, Metaplanet’s Dollar-Cost Averaging (DCA) strategy ensures a more stable long-term position. The firm’s overall purchase price remains at $82,000 per BTC, giving it a 10% unrealized profit.

With this recent purchase, Metaplanet Bitcoin Investment continues to solidify its reputation as a leader in the digital asset space. The strategy behind Metaplanet Bitcoin Investment reflects a growing confidence in the cryptocurrency market, as more companies turn to Bitcoin as a means of safeguarding their assets.

Such aggressive moves in Metaplanet Bitcoin Investment highlight the ongoing trend toward digital currency adoption in corporate reserves.

Metaplanet’s Bitcoin Strategy Fuels Stock Surge

Since adopting Bitcoin as its primary treasury reserve in April 2024, Metaplanet’s stock has soared over 4,600%, making it one of the top-performing equities on the Tokyo Stock Exchange.

The company has capitalized on Bitcoin’s bullish momentum, positioning itself as Japan’s leading publicly traded Bitcoin investment firm. However, analysts caution that corporate Bitcoin holdings remain highly sensitive to market cycles and regulatory shifts in Japan.

Following the footsteps of Strategy (formerly MicroStrategy), Metaplanet continues to grow its Bitcoin reserves aggressively. The firm’s BTC yield per share increased by 309.8% in Q4 2024, though growth slowed slightly in early 2025 as the company expanded its share count.

Metaplanet Bitcoin Investment’s strategies will play a crucial role in shaping the future of Bitcoin in traditional finance. As the firm approaches its ambitious targets, Metaplanet Bitcoin Investment will likely draw more attention from both investors and analysts alike.

Future Bitcoin Accumulation Goals and Capital Market Strategy

Looking ahead, Metaplanet has set an ambitious target of 10,000 BTC by the end of 2025 and 21,000 BTC by 2026.

The firm has secured funding through a $745 million equity capital raise, underscoring its commitment to Bitcoin as a hedge against Japan’s economic challenges, including:

- Rising national debt.

- Yen depreciation.

- Global inflation risks.

With 2,235 BTC now in its treasury, Metaplanet holds over 0.01% of Bitcoin’s total supply, reflecting its long-term vision for digital asset adoption. The above assets are currently worth up to 199.8 million USD, while the BTC price is around 89,400 USD.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |