Noble Launches Yield-Paying USDN Stablecoin with Incentive Program

Key Points:

- Noble launches USDN stablecoin, a yield-generating digital asset designed for seamless multi-chain integration.

- USDN stablecoin leverages M^0 technology, allowing developers to customize compliance, branding, and yield distribution.

Noble has introduced its highly anticipated USDN stablecoin, a yield-generating digital asset pegged to the U.S. dollar, The Block first reported the news.

The startup announced the launch on Wednesday with a new points-based rewards campaign designed to offer users additional ways to earn returns.

USDN Stablecoin Launches with Yield-Generating Features

USDN stablecoin distributes yields programmatically to on-chain partners, including developers, validators, wallets, and exchanges. The stablecoin will operate across multiple blockchain ecosystems, including Cosmos, Initia, Celestia, and Ethereum Virtual Machine (EVM) appchains, enabling seamless cross-chain functionality.

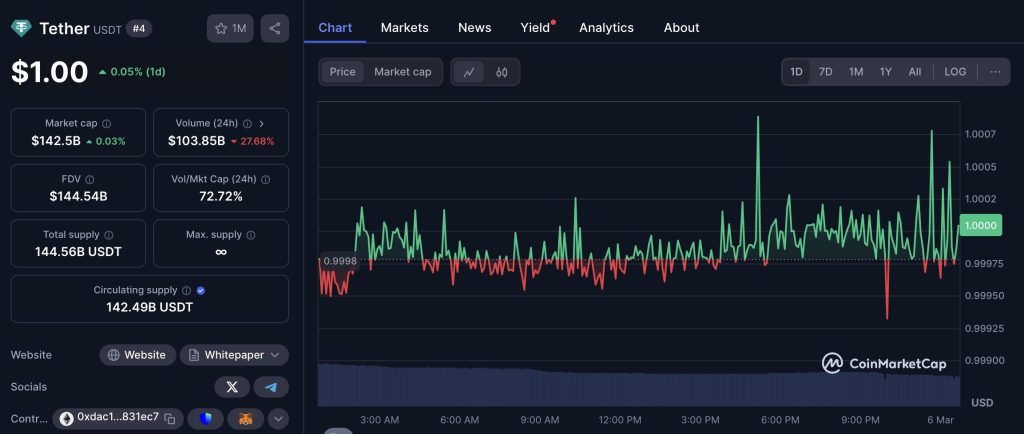

USDT has long dominated the stablecoin market, benefiting primarily its corporate backers through reserve-generated profits. In contrast, USDN stablecoin introduces a model that directly shares yields with network participants.

USDN’s yield is derived from short-term U.S. Treasury holdings, with an estimated annual percentage yield (APY) of 4.15% at launch, subject to changes based on underlying collateral. The stablecoin will initially be supported in the Keplr Wallet and can be acquired via credit card through Moonpay.

USDN stablecoin is powered by M^0, an Ethereum-based protocol that acts as a stablecoin extension engine. M^0 enables developers to customize stablecoin features such as branding, compliance tools, and yield distribution. The protocol’s core stablecoin, $M, serves as a foundation for tailored stablecoin solutions, including USDN.

New Rewards Program Encourages Adoption

To drive adoption, Noble is introducing a dual-tiered rewards system. Users can deposit USDN into a Staking Vault, where funds are locked for up to four months, sacrificing yield in exchange for accumulating points. Alternatively, the Flexible Vault offers higher yield returns, funded by forfeited staking rewards.

The launch follows Noble’s $15 million Series A funding round and marks a strategic expansion within the Interchain ecosystem. Noble has previously facilitated the integration of USDC into IBC-connected chains and improved cross-chain transactions involving Circle’s stablecoins.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |