SEC and CFTC Reaffirm Market Oversight as Crypto Enforcement Shifts

Key Points:

- SEC and CFTC officials reaffirm their dedication to crypto enforcement despite policy shifts under the Trump administration.

- The SEC has scaled back crypto enforcement, withdrawing cases against major firms, while overall enforcement actions declined in 2024.

According to Reuters, federal market regulators reaffirmed their commitment to crypto enforcement despite major changes taking place under the Trump administration.

Speaking at an American Bar Association event in Miami, officials from the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) emphasized that crypto enforcement remains a priority even as agency leadership changes.

Regulators Pledge Continued Crypto Enforcement Actions Under Trump Administration

Antonia Apps, acting deputy enforcement director at the SEC, acknowledged adjustments in priorities but stressed that core enforcement efforts will persist.

“You can expect to see some changes based on priorities and the different policies we may pursue,” Apps said. “But we are going to move forward with the core enforcement agenda we have always moved forward with.”

Brian Young, enforcement director at the CFTC, also reaffirmed the agency’s dedication to market oversight. He highlighted a shift in enforcement strategy, with a greater emphasis on cases likely to return money to victims of fraud or market manipulation. Young praised enforcement staff, noting their significant contributions and dedication to protecting investors.

SEC Scales Back Crypto Enforcement Post-Gensler Era

Crypto enforcement has seen notable shifts, with the SEC pausing or withdrawing multiple high-profile cases, including litigation against Coinbase, Robinhood, Gemini, and Uniswap Labs.

The agency also dismissed a lawsuit against Kraken and closed an investigation into non-fungible token company Yuga Labs this Monday. The SEC is reportedly scaling back a specialized unit of over 50 lawyers dedicated to crypto enforcement, according to The New York Times.

Despite shifts in strategy, Apps affirmed the SEC’s continued scrutiny of the cryptocurrency sector. “We are not walking away,” she said, emphasizing that the agency will pursue cases involving fraud and areas where it maintains jurisdiction.

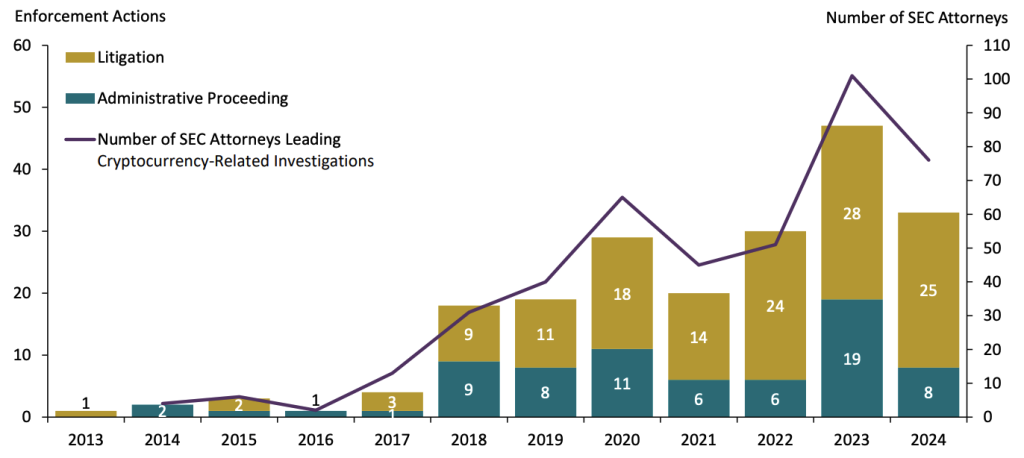

Crypto enforcement actions under former SEC Chair Gary Gensler peaked in 2023 but declined in 2024. According to a report by Cornerstone Research, the SEC pursued 33 cryptocurrency-related enforcement cases last year—a 30% drop from 2023 and the first year-over-year decline since 2021.

The agency initiated 25 lawsuits in U.S. district courts and eight administrative proceedings in 2024. While overall case numbers decreased, monetary penalties reached a record $4.98 billion, driven by a multi-billion-dollar settlement.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |