Key Points:

- Mt. Gox moves Bitcoin worth over $1 billion to an unknown wallet.

- This marks the exchange’s largest transaction since January 2024.

- Speculation rises over whether this Mt. Gox moves Bitcoin is part of upcoming creditor repayments.

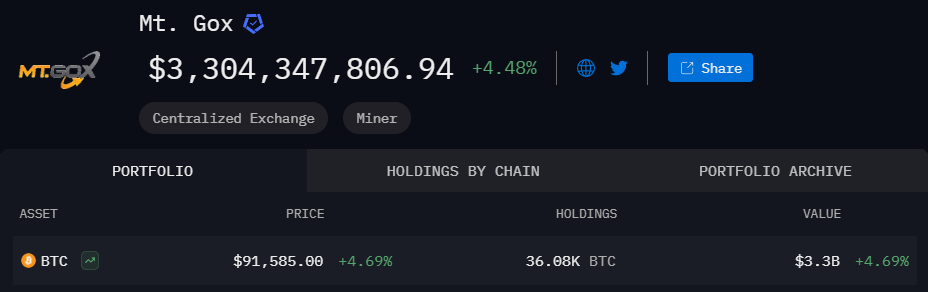

- Mt. Gox still holds over 36,000 BTC, valued at approximately $3.3 billion.

Mt. Gox, once the world’s largest Bitcoin exchange before its infamous collapse, has initiated a significant movement of funds, sparking speculation about the long-awaited creditor repayments.

The unexpected transfer of over $1 billion in Bitcoin from Mt. Gox’s cold wallets raises questions about the exchange’s repayment timeline. Given that creditors have been awaiting restitution for nearly a decade, analysts are debating whether these transfers signal imminent repayments or routine asset management by the exchange’s trustees.

Previous large transfers from defunct exchanges have historically led to temporary market fluctuations, making the event Mt. Gox moves Bitcoin crucial for traders and investors.

Mt. Gox Moves Bitcoin in Largest Transfer Since Bankruptcy

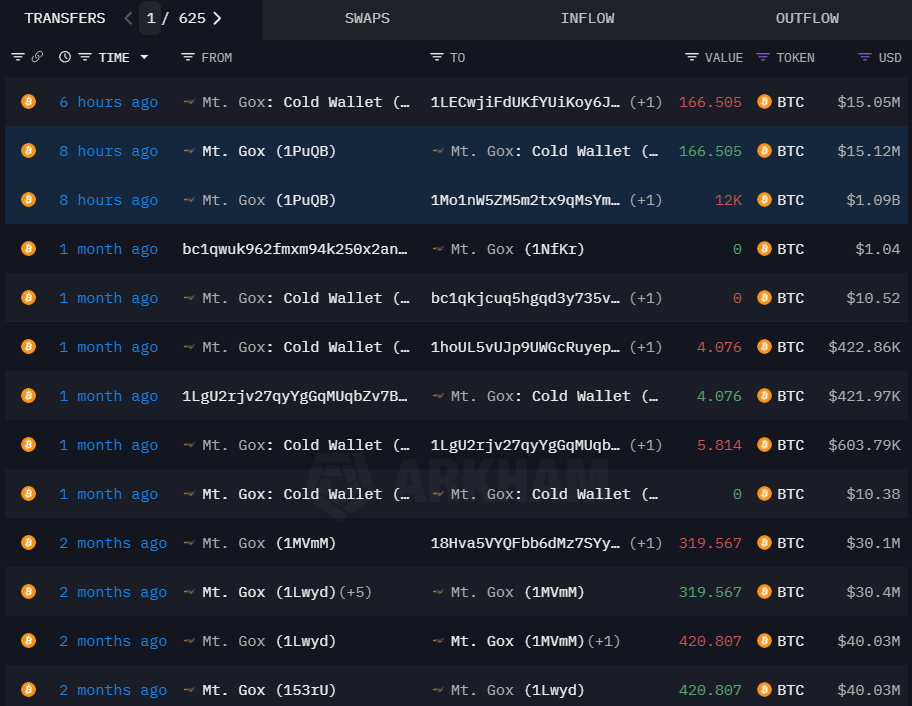

According to Arkham Intelligence, Mt. Gox moved 11,834 BTC – valued at over $1 billion – from its wallet “1PuQB” to an unmarked address “1Mo1…9gR9” earlier today. Shortly after, an additional 166.5 BTC, worth $15.12 million, was transferred to another wallet.

The Mt. Gox moves Bitcoin today are the most significant transactions from the exchange since January 2024, raising speculation that the exchange is consolidating assets ahead of its long-awaited creditor repayments. Currently, the exchange’s identified wallets still hold 36,080 BTC, approximately $3.3 billion.

A Decade After Collapse, Mt. Gox Prepares for Repayments

Founded in 2010, Mt. Gox was once the largest Bitcoin trading platform, handling 70% of all BTC transactions. However, in 2014, the exchange was hacked, losing over 800,000 BTC, which forced it into bankruptcy. Since then, thousands of creditors have been awaiting repayment.

Initially, the repayments were set for 2024, but in October, Mt. Gox extended the deadline by another year to October 31, 2025. The recent Mt. Gox moves Bitcoin transfers suggest that preparations for these repayments could be underway, though no official confirmation has been made.

Market analysts have noted that while large transfers may indicate creditor repayment efforts, they could also be part of internal asset restructuring or security enhancements. Bitcoin’s price moved past $91,903 following the transactions but remains affected by macroeconomic factors, including Trump’s tariff policies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |