| Key Points: – Kraken exchange is preparing to go public as early as Q1 2026, aiming to become the second publicly traded U.S. crypto exchange after Coinbase. – Previous IPO plans were delayed due to SEC enforcement under the Biden administration, but the return of Donald Trump has created a more favorable regulatory environment. |

Kraken exchange is reportedly preparing to go public as early as the first quarter of 2026, according to sources cited by Bloomberg.

If successful, the San Francisco-based company, officially known as Payward Inc., would become the second publicly traded U.S. cryptocurrency exchange after Coinbase, which went public in April 2021.

Kraken Exchange Aims for Long-Planned IPO Public Listing

Kraken exchange has long considered an initial public offering (IPO), but previous plans were hindered by regulatory challenges under the Biden administration.

The company faced enforcement actions from the U.S. Securities and Exchange Commission (SEC), which accused it of operating as an unregistered securities exchange, broker, dealer, and clearing agency.

In November 2023, the SEC alleged that Kraken exchange commingled customer assets with company funds. However, Kraken settled one case with the SEC and continued fighting another until the agency agreed to drop it earlier this month.

The dismissal came with no charges, penalties, or required changes to Kraken’s business operations, according to a company blog post on March 3.

Strong Revenue Growth Positions Kraken for a Successful Market Debut

The regulatory environment has shifted with the return of Donald Trump to the presidency, creating a more favorable climate for cryptocurrency firms. Kraken’s Co-CEO Arjun Sethi was among several industry leaders who attended a White House crypto summit on March 7.

The easing of regulatory pressure has encouraged other crypto firms, including stablecoin issuer Circle, digital-asset custodian BitGo, and exchanges like Gemini and Bullish, to explore IPO opportunities as well.

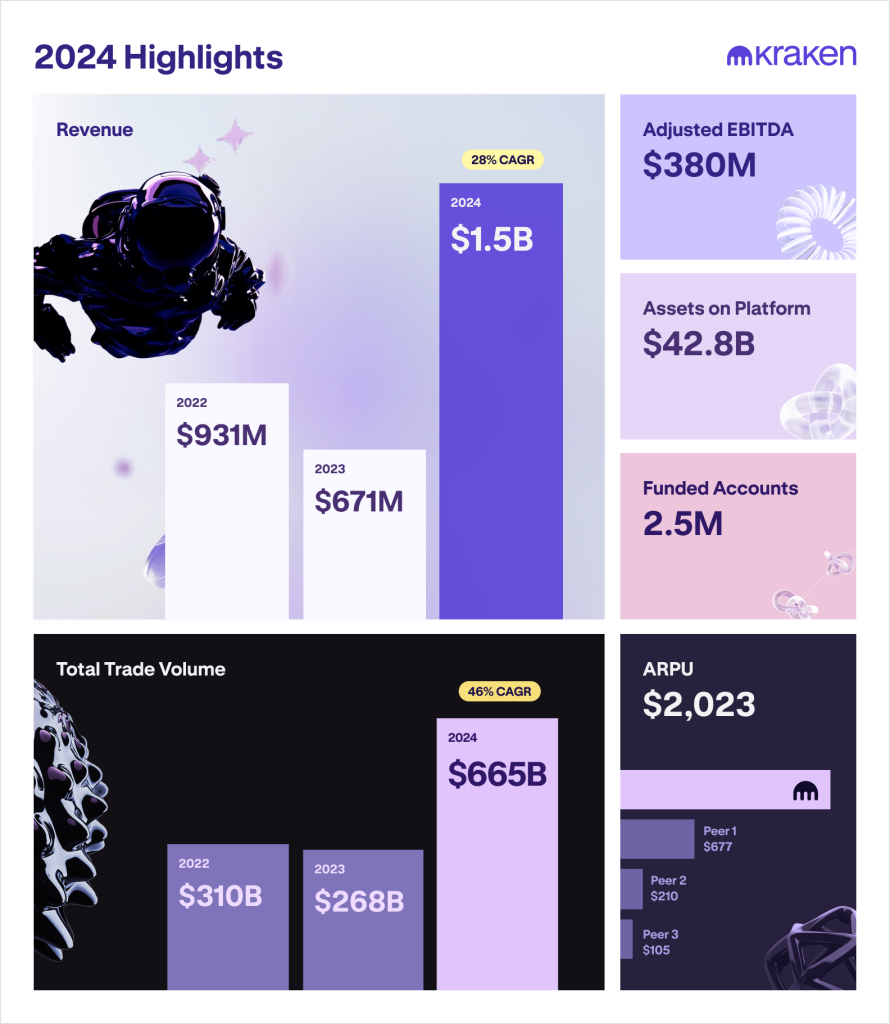

Kraken exchange also experienced significant financial growth, with revenue more than doubling in 2024, rising from $671 million to $1.5 billion.

Sethi also emphasized the company’s commitment to transparency, stating that Kraken will continue issuing quarterly reports to prepare for a potential IPO.

While Kraken’s IPO plans remain subject to change, the company’s improved regulatory standing and strong financial performance suggest that it is promoting itself for a public debut in the near future.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |