| Key Points: – Abu Dhabi-based MGX has acquired a $2 billion minority stake in Binance exchange. – This is the exchange’s first institutional investment and reinforcing blockchain’s growing role in global finance. – With clear regulations and a strong digital asset framework, the UAE continues to attract major blockchain investments.framework. |

Binance exchange has secured its first institutional investment, with Abu Dhabi-based technology investment firm MGX acquiring a minority stake for $2 billion.

The deal, announced on Wednesday, represents MGX’s initial foray into the cryptocurrency and blockchain sectors.

Binance Exchange Secures $2 Billion Investment from Abu Dhabi’s MGX

MGX, backed by sovereign wealth fund Mubadala and AI firm G42, focuses on artificial intelligence (AI) and semiconductor investments, with its assets under management expected to exceed $100 billion in the coming years. The firm is part of Abu Dhabi’s broader financial ecosystem, which manages approximately $1.7 trillion in sovereign wealth.

With this investment, the world’s largest cryptocurrency exchange solidifies its presence in the UAE, a country known for its progressive stance on cryptocurrency regulation. Mubadala, with assets of $302 billion, is one of the emirate’s three state-backed investors.

Binance exchange currently employs around 1,000 of its 5,000 global workforce in the UAE, benefiting from the nation’s clear digital asset frameworks. The UAE has introduced licensing systems for digital asset providers in Dubai and the Abu Dhabi Global Market (ADGM), making it an attractive destination for blockchain firms.

The investment underscores the increasing role of institutional players in digital finance and highlights Abu Dhabi’s commitment to fostering blockchain innovation.

Binance Maintains Dominance in the Cryptocurrency Market

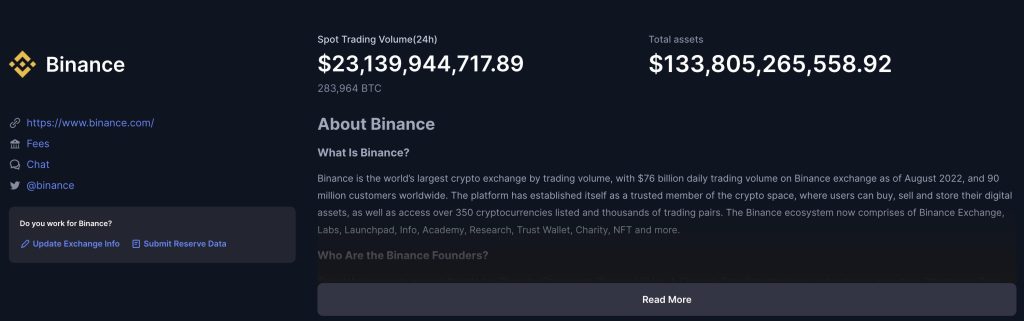

The deal reinforces Binance’s dominance in the cryptocurrency sector. The exchange boasts over 260 million registered users and has surpassed $100 trillion in cumulative trading volume, making it larger than several of its closest competitors combined.

Binance is still the leading exchange today with a daily trading volume of over $23 billion and nearly $134 billion in assets under management.

Binance CEO Richard Teng acknowledged the UAE as a potential candidate for the company’s global headquarters, though no final decision has been made. Speaking at Abu Dhabi Finance Week, Teng emphasized the nation’s appeal due to its regulatory clarity and commitment to financial innovation.

This $2 billion investment is among the largest ever in the crypto industry and is also the most significant transaction paid entirely in stablecoins. The move reflects MGX’s strategy to support AI-powered blockchain solutions, decentralized finance (DeFi), and the tokenized digital economy.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |