Key Points:

- BlackRock’s iShares involved in HYPE ETF rumors.

- No confirmed ETF application as of now.

- Market seeks clarity from official sources.

Since the reports surfaced suggesting BlackRock’s iShares has applied for a spot HYPE ETF, no confirmation has been provided by BlackRock itself or any regulatory authority.

The significance of this event lies in the potential impact on the crypto market if such an application is confirmed. However, the absence of official comments suggests information remains speculative.

BlackRock HYPE ETF Rumors Unsubstantiated as of Now

BlackRock’s iShares was rumored to have filed for a spot HYPE ETF. As of now, no evidence supports that the company has made such an application. Without backing from official channels, details remain unverified.

BlackRock’s potential ETF filing would significantly impact the cryptocurrency sector. A confirmed application could lead to increased interest and credibility for crypto-related ETFs. Until verified, investors are advised to remain cautious in speculative market responses.

“BlackRock’s commitment to crypto ETFs signals a broader acceptance of digital assets in mainstream finance.” – Emily Johnson, Financial Strategist, ETF Trends

Market reactions have been mixed, with some excited by the potential entry of BlackRock into this ETF category, while others question the legitimacy of these reports. Calls for official statements are intensifying as the situation develops.

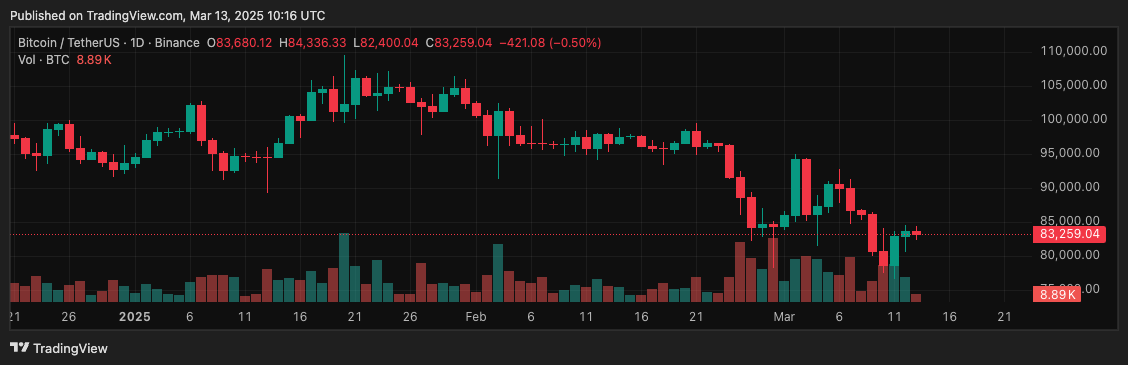

Bitcoin Price Volatility Amidst Speculative ETF News

Bitcoin (BTC) is currently trading at $83,259.04, reflecting a decrease of 0.50% over the past 24 hours, according to TradingView data from March 13, 2025.

During this period, Bitcoin’s price ranged from a low of $82,400.04 to a high of $84,336.33. Trading volume was recorded at approximately 8.89K BTC.

Financial analysts speculate on the potential influence of a BlackRock HYPE ETF on market stability. Some experts point out historical data where regulatory changes impacted cryptocurrency prices, noting that official confirmations are essential for accurate market analysis.