- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Democrats oppose Trump’s Bitcoin reserve plan, citing conflict risks.

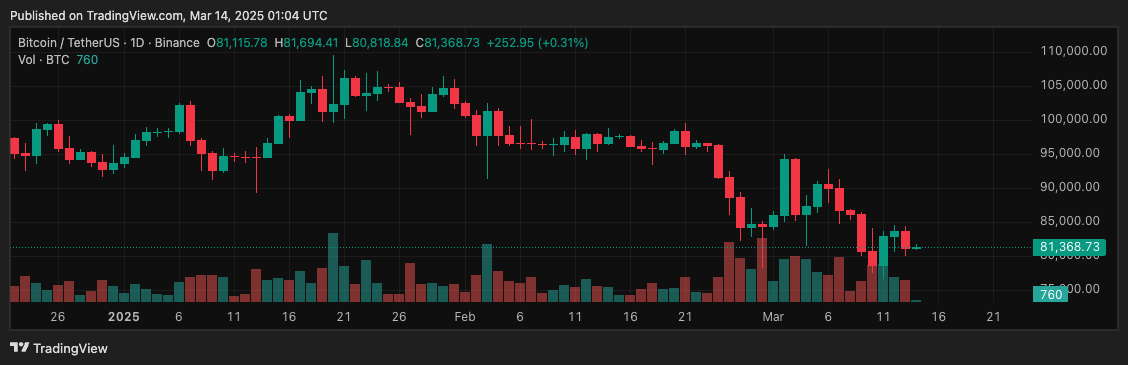

- Market volatility observed; Bitcoin down 3.2% in 24h.

Democrats Demand Halt to Trump’s Bitcoin Reserve

Democratic lawmakers, spearheaded by Representative Gerald Connolly, are challenging President Trump’s plan to establish a U.S. Bitcoin reserve. Connolly’s demand for Treasury intervention underscores growing concerns about potential conflicts of interest in the scheme.

I’ve sent a letter to @USTreasury demanding an immediate halt to Trump’s reckless crypto reserve scheme. This plan reeks of conflicts of interest and puts taxpayer money at risk.

Democrats believe taxpayer resources may be at risk, prompting calls for a reassessment of the framework. There are significant implications for future policy and governance landscapes if actions proceed unchecked.

Many in the cryptocurrency community are reacting strongly, with some emphasizing the financial market implications. Ethereum co-founder Vitalik Buterin has noted that a broader focus is essential to incorporate overall crypto ecosystem innovation, highlighting the potential impact of the reserve.

Bitcoin Dips 3.2% Amid Market Volatility

Bitcoin (BTC) is currently trading at $81,368.73, recording a decrease of 3.2% in the last 24 hours, according to TradingView data as of March 14, 2025. Over this period, Bitcoin’s price moved within a range between a low of $80,818.84 and a high of $84,392.41.

Analysts suggest Bitcoin’s volatility underscores similar past patterns seen in government-related crypto announcements, as evidenced by David Sacks’s observations:

Experts are voicing varied perspectives on this situation, noting potential changes in regulatory environments and financial system responses if the plan advances further. Historical trends point to global apprehension among investors regarding these large-scale interventions. Discussions continue to evolve as stakeholders analyze the fluctuating landscape.