| Key Points: – World Liberty Financial Token Sale successfully raised $590 million, marking one of the largest fundraising events in crypto history. – Early struggles forced WLFI to secure backing from Justin Sun, who became its largest investor with over $75 million in purchases. – The TRUMP memecoin hype played a crucial role in boosting investor interest, helping the project gain momentum. – WLFI has aggressively invested in other crypto assets, including SEI, ETH, and WBTC, but currently faces significant unrealized losses. |

World Liberty Financial Token Sale ends, raising $590M. Strong backing and memecoin hype fueled its success despite initial fundraising struggles.

Despite a rocky start, World Liberty Financial’s token sale emerged as one of the largest in recent history. Its success was driven by strategic investor backing and the rising popularity of political memecoins, signaling a shift in investor sentiment toward speculative digital assets.

World Liberty Financial Token Sale: A $590M Milestone

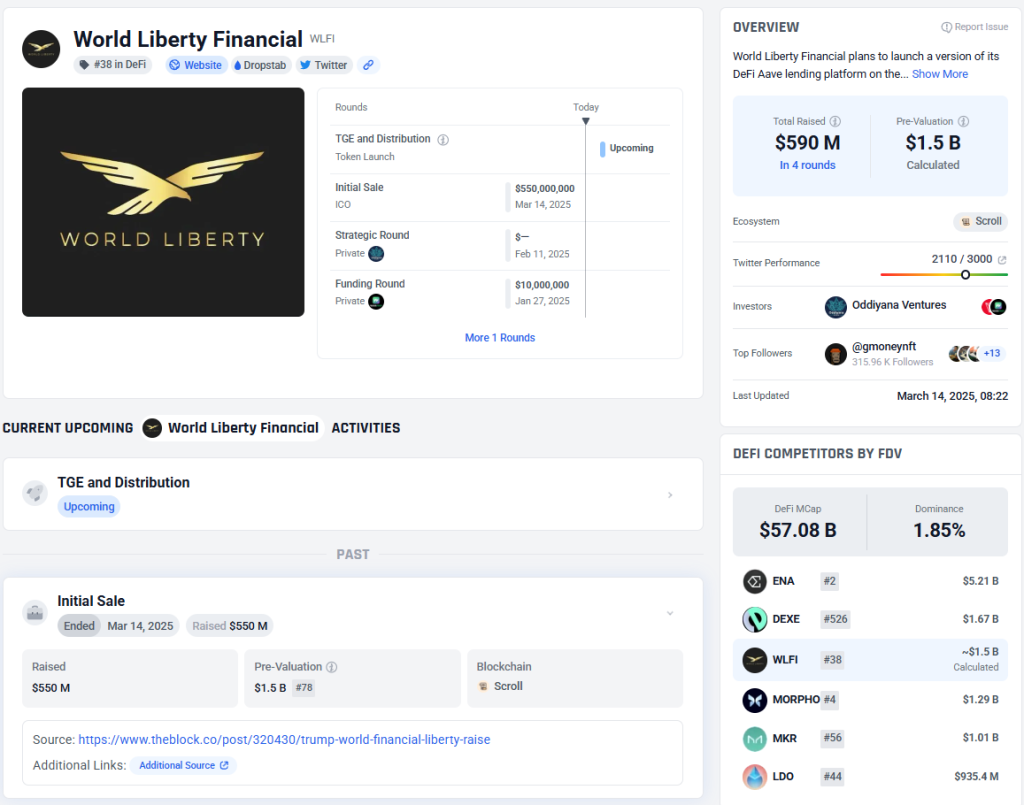

According to data by ICODrops, the World Liberty Financial Token Sale has officially concluded, securing $590 million in funding. The Trump-backed DeFi project initially struggled to attract investors but ultimately became one of the largest token sales in recent history.

WLFI’s presale began in October 2024, but after two weeks, the project had raised only $15 million, far below expectations. To counter this, WLFI brought in Tron’s Justin Sun, who committed $30 million initially and later increased his investment beyond $75 million, making him the project’s largest private investor.

How TRUMP Memecoin Hype Rescued WLFI

The TRUMP memecoin, launched in January 2025, unexpectedly fueled renewed investor enthusiasm for WLFI. The token’s FOMO-driven surge injected new energy into the project, leading to a sharp increase in demand for WLFI tokens. Capitalizing on the market momentum, WLFI quickly expanded its sales by 5%, leveraging the growing interest in politically linked crypto assets.

As a result, WLFI managed to sell a total of 25 billion tokens, raising $590 million across both presale rounds. This placed it among the top 10 biggest token sales, trailing major projects like EOS, which raised $4.2 billion in 2018.

Post-Sale Investments: A Risky Strategy?

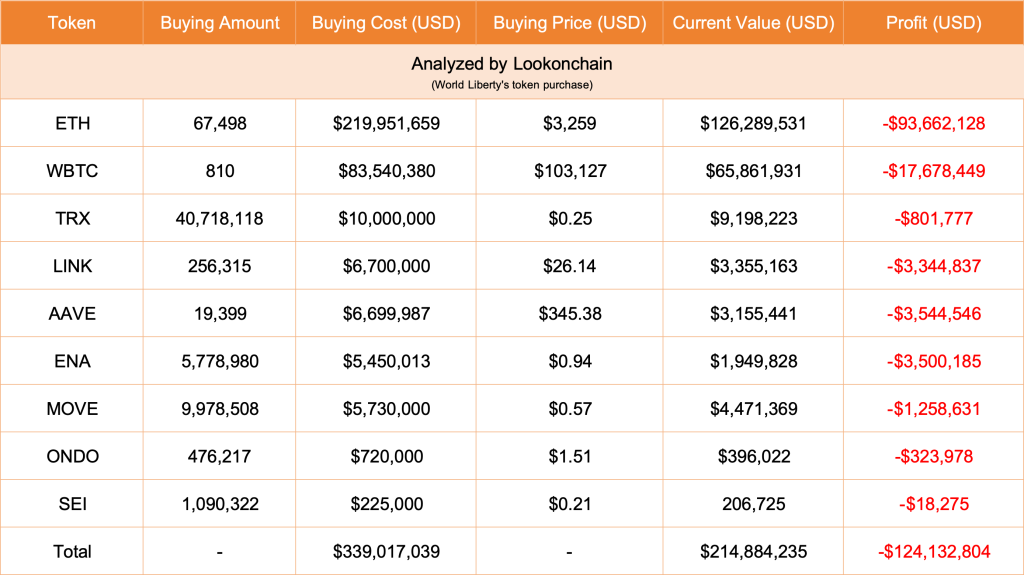

Following its successful token sale, WLFI has been actively deploying capital into various crypto assets. On-chain data reveals that the project has accumulated over 1.09 million SEI tokens, following recent transactions worth $206,000. WLFI previously invested $125,000 in SEI, suggesting an ongoing interest in the asset.

Beyond SEI, WLFI has allocated over $339 million to nine different cryptocurrencies, including Ethereum (ETH) and Wrapped Bitcoin (WBTC). However, these positions have suffered major unrealized losses of $124.1 million, with ETH alone accounting for a $93.6 million deficit.

What’s Next for WLFI?

Despite its impressive fundraising, WLFI’s token remains restricted to accredited investors and has yet to announce an exchange listing. Questions remain about the project’s long-term viability and whether its risky investment strategy will pay off.

As the World Liberty Financial Token Sale enters its next phase, investors will be closely watching how WLFI navigates the volatile crypto landscape and whether its DeFi ambitions can withstand market pressures.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |