Trump-Backed World Liberty Financial Completes Raising $250 Million in Second Token Sale

| Key Points: – Trump-backed World Liberty Financial secured $250 million in its second token sale, bringing total funds raised to $550 million. – The project has acquired major cryptocurrencies and partnered with blockchain firms like Ondo Finance, Chainlink, and Aave to develop its DeFi platform. |

World Liberty Financial (WLFI), a cryptocurrency venture linked to President Donald Trump, announced on Monday that it has raised $250 million in its second token sale, bringing total funds secured through token sales to $550 million.

The venture’s second token sale saw participation from over 85,000 investors, all of whom underwent know-your-customer (KYC) verification, according to the company’s statement.

World Liberty Financial Raises $550 Million in Crypto Token Sales

World Liberty Financial began its first token sale in mid-October, attracting both U.S. and international investors. Although specific details about its functionality remain undisclosed, WLFI has been actively acquiring cryptocurrencies such as Ether and Tron. Tron’s creator, Justin Sun, is among the project’s investors, having increased his stake in WLFI tokens to $75 million in January.

World Liberty Financial, backed by the Trump family, describes itself as a crypto banking initiative. Documents from its launch indicate that the Trump family could potentially receive 75% of the project’s net revenue. The project, which launched in October, aims to establish itself as a key player in decentralized finance (DeFi).

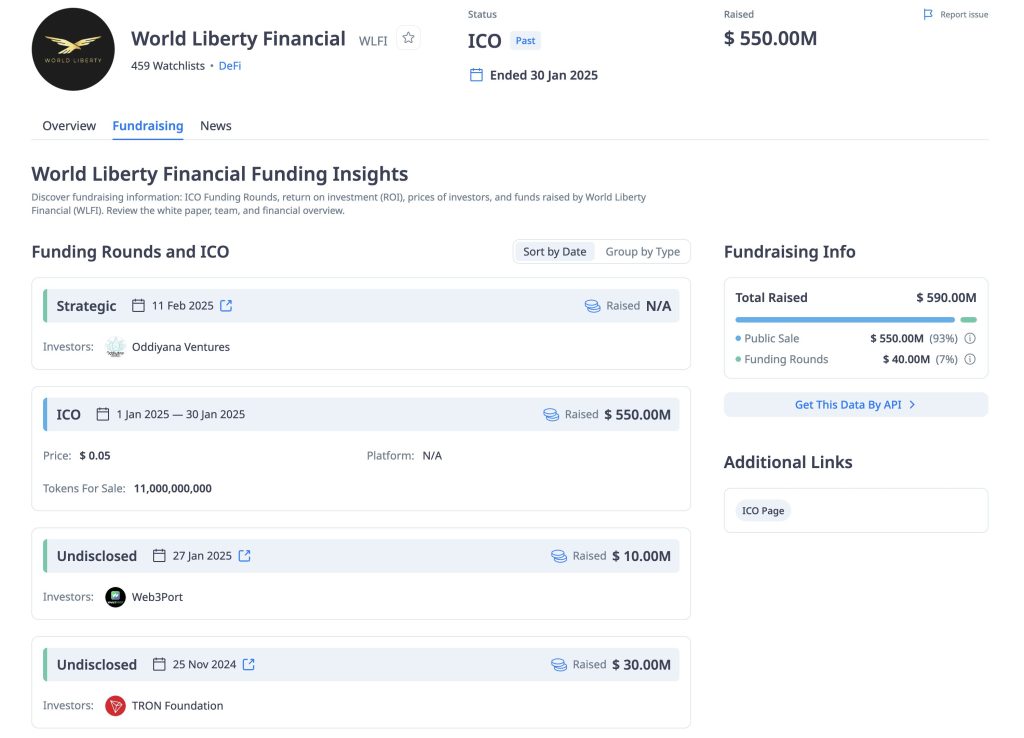

In addition to private investments, data from CryptoRank indicates that WLFI has secured $590 million in funding, including $40 million from the TRON Foundation and $10 million from Web3Port. The total could be higher, as contributions from Oddiyana Ventures remain undisclosed.

The Trump family has been engaging in multiple crypto-related initiatives as the former president promotes a crypto-friendly agenda. Earlier this month, Trump signed an executive order to establish a Strategic Bitcoin Reserve, further reinforcing his administration’s commitment to digital assets.

Trump’s Crypto Agenda and Potential Binance Connections

World Liberty Financial has forged partnerships with prominent blockchain institutions such as Ondo Finance, Ethena, Chainlink, Sui, and Aave.

The project’s “Macro Strategy” also involves the accumulation of digital assets like Bitcoin (BTC), Ether (ETH), Tron (TRX), Chainlink (LINK), Sui (SUI), and Ondo (ONDO), creating a strategic reserve designed to stabilize its treasury and support DeFi growth.

Additionally, WLFI has reportedly explored business opportunities with cryptocurrency exchange Binance. Reports suggest that representatives from the Trump family have discussed potential investments in Binance.US.

However, Binance founder Changpeng Zhao, who pleaded guilty to anti-money laundering violations in 2023, has denied allegations that he sought a presidential pardon from the Trump administration. The Trump-backed project has also denied the reports.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |