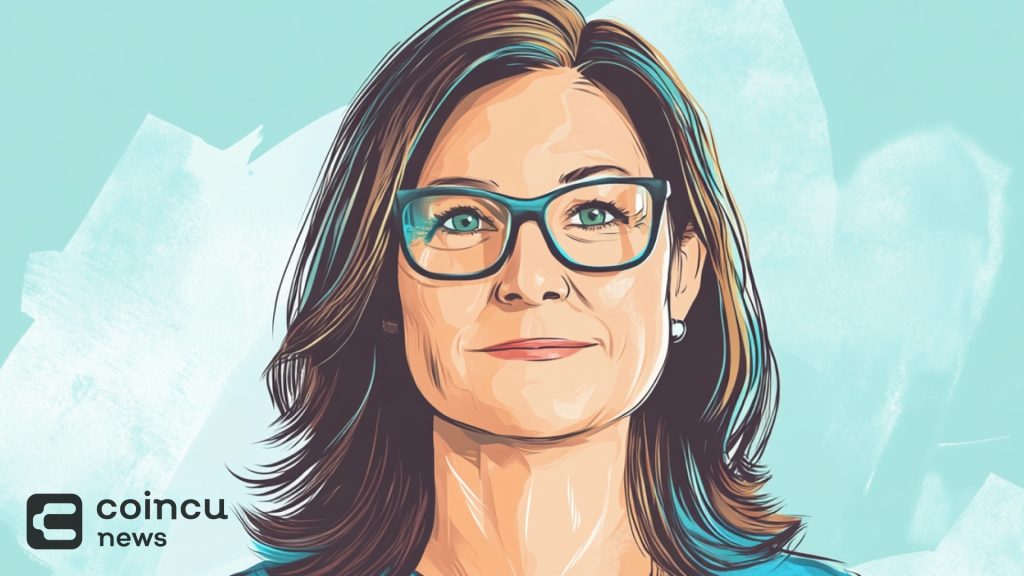

ARK Invest CEO Cathie Wood Warns Meme Coin Investors: “Buyer Beware”

| Key Points: – ARK Invest CEO Cathie Wood cautions that most meme coins flooding the cryptocurrency market will become worthless. – Wood continues to support Bitcoin as a store of value and predicts it could surpass $1 million by 2030. |

Cathie Wood, CEO and founder of ARK Investment Management LLC, has issued a stark warning about the proliferation of meme coins in the cryptocurrency market, cautioning that many of these digital assets will likely become worthless.

The ARK Invest CEO highlighted how advancements in blockchain and artificial intelligence have led to the creation of “millions” of meme coins, many of which, she believes, have little to no intrinsic value.

Cathie Wood Warns Investors About $2.6 Trillion Meme Coin Space

Speaking to Bloomberg Television on Tuesday, Cathie Wood emphasized that ARK Investment’s private funds are steering clear of such speculative tokens.

“If I have one message for those listening who are buying meme coins: buyer beware. There’s nothing like losing money for people to learn, and they’ll learn that the SEC and regulators are not taking responsibility for these meme coins,” Wood said.

Meme coins, often inspired by internet jokes, cultural trends, or public figures, have gained traction in the $2.6 trillion cryptocurrency market. The U.S. Securities and Exchange Commission (SEC) recently clarified that meme coins do not fall under securities regulations, meaning they remain largely unregulated.

One high-profile example was a meme coin associated with U.S. President Donald Trump. Launched shortly before his inauguration, the token saw a surge in trading volume before experiencing a sharp decline in value.

Institutional Adoption of Blockchain-Based Assets

While Cathie Wood remains skeptical of meme coins, she continues to advocate for cryptocurrencies with strong fundamentals. She considers Bitcoin a reliable store of value and views Ethereum and Solana as platforms with meaningful applications. Recently, ARK Invest purchased 997 BTC, valued at approximately $80 million, through Coinbase.

The ARK Invest CEO has also reiterated her long-term projection that Bitcoin could surpass $1 million by 2030. Currently, the leading cryptocurrency trades around $82,600.

Beyond Bitcoin, Wood is optimistic about the future of tokenization, an emerging trend that involves representing real-world assets (RWAs) like real estate, commodities, and financial instruments on blockchain networks.

Speaking at the Digital Asset Summit in New York, she expressed her hope that ARK Invest would be able to bring some of its funds on-chain once regulatory frameworks permit it in the U.S.

“We think tokenization is going to be huge,” Wood stated.

The concept has already gained traction among major financial institutions. BlackRock, the world’s largest asset manager, recently introduced BUIDL, a tokenized U.S. Treasury product built on Ethereum. According to RWA market tracker rwa.xyz, the product has already surpassed $1 billion in market capitalization.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |