| Key Points: – Kraken exchange is finalizing a $1.5 billion deal to acquire U.S.-based futures trading platform NinjaTrader. – The acquisition follows Kraken’s legal victory against the SEC and aligns with its strategy to diversify offerings, including equities trading. |

Kraken exchange is reportedly close to acquiring U.S.-based futures trading platform NinjaTrader in a deal valued at approximately $1.5 billion, according to sources cited by The Wall Street Journal.

The transaction is notable as major acquisitions remain rare in the cryptocurrency sector. If completed, it would be among the largest deals of its kind.

Kraken Exchange Expands Into Futures Trading With $1.5 Billion NinjaTrader Deal

The transaction, expected to be announced as early as March 20, would mark one of the largest acquisitions in the crypto industry and could significantly reshape the landscape of digital asset trading.

The acquisition would allow Kraken exchange to expand into the futures and derivatives market in the U.S. while also supporting NinjaTrader’s international growth. NinjaTrader, which serves over 1.8 million retail investors, is registered as a Futures Commission Merchant, providing a regulated pathway for Kraken to introduce futures trading services to its customers.

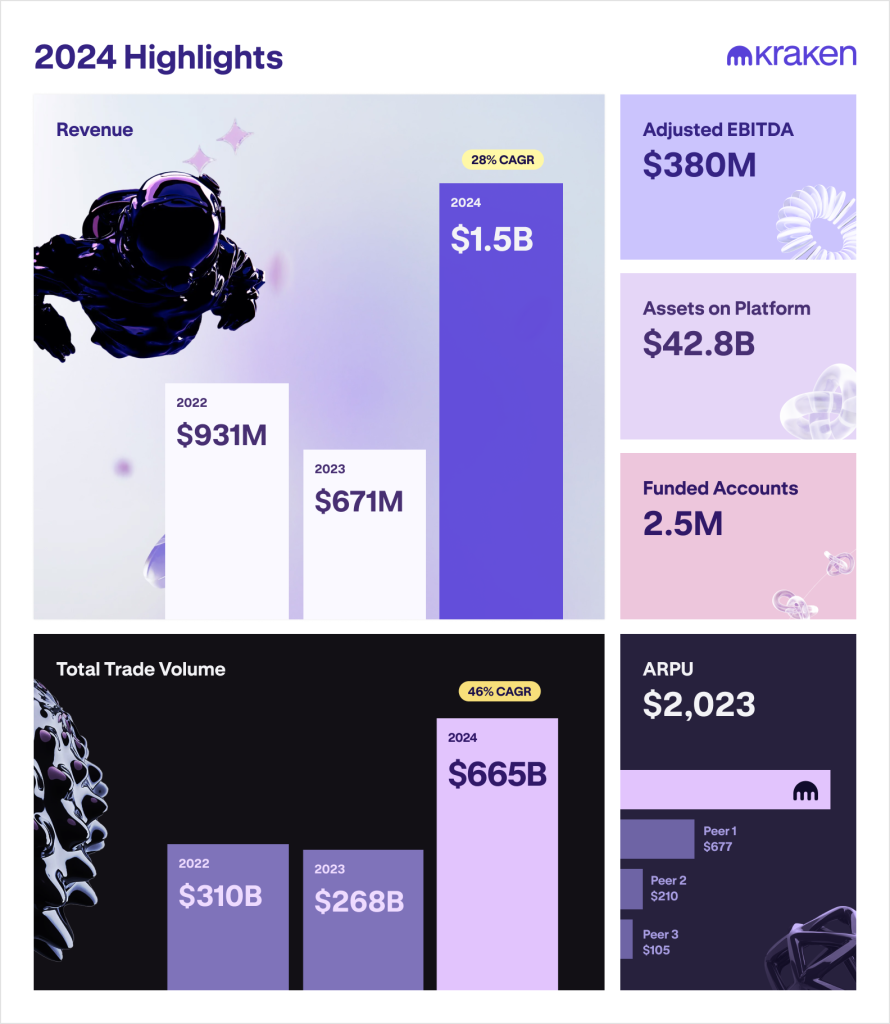

Kraken exchange reported $1.5 billion in revenue for 2024, more than doubling its earnings from the previous year. Its financial report, released on January 31, also highlighted its $42.8 billion in assets and a total trade volume of $665 billion for the year.

The move aligns with Kraken’s broader strategy to diversify its offerings across multiple asset classes, including plans for equities trading and payment services. As part of the deal, NinjaTrader is expected to continue operating as an independent platform while benefiting from Kraken’s global infrastructure and financial backing.

Bridging Crypto and Traditional Finance With a Major Industry Move

The timing of this acquisition coincides with Kraken’s recent legal victory against the U.S. Securities and Exchange Commission (SEC). On March 3, the SEC dismissed its lawsuit against Kraken exchange without penalties or an admission of wrongdoing.

Initially, the SEC had accused the platform of operating as an unregistered broker, dealer, exchange, and clearing agency. The dismissal removes a significant regulatory hurdle for Kraken as it advances its expansion strategy.

The acquisition also comes amid shifting regulatory dynamics in the U.S. under President Donald Trump’s administration. Trump has expressed support for making the U.S. a global hub for cryptocurrency with a potentially more favorable regulatory environment for firms like Kraken. The crypto industry has responded positively to these developments, anticipating reduced scrutiny from financial regulators.

Additionally, the deal could facilitate NinjaTrader’s expansion into the UK, continental Europe, and Australia. Kraken’s approval as an Electronic Money Institution (EMI) by the UK’s Financial Conduct Authority (FCA) may further ease NinjaTrader’s entry into the British market.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |