Coinbase Exchange in Advanced Talks to Acquire Deribit in Major Crypto Derivatives Push

| Key Points: – Coinbase exchange is in advanced talks to acquire Deribit to expand into the crypto derivatives market. – The potential deal would give Coinbase control of Deribit’s Dubai license and significantly boost its presence in options trading. |

According to Bloomberg, Coinbase exchange is reportedly in advanced negotiations to acquire Deribit, the world’s largest options exchange for Bitcoin and Ethereum.

According to individuals familiar with the matter, the two companies have begun notifying regulators in Dubai, where Deribit holds a trading license.

Coinbase Exchange Eyes Deribit in Strategic Crypto Derivatives Expansion

If the acquisition proceeds, that license would be transferred to Coinbase. The U.S.-based crypto giant is currently the top exchange by volume in the country, while Deribit dominates globally in crypto options, offering products across Bitcoin, Ethereum, and other digital assets.

An acquisition of this scale would represent a major strategic shift for Coinbase exchange, which has primarily focused on spot trading and futures. By integrating Deribit’s advanced options platform, Coinbase would instantly establish itself as a dominant force in the growing crypto derivatives sector — an area that has increasingly become central to institutional and retail trading strategies.

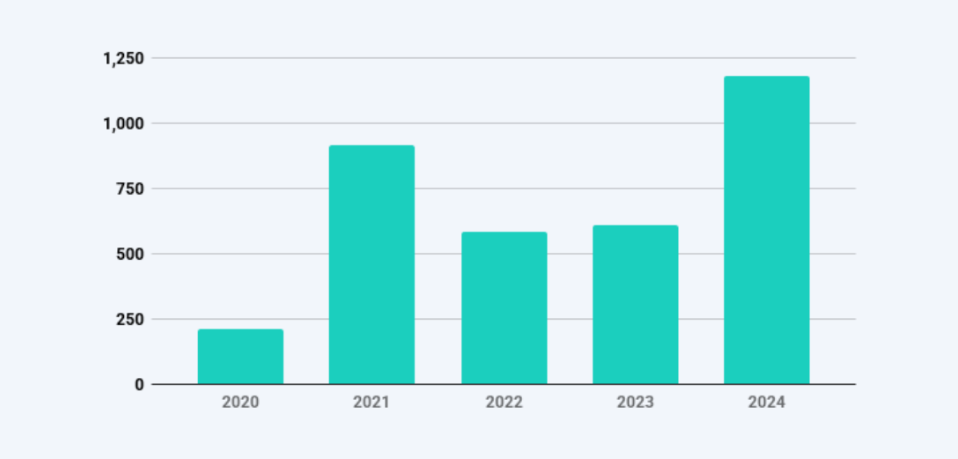

Deribit, which lists options, futures, and spot trading products, reported trading volumes close to $1.2 trillion in 2024, nearly doubling its activity from the year before.

Coinbase’s Strong Earnings and Rising Industry Competition

Earlier reports from Bloomberg valued the Panama-based exchange at between $4 billion and $5 billion, while Coinbase’s enterprise value currently exceeds $43 billion, according to Yahoo Finance.

Options trading has surged in popularity among crypto traders. These instruments allow participants to hedge their positions or speculate on price movements with less capital risk. In the volatile crypto environment, such flexibility has become a vital tool for both institutional investors and high-frequency retail traders.

The timing of Coinbase’s move is also noteworthy. The exchange recently reported a strong financial quarter, with revenues more than doubling and profits surpassing analyst forecasts. The return of retail traders, many of whom had exited during the previous bear market, has bolstered Coinbase’s confidence in making aggressive expansion plays.

If successful, this acquisition would align Coinbase exchange with a broader industry trend. Just days ago, rival exchange Kraken announced its own expansion into derivatives with a $1.5 billion acquisition of NinjaTrader. While Coinbase has historically lagged behind in the derivatives space, securing Deribit would close that gap overnight.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |