| Key Points: – Trump-linked crypto firm World Liberty Financial purchased 3.54 million Mantle Network (MNT) tokens for nearly $3 million. – Following the acquisition, MNT jumped 6.87% intraday to $0.8416, with trading volume rising 117%, driven by renewed investor interest. – Despite the MNT rally, WLFI’s $82 million crypto portfolio continues to face pressure amid a wider market downturn. |

On Monday, World Liberty Financial (WLFI), a crypto investment firm backed by Donald Trump’s family, has expanded its altcoin portfolio with a significant purchase of Mantle Network (MNT) tokens.

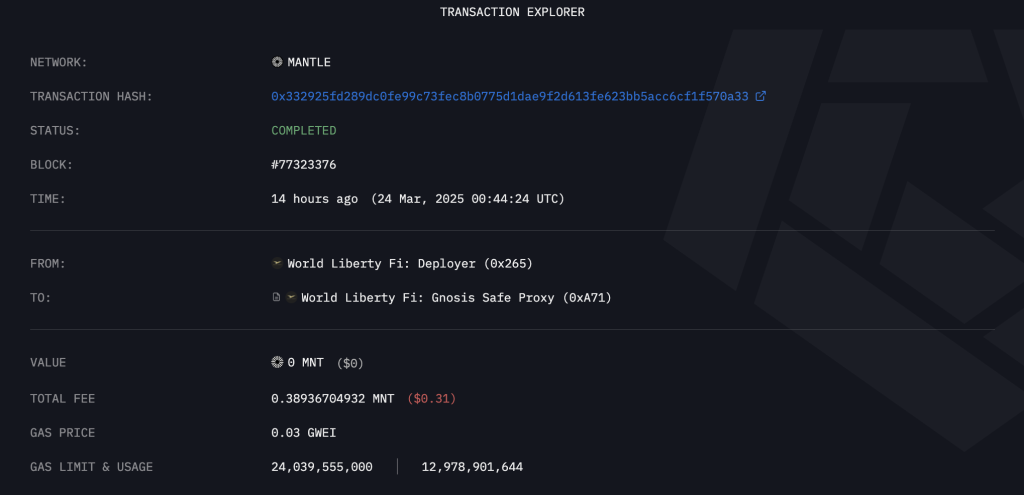

The company acquired approximately 3.54 million MNT for nearly $3 million in USDC on March 24, at an average price of $0.84 per token, according to blockchain analytics platforms Lookonchain and Arkham Intelligence.

Trump-Linked Crypto Firm Boosts Altcoin Holdings with $3M Mantle Network Token

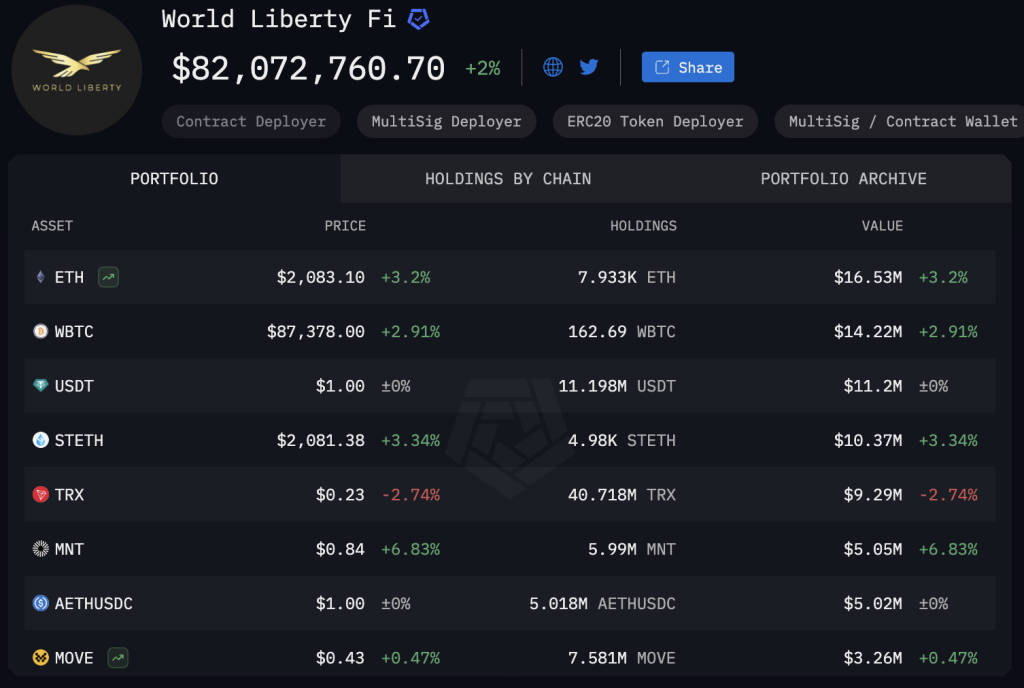

The latest acquisition brings WLFI’s total MNT holdings to nearly 6 million tokens, valued at around $5.05 million. Despite the strategic investment, the firm’s broader crypto portfolio has shown signs of decline.

WLFI currently holds $82.07 million in digital assets, with major positions in Ethereum (ETH), Wrapped Bitcoin (WBTC), Tether (USDT), staked ETH (stETH), and Tron (TRX). ETH remains the firm’s largest holding, valued at $16.53 million.

The purchase had an immediate impact on the MNT market. The token surged 6.87% intraday, reaching $0.8416, with trading volume spiking 117% to $182 million. The rally pushed MNT’s market capitalization beyond $2.83 billion, signaling renewed interest from investors following a recent downtrend.

WLFI Expands Altcoin Holdings Despite Market Downturn

Despite the boost from MNT, WLFI’s broader portfolio remains under pressure. The firm has deployed a total of $346 million across 11 cryptocurrencies, including Chainlink (LINK), Aave (AAVE), Ethena (ENA), Movement (MOVE), Ondo (ONDO), Sei (SEI), and Avalanche (AVAX). However, the Trump family backed project is facing a loss of $111.4 million.

It now appears that WLFI is expecting a bullish trend over the coming weekend, so their accumulation in MNT may be aimed at maximizing short-term gains. Additionally, recent developments in the Mantle ecosystem such as upcoming governance proposals, liquidity expansion, or potential integrations may have also contributed to WLFI’s aggressive accumulation strategy.

MNT is the native token of the Mantle Network, a Layer 2 Ethereum scaling solution. It is used for transaction fees and governance participation.

The price rebound comes on the heels of Mantle Network’s Mainnet hard fork on March 19, which introduced EigenDA—a decentralized, high-throughput data availability layer. This upgrade is expected to enhance scalability and improve compatibility with Ethereum’s forthcoming Pectra upgrade.

The MNT rally marks a short-term recovery for the token, which had dipped to $0.76 on March 21 following the hard fork, after trading near $0.83 earlier in the month.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |