- 99,999,800 USDT moved to Binance from unknown wallet, tracked by Whale Alert.

- Price change remains steady as market monitors movement.

- Expert insights suggest market adjustment to large transfers.

99,999,800 Tether (USDT) valued at approximately 100,119,799 USD was recently transferred from an unknown wallet to the cryptocurrency exchange Binance.

According to Whale Alert, this sizable transfer could signal significant movement within the crypto space, prompting market attention and analysis.

Massive USDT Transfer: Whale Alert Reports Key Movement

Whale Alert, a service known for monitoring large crypto transactions, reported this massive transfer of 99,999,800 USDT from an unknown wallet to Binance. This move, capturing community attention, emerges amidst background transfers noted across various platforms. Noteworthy, it reflects similar transactions, illustrating a pattern of liquidity movement within the crypto market.

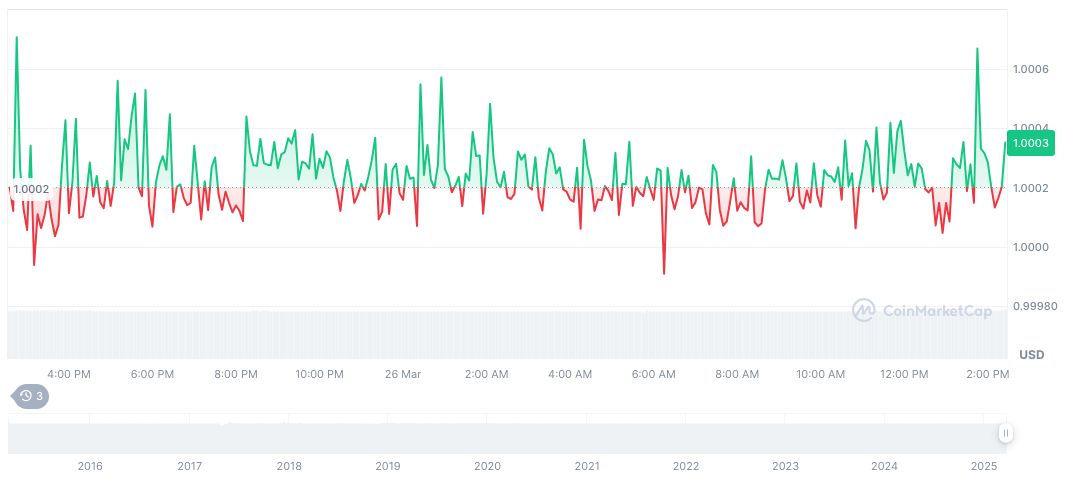

In response to the transfer, trading activities on Binance remained stable with a small impact on Tether’s price. These transformations in liquidity flow could influence market dynamics, affecting trading volumes and value fluctuations on the exchange.

Experts within the crypto community have commented on the shift, highlighting potential shifts in market sentiment. Richard Teng, Binance’s CEO, commented on the exchange’s commitment to providing transparency and security, reinforcing the firm’s staying approach during notable occurrences. As Teng has stated, “Transparency, security and compliance are our guiding principles.“

Analyzing the Market Effects of Strategic USDT Transfers

Did you know? In March 2025, crypto whale movements included a 211 million USDC transfer exiting Binance, showcasing ongoing liquidity maneuvers amid broader market adjustments.

CoinMarketCap data highlights Tether (USDT) with a current price of $1.00 and a market cap at $144.15 billion, comprising 5.13% market dominance. Trading volume over the past 24 hours reached $59.02 billion, showing a minor decrease of 0.04% in price during this period.

The Coincu research team suggests that such large-scale transfers may illustrate strategic liquidity adjustments by investors. These movements typically reflect market confidence and strategic financial repositioning, affecting trading strategies and potential regulatory scrutiny over stablecoin dynamics.