- Circle and ICE partnership targets stablecoin market integration.

- Potential innovation in traditional financial markets.

- Significant step towards widespread stablecoin adoption.

Circle announced on March 27, 2025, an agreement with the Intercontinental Exchange (ICE) to explore the integration of USDC and USYC into a variety of traditional financial markets.

The collaboration marks a significant step towards mainstream adoption of stablecoins. The arrangement aims to enhance existing infrastructure while spurring innovation.

Circle-ICE Partnership Poised to Innovate Financial Markets

Circle and ICE have initiated a partnership targeting the integration of USDC in traditional finance. Jeremy Allaire, Circle’s CEO, highlighted this opportunity as a chance for market innovation. Lynn Martin from NYSE endorsed the strategic alignment of stablecoins with capital markets.

Immediate implications of this partnership include potential new applications of stablecoins in traditional exchanges and clearinghouses. The move suggests an evolving relationship between digital currencies and conventional financial systems. Circle and ICE sign MOU for digital asset innovation.

“ICE’s reputation and global network across markets offer a unique pathway for Circle to integrate USDC into major new use cases, and we are thrilled for the opportunity to innovate together.” – Jeremy Allaire, Co-Founder and CEO of Circle.

Market reactions have been predominantly positive, as evidenced by significant community support. Allaire’s announcement has encouraged optimism for stablecoin adoption in major financial industries, with stakeholders viewing it as a transformative trend. Circle’s advancements in cross-chain transfers further boost confidence in its direction.

Stablecoin Market Stability and Future Integration Prospects

Did you know? USDC’s market cap exceeds $60 billion, reflecting its expanding trust among market participants since its inception.

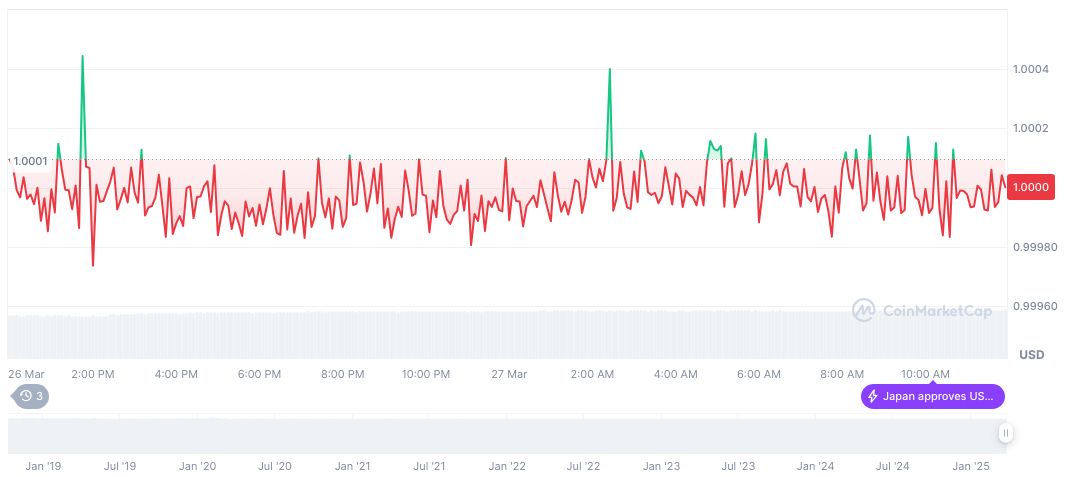

The stablecoin USDC, priced at $1.00, holds a market cap of approximately $60.28 billion. With a 24-hour trading volume near $9.77 billion, USDC remains a significant player in the digital currency arena. CoinMarketCap notes minimal price fluctuation, signaling stable usage trends.

Coincu analysts emphasize stablecoins’ growing importance in financial systems. Regulatory considerations remain, yet the potential benefits for liquidity and efficiency in traditional markets are substantial. Market integration could lead to increased confidence in digital and conventional finance synergy. In a related development, Circle’s CEO advocates for clearer stablecoin regulations to support this integration.