Former SEC Chairman Paul Atkins’ Crypto Involvement Sparks Industry Attention

- Former SEC Chairman Paul Atkins, known for his pro-crypto stance, potentially impacts regulation.

- His leadership may apply a thoughtful regulatory approach to digital assets.

- Market participants observe potential positive changes under Atkins’ influence.

Former SEC Chairman Paul Atkins, known for supporting digital finance, sparks industry attention amid discussions on crypto regulations. His potential leadership could align with President Trump’s vision of integrating crypto innovations into U.S. policy.

The focus on Paul Atkins’ crypto involvement highlights potential shifts in regulatory attitudes, potentially creating a more favorable environment for digital asset innovation.

Paul Atkins in the Crypto Regulatory Spotlight

Paul Atkins, a former SEC Commissioner, emerged as a central figure in the crypto regulatory landscape. Nomination discussions are ongoing, with Atkins known for guiding Anchorage Digital and Off the Chain Capital, which invests in major crypto enterprises like DCG and Kraken. His pro-crypto stance is widely recognized among industry stakeholders. Upon his potential appointment, Atkins might influence regulatory frameworks, marked by informed policies benefitting the crypto sector. His history suggests advocacy for blockchain-friendly regulations.

Market participants, including experts and traders, await Atkins’ influence on policies. Chris Giancarlo, ex-CFTC chair, highlighted Atkins’ long-standing blockchain support:

Paul Atkins’ engagement with crypto goes back many years as an advocate for blockchain and digital assets. As SEC Chairman, he will embrace technological innovation, including digital network finance, after years of SEC hostility and regulation by enforcement.

Bitcoin Market Trends Amid Regulatory Conjectures

Did you know? Former regulatory figures like Paul Atkins have long been pivotal in shifting U.S. cryptocurrency policy dynamics, often advocating for industry progression versus aggressive enforcement.

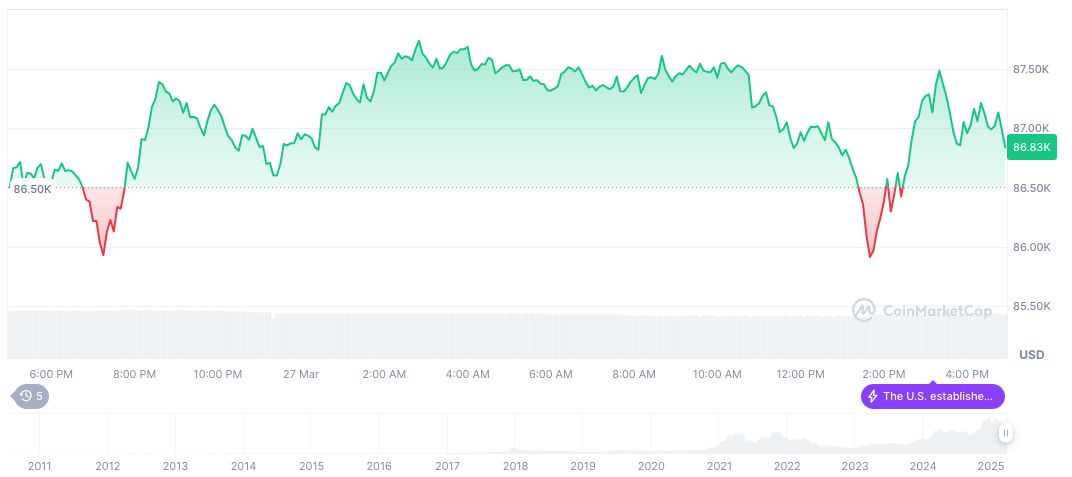

Bitcoin (BTC) continues to showcase robust market presence, priced at $87,389.54 with a market cap of $1.73 trillion, commanding a dominance of 60.74%. Despite recent 24-hour volume dips, BTC’s price sees a minor 0.62% increase. Price trends display mixed performance: 7-day growth at 3.88% contrasts with a 30-day dip of -1.66%, as reported by CoinMarketCap on March 27, 2025.

Coincu’s research team affirms that involving experienced regulators like Atkins could result in careful calibration of crypto regulation, potentially impacting Bitcoin’s market performance positively. Experts anticipate regulatory policies to increasingly align with crypto growth aspirations, fostering further sector development.