- The acquisition of Stronghold Digital Mining signifies Bitfarms’ strategic refocus.

- Divestment from Yguazu data center marks an operational pivot.

- The company emphasizes North American presence with HPC/AI developments.

Bitfarms announced strategic changes by acquiring Stronghold Digital Mining and selling the Yguazu data center as revealed in their Q4 2024 financial report.

These moves, as detailed by Bitfarms CEO Ben Gagnon, intend to solidify their North American presence and focus on HPC/AI growth.

Bitfarms’ Strategic Moves

The acquisition of Stronghold Digital Mining and divestment from the Yguazu data center reflects a strategic pivot. The release cited a 21% revenue growth, reaching $56 million in Q4 2024, affirming a shift in operational focus. CEO Ben Gagnon emphasized energy status enhancement, noting the 188% increase in computing power and bold plans for HPC/AI infrastructure. Additionally, CFO Jeff Lucas highlighted the 20% reduction in capital expenditure for 2025 as a financial boon, stating, “The strategic acquisition of Stronghold Digital Mining and divestment of our Yguazu data center will reduce our capital expenditure requirements by 20% in 2025, improving cash flow and operating margins.”

The decision to sell Yguazu aligns with a broader pattern seen across similar industry moves, where companies refocus assets to boost profitability. The market reacted positively, with Bitfarms’ leadership recounting an upswing in their profile on social channels, suggesting community support for this strategic direction.

The market reacted positively, with Bitfarms’ leadership recounting an upswing in their profile on social channels, suggesting community support for this strategic direction.

Industry Trends: AI Focus Could Reshape Market Regulations

Did you know? The shift towards HPC/AI is a marked departure from typical practices in the crypto mining industry, possibly setting a trend for enhanced efficiency and strategic asset management.

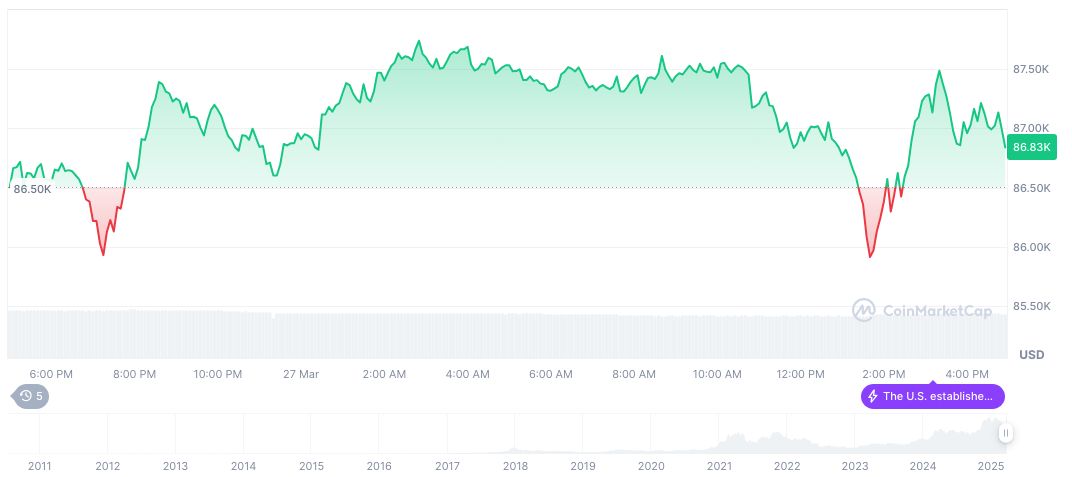

According to CoinMarketCap, Bitcoin prices stood at $87,269.80 with a market cap of $1.73 trillion and a slight 24-hour decline of 0.30%. The market dominance remained at 60.79%, reflecting sustained confidence.

The Coincu research team suggests that Bitfarms’ new focus on North American markets and AI infrastructure could inspire similar strategies among competitors, potentially shaping future regulatory landscapes. Leveraging U.S.-based resources might yield economic rewards.