- Paul Atkins’ SEC nomination indicates a regulatory policy shift.

- Potential positive impact on the cryptocurrency market.

- Awaiting Senate Banking Committee’s final decision on nomination.

Paul Atkins has been nominated as the new chair of the U.S. Securities and Exchange Commission (SEC), signaling potential regulatory changes for the cryptocurrency industry.

If confirmed, Atkins’ focus on a reasonable, coherent, and principled regulatory approach may influence digital asset markets favorably and alter previous enforcement strategies.

Atkins Nomination: Possible Crypto Market Boost

Paul Atkins’ nomination for SEC chairman highlights a potential shift in regulatory strategy, differing from previous enforcement-focused policies. He emphasized a balanced approach, prioritizing collaboration with Congress and enhancing digital asset regulation. SEC hopes for more efficient oversight, rather than punitive actions, reflecting a more supportive stance towards market innovation.

Should Atkins adopt new policies, industry participants expect reduced regulatory pressures and increased clarity regarding compliance. This could signal a welcome change for digital asset firms looking to expand operations in the U.S. Investors speculate that this may lead to improved market conditions.

Industry reactions reflect cautious optimism, with key figures expressing their endorsement for Atkins. Eleanor Terrett shared on social media, supporting his nomination for encouraging market growth and regulatory transparency. The Senate Banking Committee has deferred its vote, pending additional questions before final confirmation.

My first priority as chairman is to work with my fellow commissioners and Congress to provide a solid regulatory foundation for digital assets through a reasonable, coherent and principled approach. — Paul Atkins, Nominee for SEC Chairman

Historical Context and Market Data Insights

Did you know? Paul Atkins’ regulatory approach contrasts sharply with his predecessor, Gary Gensler, whose enforcement strategy in 2020 resulted in several high-profile cryptocurrency lawsuits, profoundly impacting market dynamics at the time.

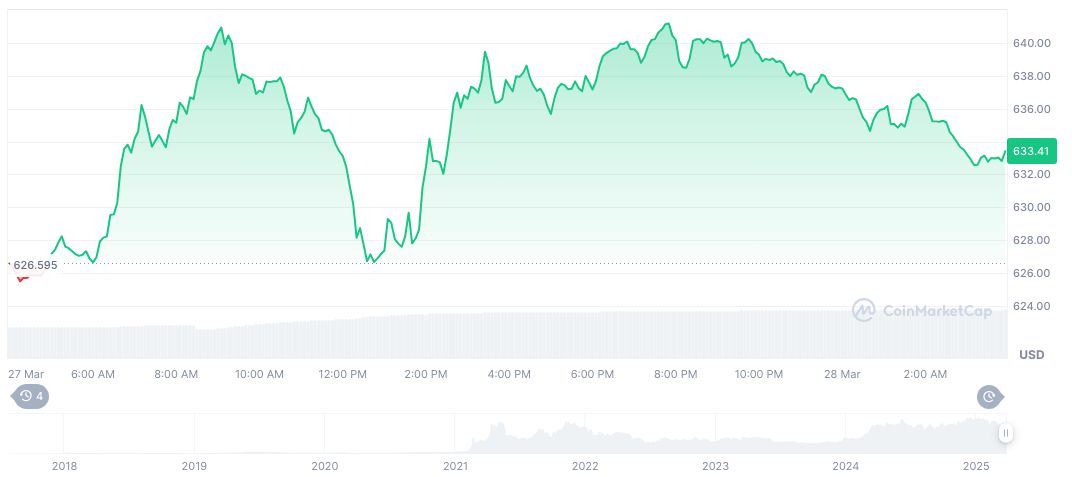

According to CoinMarketCap, BNB is currently valued at $633.11 with a market cap of $90.20 billion and a 53.24% increase in trading volume over the last 24 hours. Price changes over 90 days reveal a decline of 9.04%, indicating a potential trend reversal depending on upcoming regulatory shifts.

The Coincu research team notes that Atkins’ appointment could enhance market stability by fostering innovation-friendly regulations. While the SEC’s historical stance appeared restrictive, this potential shift may usher in an era of growth for digital assets, aligning regulatory frameworks with technological advancements.