- South Carolina proposes to form a Bitcoin reserve of up to 1 million BTC.

- The reserve could account for approximately 4.76% of Bitcoin’s total supply.

- The proposal includes strategies for security and transparency in digital asset management.

Jordan Pace proposed the Strategic Digital Asset Reserve Act in South Carolina’s legislature this March to form a Bitcoin reserve of up to 1 million BTC.

The potential reserve could significantly position South Carolina among global leaders in governmental cryptocurrency holdings, if fully realized.

South Carolina Moves to Invest $85 Billion in Bitcoin

South Carolina has introduced the “Strategic Digital Asset Reserve Act” to the legislature, permitting the state treasurer to invest up to 10% of unused state funds in digital assets, with a specific focus on Bitcoin. The proposal limits the state’s digital holdings to 3% of the total investment portfolio, targeting a reserve up to 1 million BTC.

Once fully implemented, this reserve could account for approximately 4.76% of Bitcoin’s total supply, making it a significant governmental holding. To ensure security, the proposal includes custodial measures like cold storage and public transparency through official updates on Bitcoin management.

The proposal has attracted broad attention, with Paul Grewal of Coinbase commending South Carolina’s action, viewing it as a potential shift in regulatory environments. Grewal noted, “The 52 million Americans who own crypto deserve commonsense consumer protections and clear rules. We applaud South Carolina for standing up for justice and hope the remaining states with bans on staking will take notice.”

Bitcoin Legislation Spurs Interest and Market Insights

Did you know? 42 Bitcoin reserve bills have been presented in various U.S. states, but South Carolina’s move to potentially establish one of the largest government crypto holdings marks a notable shift in state-level cryptocurrency policy.

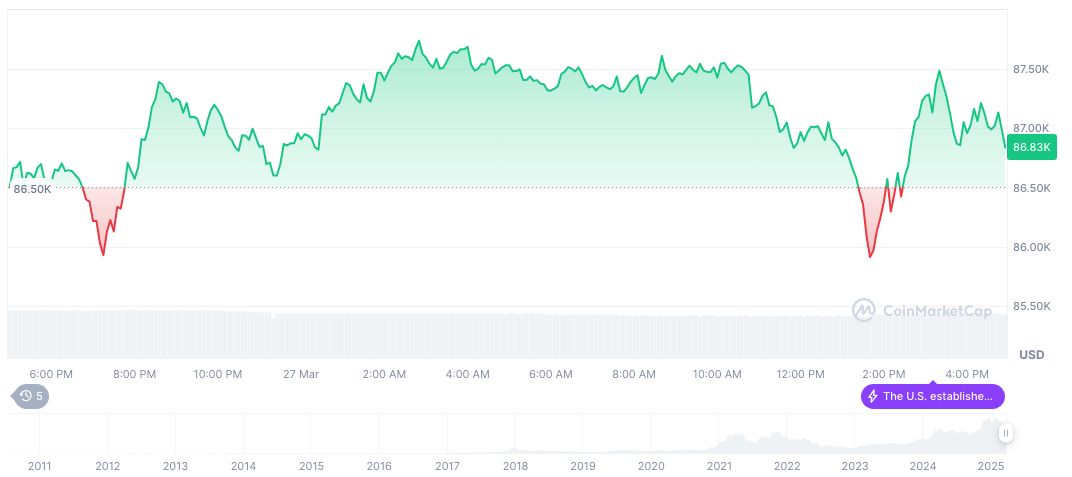

Bitcoin (BTC) is currently valued at $85,182.67, with a market capitalization exceeding $1.69 trillion and market dominance of 61.16%, according to CoinMarketCap data dated March 28, 2025. The digital currency has seen a 2.62% decline over 24 hours, contrasting a minor 1.33% 7-day increase amid macroeconomic volatility.

Insights from the Coincu research team highlight that the legislation may spur financial inclusivity and broader cryptocurrency acceptance, catalyzing other states to undertake similar initiatives. The proposal’s encryption and transparency facets further assure heightened public confidence in digital asset security.