- HyperLiquid delists JELLYJELLY due to security breach

- Debate on decentralization versus security and flexibility in DEXs

- Potential regulatory scrutiny discussed as market trust is affected

HyperLiquid, a decentralized exchange, recently delisted the meme coin JELLYJELLY following a security breach, prompting debates on DEX security and decentralization.

The incident has sparked discussions about the resilience of decentralized exchanges to such attacks and the implications for decentralization.

HyperLiquid’s Delisting Reflects Security and Decentralization Tensions

HyperLiquid has once again come under scrutiny after delisting the meme coin JELLYJELLY following a security breach. This incident has led to a broader discussion on decentralized exchanges and their resilience to such attacks.

Opinions vary on how this incident impacts the perception of decentralization. While some question HyperLiquid’s security protocols, others point to the necessary flexibility required during extreme market conditions.

“The reaction to the $JELLYJELLY incident illustrates the delicate balance of risk management on DEXs.” – Jason Kan, Founder, 8020trade

Price Declines Amid Expert Warnings of Regulatory Impacts

Did you know? The debate over DEX and CEX security intensified following past crises, echoing back to incidents with other tokens that showcased significant vulnerabilities in decentralized models.

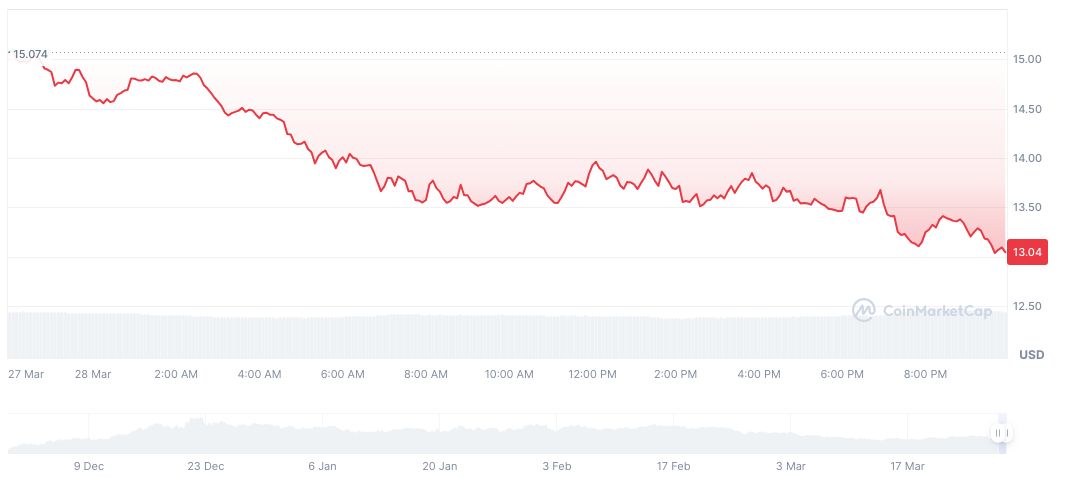

According to CoinMarketCap, HyperLiquid’s token, HYPE, currently trades at $13.05 with a market cap of around $4.36 billion and a 24-hour trading volume of $104.37 million. The token has experienced a 13.32% price drop over the past 24 hours, with longer-term declines of up to 54.75% noted over 90 days.

Experts from Coincu foresee potential regulatory implications from incidents like these. Technological advancements are also anticipated as exchanges seek to improve vulnerabilities. Understanding these patterns could shape future resilience strategies for decentralized trading platforms.