- Nasdaq files to list Grayscale Avalanche Trust shares, involving major industry names.

- AVAX token shows no immediate price change.

- Grayscale continues its ETF expansion, venturing into new digital assets.

Nasdaq has filed a 19b-4 form with the SEC to list Grayscale Avalanche Trust shares. Grayscale, a significant digital asset manager, collaborates with Nasdaq, a leading stock exchange.

This move reflects the growing interest in Avalanche-based investment products, despite AVAX’s current $8.40 billion market cap showing no immediate change.

Nasdaq and Grayscale Propel Avalanche Trust Forward

Nasdaq submitted a 19b-4 form to the SEC for listing Grayscale Avalanche Trust shares, indicating a strategic partnership between Grayscale Investments and the Nasdaq Stock Exchange. The trust holds $1.76 million in assets, with a net asset value per share of $10.86, at a 7.4% premium to its underlying assets.

Market participants observe no immediate price fluctuations for AVAX, the native Avalanche token. The trust’s initiation signals increased institutional exploration into Avalanche investments. The filing follows VanEck’s similar ETF proposal, highlighting growing interest in Avalanche’s ecosystem.

Key entities like Coinbase, BNY Mellon, and CoinDesk Indices are designated roles within this framework. The SEC, now tasked with evaluating the application, may take up to 90 days for a decision. This is part of Grayscale’s broader ETF strategy, including assets like XRP, SOL, and LTC. As noted in a recent CoinTelegraph article, “the filing indicates that Coinbase will serve as the crypto custodian for the proposed ETF, BNY Mellon will act as the administrator and transfer agent, and CoinDesk Indices will provide an index for the ETF.”

Avalanche Market Resilience and Potential Institutional Growth

Did you know? In March 2021, Grayscale successfully converted its Ethereum and Bitcoin funds into spot ETFs, setting a precedent for similar future ventures.

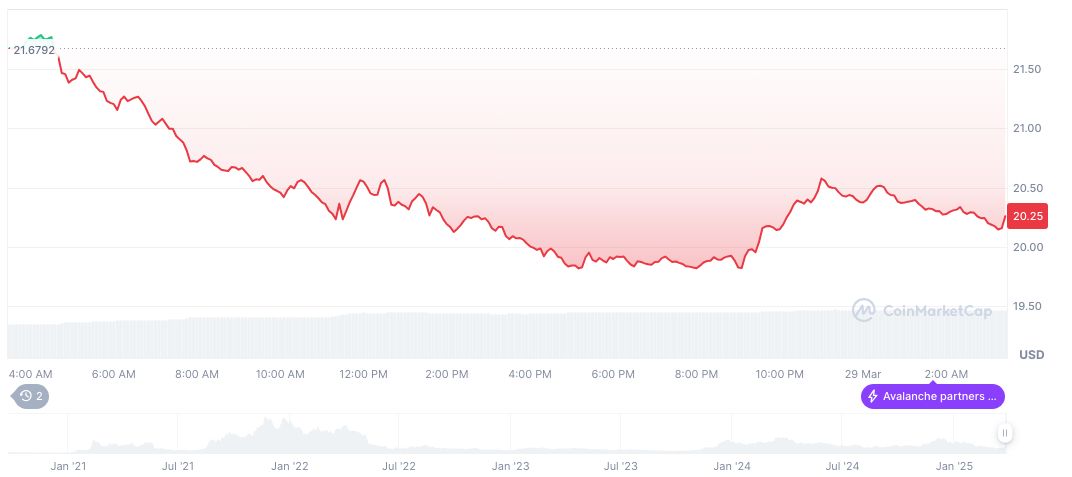

Avalanche (AVAX) trades at $20.24, with a market cap of 8.39 billion, showing resilience amid fluctuating trends. The 24-hour trading volume was 320.59 million, increasing by 40.47%. While experiencing a 6.73% dip over 24 hours, AVAX has risen 4.99% in the past week, though showing a decline across 30, 60, and 90 days metrics.

The Coincu research team notes that successful ETF launches beyond Bitcoin and Ethereum often face prolonged regulatory scrutiny. A potential Grayscale Avalanche Trust could catalyze greater institutional confidence in the broader crypto landscape, driving innovation within financial markets.