- HIFI’s price fell by 11% after Upbit’s warning.

- Investors show increased caution, seeking clarity.

- Potential regulatory scrutiny on the project.

Market analysts noted HIFI’s price fell by 11% following the warning, highlighting investor confidence concerns. The decrease in value serves as a cautionary signal to stakeholders. Reports on Reddit reflect a mix of apprehension and calls for clarity from project leaders.

The warning is significant due to immediate price impacts and signals potential regulatory scrutiny. HIFI’s value dropped 11% shortly after, reflecting increasing caution among investors.

Investor Concerns Deepen Amid Governance Issues

Upbit’s decision to issue an investment warning for HIFI follows consulting with the Digital Asset Exchange Association. The aim is to safeguard investors from potential risks stemming from uncertainties in the token’s issuance and project changes.

The observation period, spanning from March 28 to April 11, 2025, focuses on monitoring market behavior and project responses. Upbit may decide on further actions post-review, such as extending the observation or altering trading support.

“The trading observation period is from March 28, 2025, to April 11, 2025, 23:59 (KST). During this period, an in-depth review will be conducted.” – Upbit Official Statement, Cryptocurrency Exchange, Upbit

Market Data and Future Insights

Did you know? In March 2025, a governance vote increased HIFI’s token supply, echoing a 15-year-old similar event with Bitcoin’s “Genesis Block” enlargement. This showcases comparable patterns in crypto governance across different timeframes.

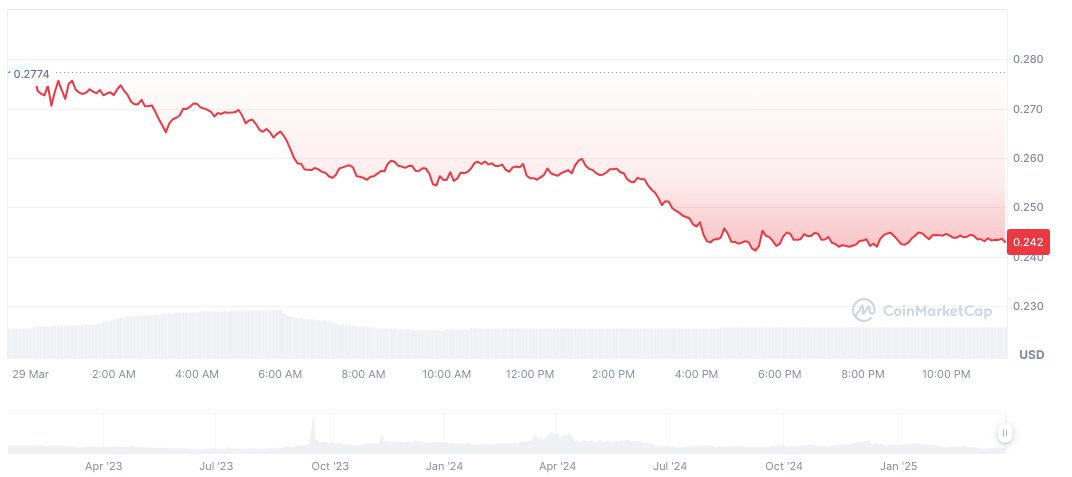

CoinMarketCap data indicates Hifi Finance’s price currently at $0.24, marking a 12.39% drop in 24 hours. Its market cap stands at $34.48 million, reflecting a continued decline amid investor concerns. Recent price movements show a 90-day decrease of 55.47%, underscoring market volatility.

The Coincu research team suggests regulatory clarifications might influence HIFI’s long-term viability. Given the project’s track record, aligning governance actions with investor transparency can stabilize its financial foundation. Such measures could mitigate ongoing market apprehensions.