- Tariffs announcement by Trump during an Air Force One interview.

- Global market reactions with potential financial impacts forthcoming.

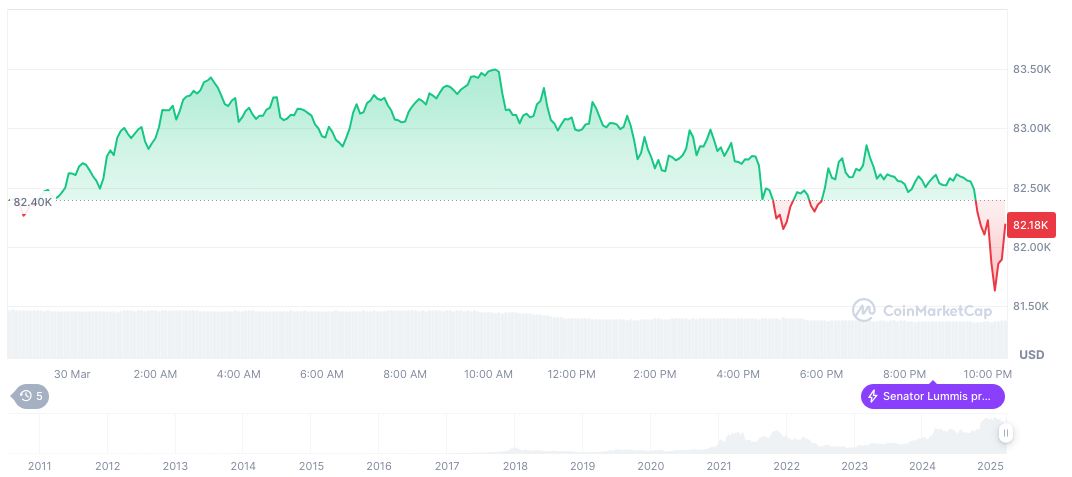

- Cryptocurrency volatility observed with Bitcoin topping $83,000.

President Trump told Bloomberg on Air Force One about his intention to impose tariffs on all countries, raising widespread market uncertainties. His statement lacked official White House confirmation, but has already caught global attention.

Immediate changes focused on the potential ripple effects across various economic sectors. While no concrete actions were taken yet, investors are poised for potential financial implications impacting stock prices and currency exchange rates.

Bitcoin Volatility Soars Amidst Speculative Trade Environment

Bloomberg reported from President Trump’s remarks indicated impending international tariffs. With no explicit timelines detailed, his plans hint at a major economic shift. Key details remain scarce, causing speculation among global market participants.

Market responses echoed across industries and financial communities. Words from Trump, lacking White House corroboration, created speculative chatter, emphasizing the need for caution. Market volatility followed closely, with impact assessments likely forthcoming.

“95% of the time in the crypto market is a bear market, and only 5% is a bull market. The pulse-like bull market in the 5% of the time determines your gains.” — BMAN, Co-Creator, ABCDE

Historical Context, Price Data, and Expert Analysis

Did you know? The last major tariff announcement by the Trump administration in 2018 led to intense global market scrutiny and a temporary dip in several stock indexes, reflecting comparable trader wariness today.

As of March 31, 2025, Bitcoin (BTC) is priced at $81,754.39, exhibiting a market cap of $1.62 trillion and a market dominance of 61.31% according to CoinMarketCap. Trading volume over the past 24 hours reported at $16.65 billion, marking a decrease amid a 2.04% slump. BTC has undergone a negative price movement of 5.28% over seven days and dropped by 21.88% in the past two months.

Insights from Coincu research team propose that the potential repercussions of tariffs include tighter regulatory environments and technology investment slowdowns. Historical trends suggest likely impacts on global economic stability, with investment portfolios poised to reallocate in response.