- BlockBeats traffic returns to pre-meme levels impacting market environment.

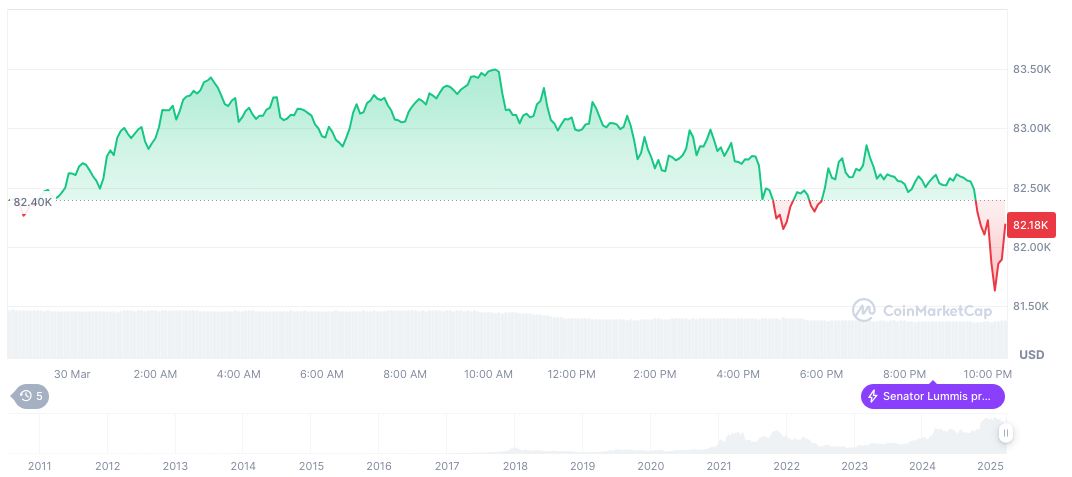

- Bitcoin demand decline amidst global challenges.

- Market addresses recession, increased trading activity.

BlockBeats traffic data as of March 31 reveals a decline to pre-TRUMP meme project levels, last observed on January 17. The drop suggests the crypto enthusiasm from this event has significantly wavered.

Market participants are reassessing digital currencies like Bitcoin as demand plummets alongside BlockBeats’ reported traffic decline.

BlockBeats Traffic Returns to January 17 Levels

BlockBeats traffic reportedly decreased, registering figures last seen before the TRUMP meme project release by former U.S. President Trump in early 2023. This recent development marks a notable shift back to January 17 levels, highlighting a significant return to stability in industry engagement metrics.

The reduced platform engagement reflects a broader waning interest in crypto triggered by sensational projects. Such trends emphasize industry’s sensitivity to hype-driven investment booms. With decreasing user activity, the focus now turns towards more sustainable growth metrics.

Cas Abbé, Web3 Growth Manager at Binance, stated, “Bitcoin demand is declining at the fastest pace since Q4 2023 due to ongoing global trade wars.”

Bitcoin Volatility Amid Market Shifts

Did you know? The BlockBeats platform, once propelled by the TRUMP meme effect, highlights how ephemeral events can initially drive, yet unsustainably fuel, surges in crypto market interests, cautioning stakeholders on reliance on singular phenomena.

Bitcoin, trading at $82,041.85, shows a market cap of $1.63 trillion and dominates 61.4% of the market, according to CoinMarketCap. With a 1.30% 24-hour decline, recent data underlines Bitcoin’s volatility amid a challenging macroeconomic landscape.

Analysts from Coincu suggest potential stabilization if cryptocurrency industries pivot towards frameworks mitigating speculative run-ups. Citing past market trends, they recommend strategic focus on regulatory coherence to foster resilience against hype-driven volatility.