- Trump family consolidates WLFI control, restructuring leadership and ownership.

- 50% of tokens sold to U.S. accredited investors.

- Significant public scrutiny amidst governance concerns.

Donald Trump and his family have gained increased control over World Liberty Financial (WLFI) following a restructuring process that involves a newly established company.

This restructuring suggests significant changes in leadership and market position for WLFI, engaging with new family-led management and potential public response.

Trump Family Raises $550 Million through Token Sales

The Trump family solidified its command over WLFI by forming WLF Holdco LLC, effectively facilitating new governance under their leadership. Restructuring involved the displacement of prior controlling members, positioning DT Marks DeFi LLC as a commanding force. WLFI subsequently raised $550 million, with documented allocation producing 75% of net proceeds channelled to the Trump family.

Immediate implications include the changing operational control dynamics, potentially steering new tactical initiatives within the WLFI framework. Market analysts raise governance and transparency concerns while noting a significant ownership shift.

Donald Trump Jr. labeled WLFI a vital connection bridging crypto and retail landscapes, emphasizing its importance at a recent Ondo Summit. However, entrepreneur Mark Cuban cautioned on Twitter, warning potential investors of a seeming pump and dump. “This has all the signs of a classic pump and dump. Be careful out there folks,” said Cuban (source). Public discourse has spread quickly, accentuating the need for scrupulous insight.

WLFI Token Performance amid Governance Concerns

Did you know? The Trump family’s 60% stake in WLF Holdco LLC mirrors early consolidation practices seen in other major crypto projects, reflecting both entrepreneurial ambition and significant governance risks uniquely expressed in this financial setting.

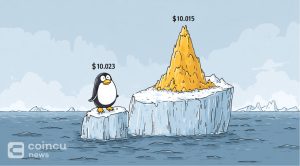

According to CoinMarketCap data, World Liberty Financial (WLFI) currently reports a fully diluted market cap of $14,092,060.01, with no circulating supply and a 24-hour trading volume of $1,980.49. The token experienced a 10.06% increase over 24 hours but faces a -72.43% drop in the last 60 days. These alterations highlight the token’s dynamic yet volatile status, emphasized by shifting market sentiment.

Insights from Coincu highlight the potential for regulatory scrutiny amid evolving governance paradigms, especially considering the Trump family’s prominent engagement in the space. The project’s trajectory remains under strategic observation due to both its ambitious crypto endeavors and the complexities inherent in its current structure.