- Call for regulations to permit stablecoin interest.

- Emphasis on equal opportunities for banks and crypto firms.

- Potential for diversifying consumer financial products.

Brian Armstrong has called for US regulators to permit interest payments on stablecoins. He highlighted that current prohibitions restrict opportunities in the stablecoin market, which could benefit US consumers if interest were allowed.

Armstrong argued that both banks and crypto firms should have equal opportunities to offer interest on stablecoins. He stated that prohibiting one industry while supporting another is not beneficial. Armstrong emphasized, “US stablecoin legislation should allow consumers to earn interest on stablecoins. The government should not favor one industry but should allow both banks and crypto companies to offer interest to consumers and incentivize them to do so.”

Stablecoin Market Stability and Expert Insights

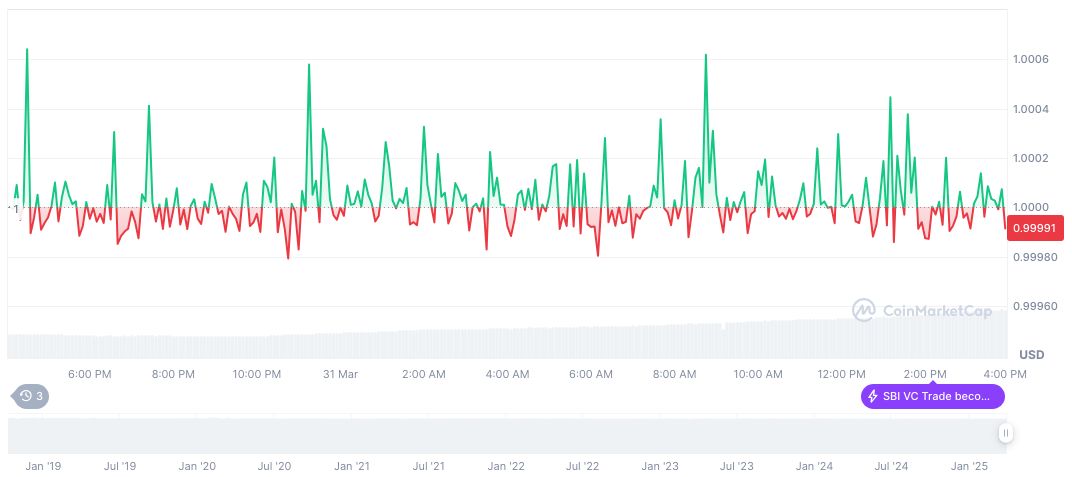

USDC, a stablecoin, maintains a price of $1.00 with a market cap of formatNumber(60099399840, 2). Its 24-hour trading volume rose by 121.19%, reaching formatNumber(10906616313, 2). The minimal price changes over the last three months underscore its stability. Data as of March 31, sourced from CoinMarketCap.

The introduction of interest-bearing stablecoins could diversify consumer financial products. This may incentivize more users to integrate stablecoins into traditional financial ecosystems.

The Coincu research team comments that both financial and technological frameworks may need adjustments to facilitate on-chain interest on stablecoins. Such changes could offer consumers enhanced financial options, potentially increasing stablecoin adoption.

Bank of America and Stablecoin Interest

Did you know? In the past, attempts to align cryptocurrencies with traditional finance systems have often faced regulatory hurdles, highlighting the ongoing complexity of such integrations.

Bank of America has also shown interest in the potential of stablecoins, further emphasizing the growing focus on this financial innovation.

Such changes could offer consumers enhanced financial options, potentially increasing stablecoin adoption.