- President Trump’s anticipated tariff announcement influences market trends.

- Crypto markets experience volatility and strategic shifts.

- Investor sentiment reflects cautious optimism and fear.

U.S. President Donald Trump has hinted at unveiling new tariff details soon, potentially by tomorrow night. The anticipation surrounding this announcement has already sent ripples through the cryptocurrency markets.

President Trump’s remarks come amid heightened market attention, particularly within cryptocurrency circles. This announcement could mark significant changes as traders brace for potential impacts on market dynamics.

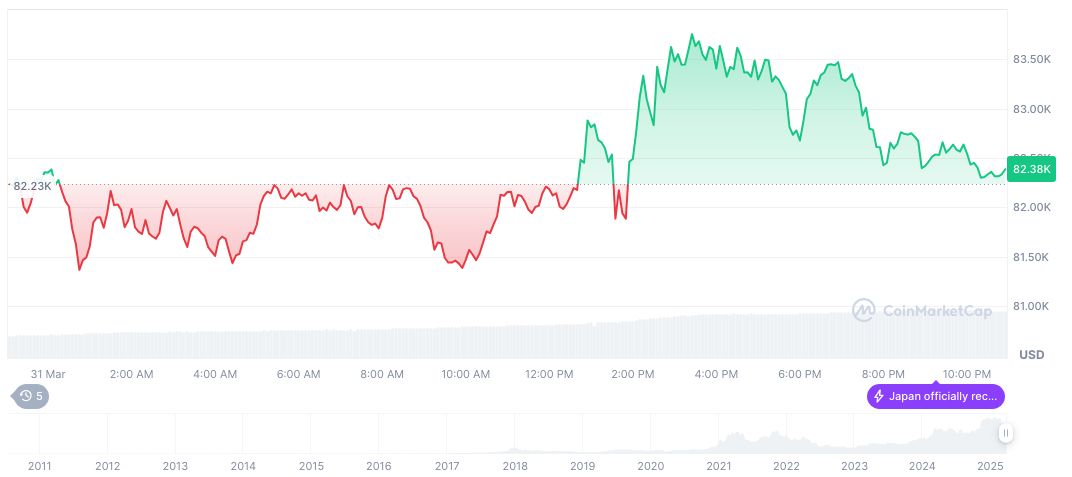

Tariff Anticipation Sends Bitcoin Plummeting by 21.69% Over 60 Days

President Trump has indicated potential updates on peer-to-peer tariff details, expected to be disclosed imminently. This comes amidst his administration’s shift in stance, viewing cryptocurrency as an essential component of U.S. financial policy. During Trump’s previous tenure, tariffs had wide-reaching effects on market volatility and trade relations.

Changes in crypto market trends are already apparent, as prices of major tokens like Bitcoin have shown fluctuations in anticipation of the announcement. The Fear & Greed Index remains unchanged, suggesting persistent apprehension among investors about impending policy adjustments.

Reactions across the industry vary. An unnamed analyst highlighted the shift from regulatory hostility to strategic positioning, suggesting that cryptocurrencies are emerging as a foundational aspect of U.S. financial frameworks. Meanwhile, traders adopt a risk-off approach, reflecting a mix of caution and optimism.

“So far, the tone has shifted dramatically from regulatory hostility to strategic positioning. The Trump administration is making crypto a pillar of US financial policy rather than an afterthought. Between the announcement of the Strategic Crypto Reserve, support for stablecoin legislation, and clearer signals around digital asset frameworks, we’re seeing policy alignment that was missing for years.” — Unnamed Analyst, Crypto Market Analyst

Cryptocurrency Adjusts to Potential U.S. Policy Shifts

Did you know? During Trump’s previous tenure, tariff implementations led to significant volatility across global markets, establishing a historical precedent for potential impacts on the crypto market today.

According to CoinMarketCap, Bitcoin (BTC) is currently valued at $82,369.20 with a market cap of $1.63 trillion. Exhibiting a dominance of 61.39%, Bitcoin’s 24-hour trading volume shows an increase of 108.04%. Its price has seen a minor 0.04% decline over the past day, yet it remains affected by more significant trends, indicated by a 21.69% decrease over 60 days.

Insights from the Coincu research team suggest that the potential ramifications of Trump’s tariff policy could further extend to technological innovations and regulatory frameworks in cryptocurrency. Analysts emphasize the importance of monitoring policy signals that align with strategic crypto positioning.