- The Trump family gains control of crypto firm World Liberty Financial.

- Raised $550 million amid governance token sales.

- Concerns over centralized control and financial exclusion arise.

Donald Trump’s family acquired a 60% stake in World Liberty Financial after the firm raised $550 million in token sales. This acquisition, unveiled in April, has been reported by PANews.

The move highlights potential governance issues and raises questions about implications for the DeFi space and public investors.

Trump’s $400M Stake Raises Centralization Concerns

World Liberty Financial has recently come into the spotlight after revelations of a significant stake acquisition by the Trump family. The former President’s family commands approximately $400 million of the firm’s funds, claiming 75% of token sale revenues and 60% of operational income. Critical concerns arise over governance structures, particularly allocation methods and the role of founding figures Zak Folkman and Chase Herro. Their control transition allowed the family to assume such a significant share.

The Trump family’s involvement inevitably prompts renewed questions about the impact on both the broader crypto market and World Liberty Financial’s developmental future. With control over governance clauses firmly in their favor, skeptics highlight risks of future project development being limited or skewed.

“It’s hard for me to see any economic benefit to the owner of these tokens,” said Jim Angel, Associate Professor, Georgetown University.

International response varies, with attention quickly shifting toward regulatory scrutiny.

Governance Token Dynamics and Regulatory Scrutiny

Did you know? World Liberty Financial’s governance structure marks a stark deviation from typical DeFi arrangements, drawing industry parallels to centralized banking models. This shift emphasizes how traditional influences can reshape decentralized platforms.

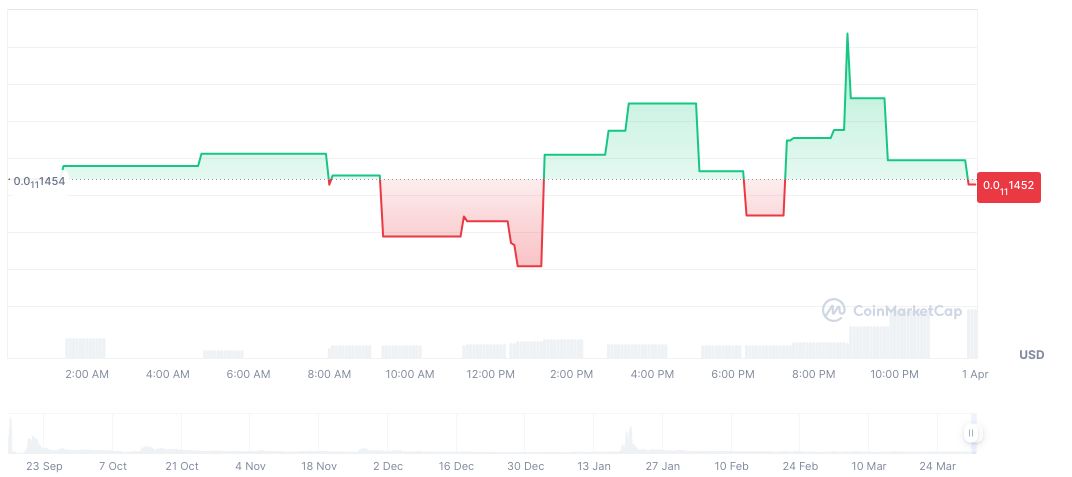

World Liberty Financial’s governance token, WLFI, is unique in providing sole voting rights for project modifications, without typical tradable features. Despite a current market cap hovering at $0 and a fluctuating 30-day price increase of 6.51%, uncertainties remain. Alleged control dynamics and limited public transparency prompt scrutiny, heightened amidst recent 34.29% 90-day price recovery, according to CoinMarketCap.

Insights from Coincu suggest potential regulatory challenges as typical DeFi structures are contrasted with centralized control elements. Historical patterns in governance showcase potential vulnerabilities; industry experts advocate watchful oversight to ensure the platform aligns with investor expectations and transparency standards.