- BlackRock CEO Larry Fink discusses Bitcoin’s impact on U.S. dollar status.

- Fink highlights the potential risk by 2030.

- Recognizes tokenization’s benefits for traditional finance.

Larry Fink, CEO of BlackRock, recently highlighted in a letter to shareholders that Bitcoin might undermine the U.S. dollar’s status if used as a hedge against inflation.

Larry Fink, CEO, BlackRock, “If the U.S. doesn’t get its debt under control, if deficits keep ballooning, America risks losing that position to digital assets like Bitcoin.” The letter discusses implications if the U.S. doesn’t control its debt by 2030.

Bitcoin’s Role in Reshaping Financial Landscapes

Larry Fink of BlackRock raised concerns over Bitcoin and cryptocurrencies potentially challenging the U.S. dollar’s international status. He stressed that if investors continue to view Bitcoin as a hedge against inflation, this could undermine the dollar.

Financial experts and market analysts note the change, recognizing the significance of Bitcoin in traditional finance. Fink emphasized tokenization among cryptocurrencies’ advantages, suggesting it could democratize finance but warned of its potential dangers if improperly managed.

Market responses to Fink’s comments reflect a mix of anticipation and caution. While some embrace the possibilities of financial innovation, others share Fink’s concerns about implications for the U.S. economy. Discussions on cryptocurrencies’ role in potentially affecting the dollar continue.

Bitcoin Market Surge: Trends and Expert Warnings

Did you know? In the past decade, Bitcoin’s market cap surged from less than 100 million USD to approximately 1.6 trillion USD, showcasing its influence in potentially reshaping traditional finance.

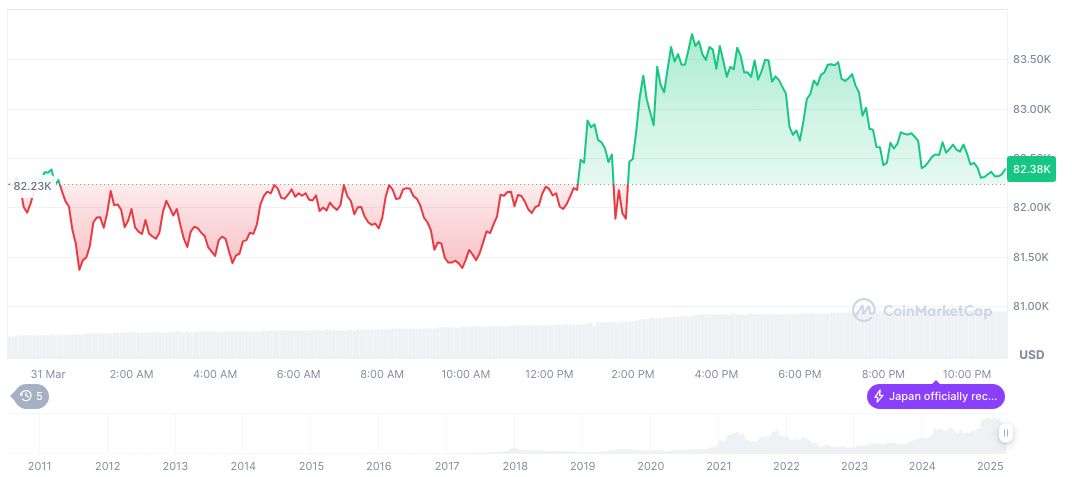

Bitcoin (BTC) is currently priced at $82,592.09, with a market cap of $1.63 trillion, dominating 61.36% of the crypto market, per CoinMarketCap. Recent price actions show a 1.11% rise in 24 hours, a 5.76% drop in 7 days, with a 21.27% decrease over 60 days. Total supply ranks near its limit of 21 million.

The Coincu research team observes that tokenization, a notable innovation Fink favors, could enhance traditional finance through faster, transparent transactions, but also warns of economic implications if debt issues persist. Bitcoin’s potential market impact remains a critical talking point among financial experts, emphasizing both risks and opportunities amid technological advancements.