- Grayscale submits S-3 for ETF conversion, boosting investor interest.

- Immediate market reactions observed, with Bitcoin values rising.

- Past success in ETF conversions hints at regulatory progress.

Grayscale filed an S-3 registration on April 1, 2025, aiming to convert its Grayscale Digital Large Cap Fund into an ETF. The move addresses ongoing interests in regulated digital asset investment strategies.

The submission continues Grayscale’s push to modernize its fund structures amidst growing market interest in cryptocurrency ETFs.

Grayscale’s Strategic Move: Large Cap Fund ETF Conversion

Grayscale Investments filed an S-3 registration with the intent of transforming its Grayscale Digital Large Cap Fund LLC into a publicly tradable ETF. Situated in the Cayman Islands, this fund marks Grayscale’s latest attempt to elevate its product offerings in the evolving cryptocurrency investment market.

This conversion aims to capture the rising demand for regulated digital assets. By transforming the fund into an ETF, Grayscale seeks to provide more accessible trading methods for institutional investors. This shift is expected to align with the momentum seen in their previous fund conversions, such as the Bitcoin Trust ETF.

Michael Sonnenshein, CEO of Grayscale Investments, said, “Our mission has always been to provide investors with access to the digital economy. We believe that converting our funds into ETFs is a critical step to achieving that.” – Grayscale Digital Large Cap Fund

Market participants reacted swiftly, with increased interest seen in Bitcoin and other related digital assets. Analysts suggest that past efforts by Grayscale to convert its funds, such as the Ethereum Trust, serve as promising indicators for the latest transformation. Despite a careful regulatory examination, market optimism persists.

Analyzing Bitcoin’s Surge and the Role of ETFs

Did you know? In 2024, Grayscale successfully converted its Bitcoin Trust to an ETF within six months, showcasing regulatory adaptability crucial for the crypto asset market.

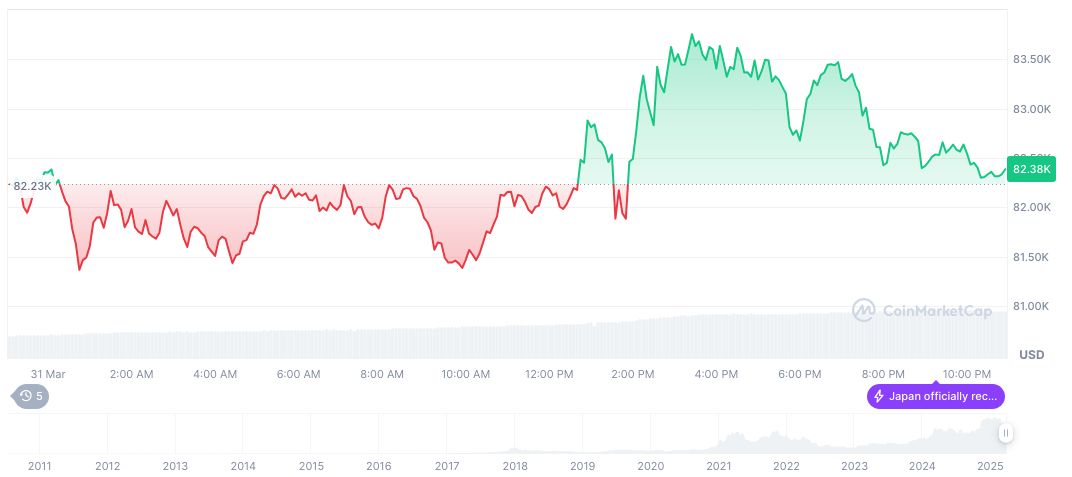

Bitcoin, as detailed on CoinMarketCap, currently trades at $84,195.32 with a market cap nearing $1.67 trillion. Over the past 24 hours, its trading volume increased by 34.77%, while the price saw a 2.48% uptick. However, the last 90 days reveal a 9.58% decrease, emphasizing market volatility.

The Coincu research team highlights that Grayscale’s continued pursuit of ETF conversions suggests significant financial opportunities. Analysts predict increased regulatory clarity could foster greater institutional involvement, heralding a new era for digital asset investments. Additionally, historical data highlights the scalability of such ventures, underscoring their transformative potential in the crypto industry.