- Grayscale files S-3 form to convert its Digital Large Cap Fund into an ETF.

- Fund holds $606 million in assets, with Bitcoin and Ethereum as major components.

- Filing aligns with industry trend towards mainstream crypto ETF approvals.

Grayscale Investments submitted an S-3 form on April 1, aiming to register its Digital Large Cap Fund as an exchange-traded fund (ETF), according to the SEC website.

Grayscale’s move to convert its fund into an ETF reflects the broader industry shift toward mainstream acceptance of crypto investments.

Grayscale Files for ETF with $606 Million in Assets

Grayscale Investments, a subsidiary of Digital Currency Group, has initiated the process to register its Digital Large Cap Fund as an ETF. This marks a new step in the growing acceptance of cryptocurrency-focused investment vehicles. The fund manages approximately $606 million in assets, primarily composed of Bitcoin and Ethereum.

The proposed ETF conversion could increase accessibility of diversified crypto investments for retail investors. By converting to an ETF, the fund could potentially draw more interest from traditional investors seeking exposure to digital assets without directly purchasing them.

Market responses have been generally positive, as previous approvals of spot Bitcoin and Ethereum ETFs demonstrated growing regulatory support for these products. Grayscale’s CEO, Michael Sonnenshein, has stated:

“The approval of our ETF application would represent a major milestone in our mission to bridge the gap between traditional finance and digital assets.”

Historical Precedents and Market Implications

Did you know? Grayscale previously set precedents by converting its Bitcoin and Ethereum Trusts into spot ETFs in 2024, marking pivotal moments in the crypto industry.

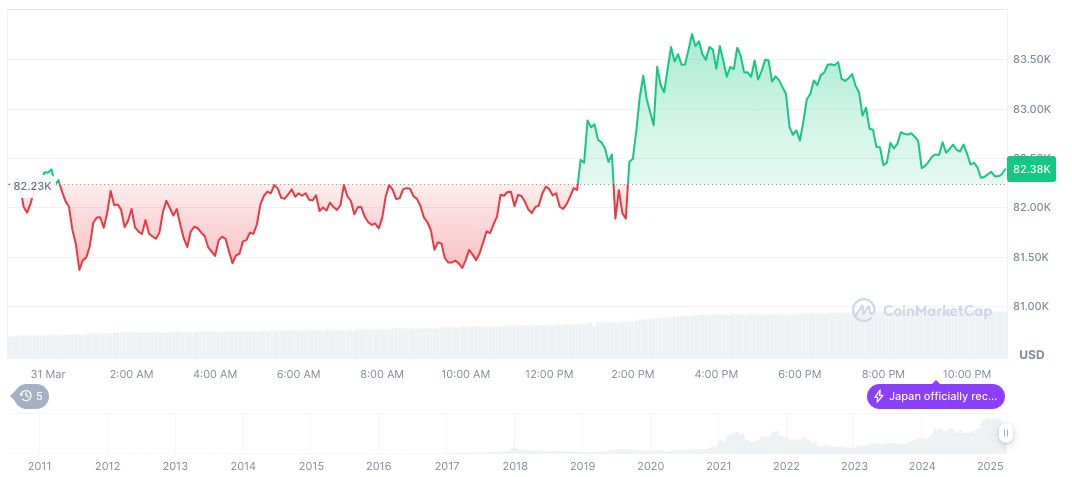

Bitcoin (BTC) is currently priced at $84,965.93, with a market cap of $1.69 trillion and a dominance of 61.61%, per CoinMarketCap. Recent price movements show a 2.70% 24-hour increase, offset by a 9.60% drop over 30 days, with a trading volume of $27.94 billion.

The Coincu research team suggests that Grayscale’s fund conversion may accelerate regulatory acceptance. This move could pave the way for additional multi-asset crypto funds to enter the ETF market, expanding the range of crypto investment options available to broader audiences.