- DWF Labs transfers $25 million USDC to WLFI project associated with Trump family.

- Speculation on USD1 stablecoin partnership grows.

- Market reactions remain cautious as regulatory conditions are unclear.

DWF Labs has transferred $25 million USDC to WLFI, a cryptocurrency initiative linked to the Trump family. This transaction was monitored and reported by OnchainLens.

The funding highlights potential collaboration between DWF Labs and WLFI to launch the USD1 stablecoin, emphasizing significant financial movement in the DeFi space.

$25 Million USDC Infusion into Trump’s WLFI Crypto Initiative

ChainCatcher News revealed that DWF Labs, a prominent market player, transferred $25 million USDC to the Trump family’s WLFI crypto project. The initiative aims to enhance DeFi functionalities through blockchain technology. WLFI’s focus includes stablecoins and liquidity pools, positioning itself as a significant player in digital finance. The involvement suggests a potential partnership for launching USD1, which could elevate WLFI’s offering, integrating stablecoin transactions into its ecosystem.

The injected capital is poised to fortify WLFI’s financial stability, potentially accelerating the launch of the USD1 stablecoin. It signifies increasing institutional support for such initiatives, aligning with broader trends in decentralized finance. WLFI seeks to expand its ecosystem through strategic funding sources, aiming for comprehensive DeFi services.

From a community perspective, market participants cautiously observe the developments around WLFI’s stablecoin. Notable industry figures and exchanges, including Binance’s CZ, have shown interest. CZ himself said, “Welcome to the project on BNB Chain,” indicating serious attention to the developments. However, regulatory clarity and execution remain under scrutiny, particularly given the high-profile associations and the project’s ambitious goals.

Stablecoin Ventures: Historical Precedents and Market Implications

Did you know? In previous stablecoin ventures, major influencers have often secured funding from institutional giants, hinting at the necessity for early financial backing in ambitious DeFi projects.

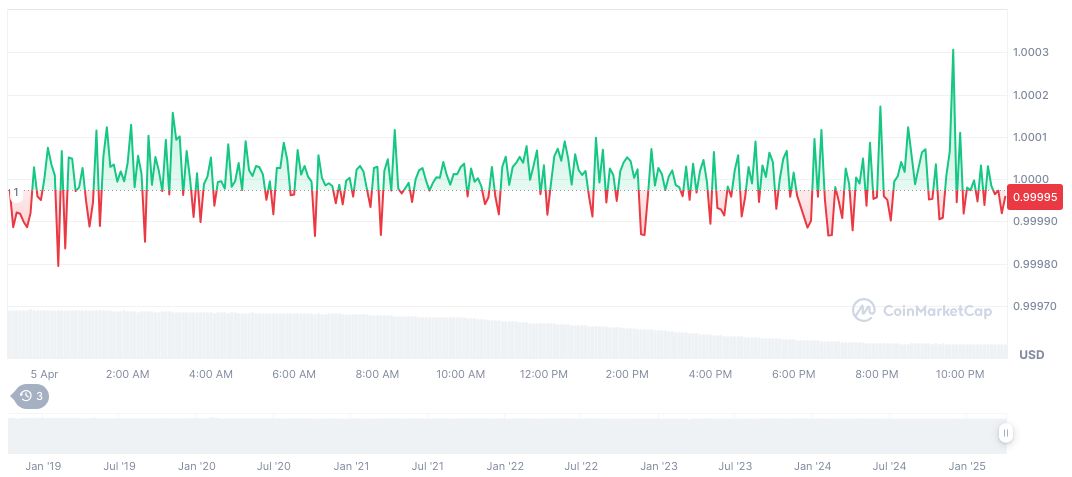

As of the latest update, USDC trades at $1.00 with a market cap of 60.53 billion, accounting for a 2.27% market dominance. According to CoinMarketCap, USDC’s 24-hour trading volume is at 4.48 billion, reflecting a 69.54% decrease. Price changes in the past 90 days show a subtle volatility, maintaining a near-constant value crucial for stablecoins.

Coincu’s research team suggests that WLFI could achieve enhanced liquidity with its USD1, supported by such substantial fund transfers. Historically, regulatory changes and market trends have influenced crypto projects, and WLFI’s alignment with these trends might dictate its long-term success in the competitive market.