Trump Emphasizes Global Crypto Standards as Citadel Enters Market

- Market impact of Trump’s regulatory call and Citadel’s crypto entry.

- Citadel Securities eyes liquidity growth in cryptocurrency sector.

- Institutional inflows expected following Citadel’s market expansion.

Former U.S. President Donald Trump underscored the necessity for rigorous yet reasonable global crypto standards, as global discussions on regulatory frameworks advance. Citadel Securities’ anticipated entry into the cryptocurrency market is poised to affect liquidity dramatically.

Trump’s call for global crypto standards aims to integrate cryptocurrency into existing regulatory systems. Meanwhile, Citadel Securities plans to enter the crypto market in 2025, an anticipated move that could heighten liquidity yet raise concerns over market concentration.

Trump’s Crypto Standard Appeal and Citadel’s Market Entry

Former President Donald Trump, as reported by Jinshi and ChainCatcher, stated nations are in discussion with the U.S. to set “rigorous yet reasonable standards” for cryptocurrency. This aligns with his earlier policies focusing on regulatory development and reciprocal tariffs. Notably, Citadel Securities is planning market entry, signaling significant market shifts.

Citadel Securities’ upcoming participation in crypto is predicted to enhance liquidity, aligning with Trump’s regulatory emphasis. Impact assessment of new entrant nonbank firms suggests this move could, however, pose challenges to smaller market players due to increased resource centralization and potential for market manipulation.

Global nations are engaging with the U.S. to establish ‘rigorous yet reasonable standards.’ — Donald Trump, Former U.S. President

Historical Context, Price Data, and Expert Insights

Did you know? Trump’s crypto regulatory push mirrors his deregulation efforts from his prior presidency, which benefited fintech significantly, paving the way for wider crypto acceptance.

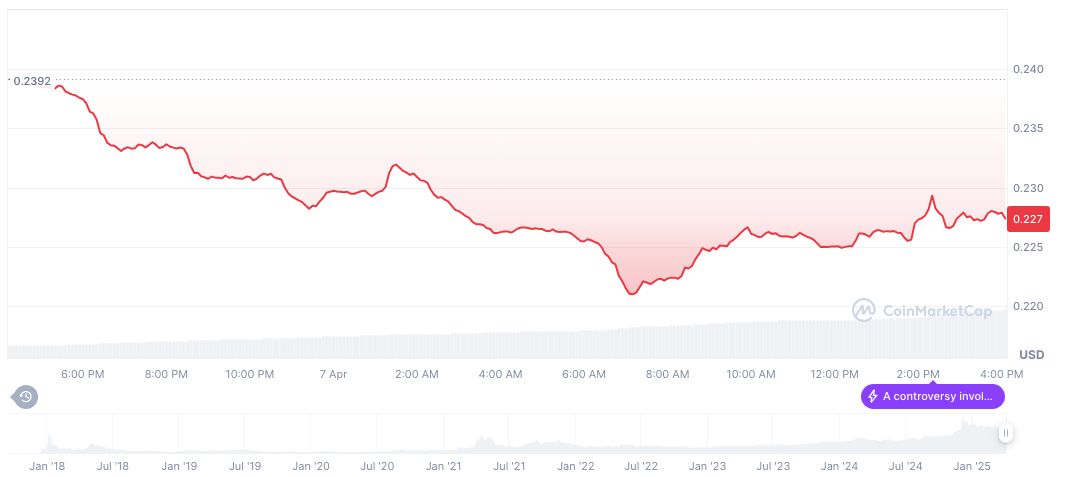

TRON (TRX) currently prices at $0.23 with a $21.67 billion market cap. As per CoinMarketCap, it holds 0.87% market dominance and experienced a 1.17% decrease in 24 hours. The cryptocurrency displays a mixed performance trend, facing a varied percentage drop over different timelines.

The Coincu research team emphasizes potential shifts as U.S. regulators increasingly engage with cryptocurrency standards. Citadel Securities’ entry may encourage more institutional participation but requires cautious navigation of evolving compliance frameworks. Historical trends suggest a dynamic yet uncertain trajectory for market adaptation.