- Andrew Bailey takes over as FSB Chair, impacting global crypto regulations.

- Bailey’s leadership will influence crypto regulatory frameworks.

- Expect increased stablecoin scrutiny under Bailey’s tenure.

Andrew Bailey, Governor of the Bank of England, will assume the position of Chair of the Financial Stability Board (FSB) from July 2025.

His leadership is crucial as the FSB aims to create stronger global cryptocurrency regulations, shaping the future stability of financial systems globally.

Andrew Bailey to Lead FSB: Impact on Global Crypto Regulations

Andrew Bailey has been unanimously nominated by the FSB Nomination Committee to become the Chair, starting in July 2025. His previous roles include being Chief Executive Officer of the UK’s Financial Conduct Authority. Bailey currently chairs the FSB’s Standing Committee on Supervisory Coordination.

His appointment signifies a potential shift toward tighter regulation on stablecoins worldwide. Emphasizing systemic stability, Bailey’s new role strengthens global regulatory frameworks amid the growing crypto market.

Andrew possesses the leadership, expertise, and vision needed to guide the FSB in achieving its objectives. — François Villeroy de Galhau, Governor of the Bank of France

Stablecoins Under Scrutiny: Potential Compliance Changes Ahead

Did you know? During Mark Carney’s tenure as FSB Chair post-2008 crisis, stringent policies advanced systemic stability, illustrating Andrew Bailey’s significant regulatory leadership could lead similar global crypto regulatory enhancements.

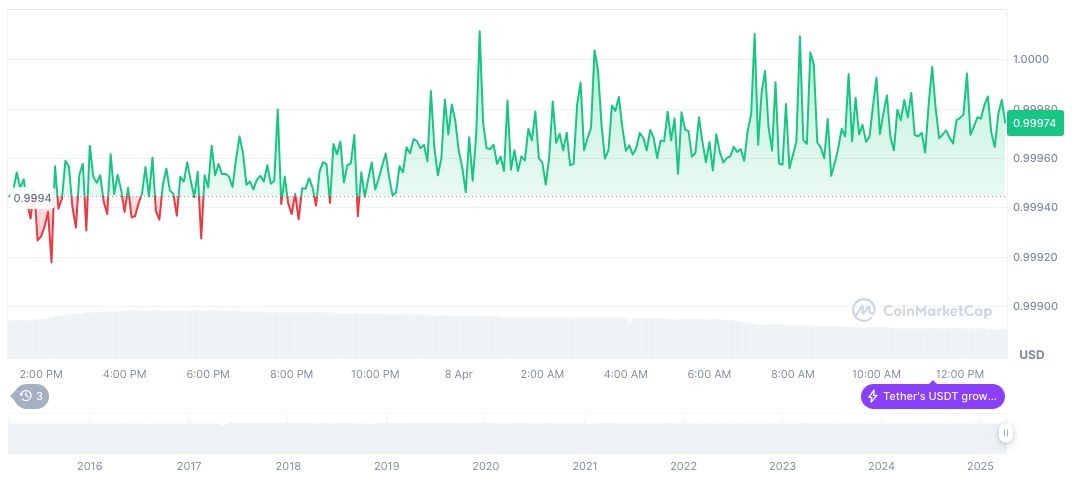

According to CoinMarketCap, Tether USDt (USDT) maintains a $1.00 value with a market cap of formatNumber(144179775455, 2). Despite the 22.55% drop in 24-hour trading volume, the market dominance stands at 5.69%. The circulating supply is formatNumber(144192090764, 2), last updated April 8, 2025.

The Coincu research team highlights that Bailey’s leadership might prompt new financial compliance standards and regulatory measures for stablecoins like USDT. This could impact the broader DeFi sector if new frameworks are adopted.