KernelDAO Powers 50+ Integrations and Expands to Six L2s

| Key Points: – KernelDAO powers 50+ integrations across Ethereum, BNB Chain, and six Layer 2s. – $50M funding supports validator onboarding, tooling, and ecosystem scalability. – Backed by Binance Labs, Nomura, GSR, and 30+ validator network deployments. |

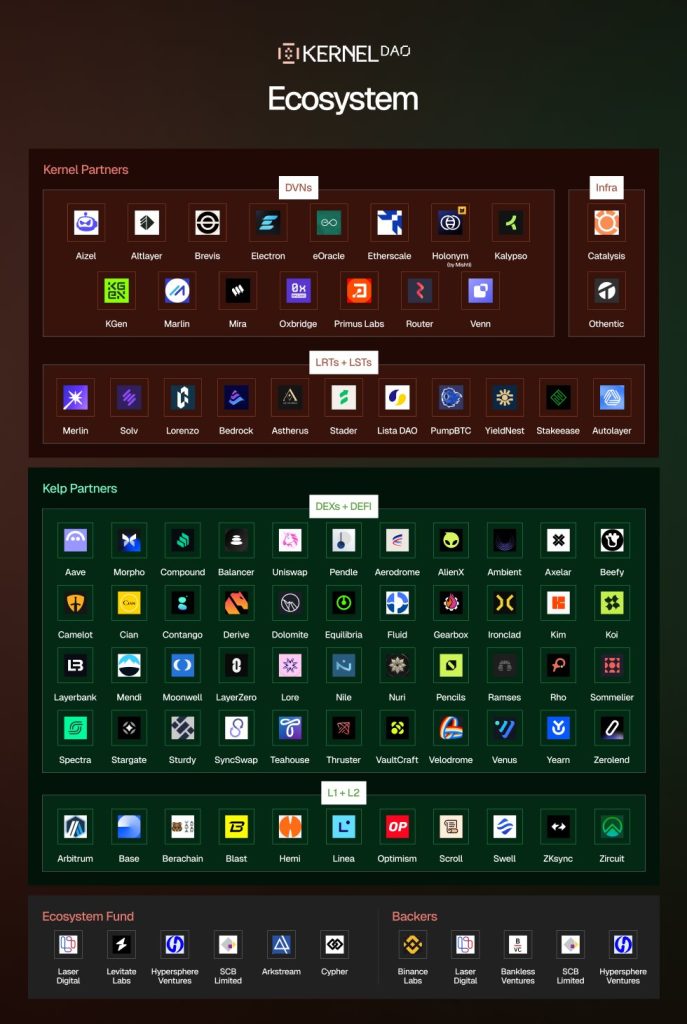

KernelDAO now powers a network of 50+ integrations, including major DeFi protocols like Aave, Compound, Morpho, and Uniswap, while supporting 30+ DVNs and deployments across six leading Layer 2s.

Backed by Binance Labs, Nomura’s Laser Digital, and GSR, KernelDAO’s $40M ecosystem fund and prior $10M raise provide critical support for developer tooling, validator onboarding, and ecosystem scalability across Ethereum, BNB Chain, and beyond.

KernelDAO Powers 50+ Integrations Across Ethereum, BNB, and L2s

KernelDAO has positioned itself as a core infrastructure provider within the restaking sector, expanding its presence across Ethereum, BNB Chain, and several Layer 2 networks. Its primary offerings — Kernel, Kelp, and Gain — are integrated with many decentralized applications, validator frameworks, and restaking platforms.

As of early 2025, the project reports:

- Over 50 active integrations, including Aave, Compound, Morpho, Spark, Pendle, and Uniswap

- More than 30 Distributed Validator Networks (DVNs) supported via Kernel

- Deployment across six L2s: Arbitrum, Base, Linea, Optimism, Scroll, and Mode

KernelDAO’s product suite supports a wide array of Web3 verticals, collaborating with developers and platforms working in AI, zero-knowledge technology, identity, oracle networks, and cross-chain communication.

Ecosystem highlights include:

- AI and Computing: Mira Network, Aizel

- ZK Infrastructure: Electron Labs, Kalypso

- Identity and Security: Holonym, Mishti, Venn, Altlayer

- Oracles: eOracle, Brevis, KGen

- Bridges: Router Protocol, 0xbridge

- Restaking and Yield: StakeEase, YieldNest, AutoLayer

These integrations reinforce KernelDAO’s goal of providing modular, composable infrastructure across blockchain verticals.

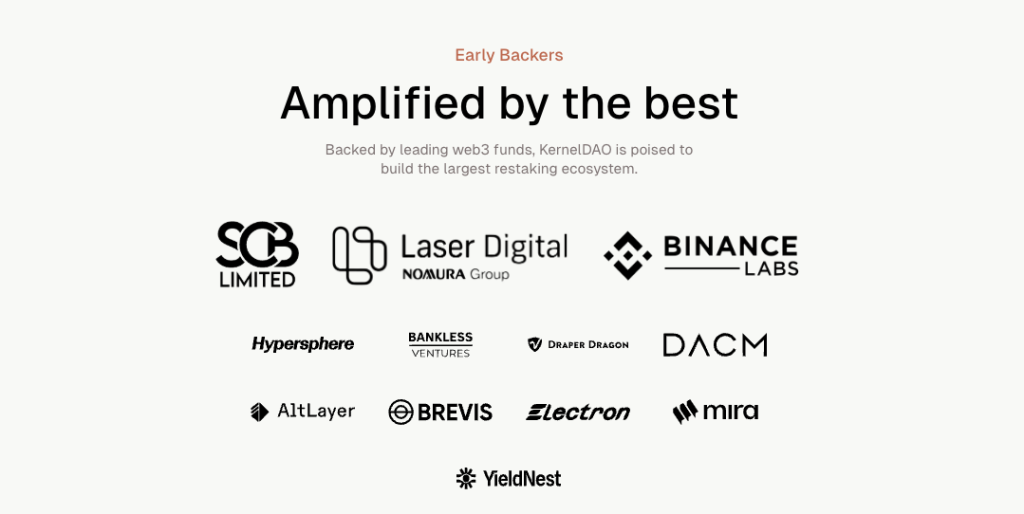

KernelDAO Raises $10M Backed by Binance Labs, Nomura, and GSR

In February 2025, KernelDAO introduced a $40 million ecosystem fund aimed at accelerating restaking adoption on BNB Chain and enhancing access to developer infrastructure. The fund supports grants, co-development of tools, and validator onboarding, contributing to the long-term scalability of the protocol.

The announcement follows KernelDAO’s earlier $10 million capital raise from a mix of venture capital and institutional investors. These participants bring strategic expertise, ecosystem connections, and operational guidance to the project’s multi-chain expansion across DeFi, CeDeFi, and real-world asset frameworks.

The following table outlines the key participants in the ecosystem fund and the investment round.

| Ecosystem Fund Backed By | Strategic VC Backing and Institutional Validation |

|---|---|

| Laser Digital (Nomura) | Binance Labs |

| SCB Limited | Bankless Ventures |

| Hypersphere Ventures | DWF Ventures |

| Cypher Capital | Laser Digital (Nomura) |

| ArkStream Capital | Cypher Capital |

| Levitate Labs | Hypersphere Ventures |

| SCB Limited | |

| Cluster Capital | |

| GSR, LongHash, Draper Dragon, among others |

With over $2 billion in TVL and more than 50 integrations, the restaking protocol continues to grow its role as a foundational infrastructure layer for multi-chain restaking systems. The combined capital from both rounds is critical in expanding its footprint in decentralized infrastructure.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |