- 21Shares files for a Dogecoin spot ETF with the SEC, boosting institutional interest.

- Dogecoin’s price surged 8-12% post-application.

- Approval could set a precedent for altcoin ETFs.

21Shares filed with the U.S. SEC on April 9, 2025, for a Dogecoin spot ETF to track DOGE price. The move indicates increasing interest in institutional adoption of cryptocurrencies.

The Dogecoin spot ETF proposed by 21Shares signals a notable expansion in crypto investment products, potentially offering more secure avenues for institutional investors.

21Shares Targets Dogecoin with New Spot ETF Proposal

21Shares, a prominent cryptocurrency ETP provider, has applied to the U.S. SEC for permission to establish a Dogecoin spot ETF. The filing seeks to leverage the CF DOGE-Dollar US Settlement Price Index. House of Doge, the corporate arm of the Dogecoin Foundation, supports the effort, providing marketing assistance. Coinbase Custody is chosen as the proposed custodian for the ETF’s Dogecoin assets.

Duncan Moir, President of 21Shares, has emphasized, “Dogecoin has become more than a cryptocurrency: it represents a cultural and financial movement […] offering investors a regulated avenue to be part of this exciting project.” The filing reflects growing institutional interest in cryptocurrencies and the strategic positioning of Dogecoin in the digital asset market. Bloomberg analyst James Seyffart has remarked on the aggressive nature of current crypto ETF filings, comparing them to a “spaghetti cannon approach” by issuers.

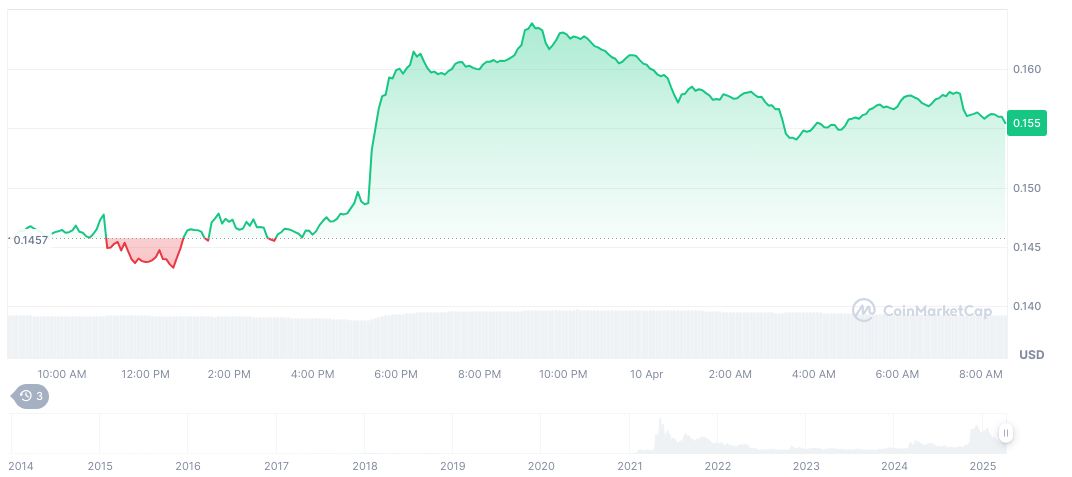

The market responded with optimism, seeing Dogecoin’s price increase by 8-12% following the ETF filing. Social media buzzed with discussions of potential institutional legitimacy and what this might mean for broader adoption. Analysts anticipate further altcoin ETF filings if the SEC approves, highlighting expectations for growing participation in the altcoin sector.

Historical Altcoin ETF Attempts and Dogecoin’s Market Data

Did you know? The filing for a Dogecoin spot ETF follows previous attempts by Grayscale and Bitwise. Grayscale’s proposal set a 240-day review window, underscoring a rigorous SEC vetting process for altcoin ETFs.

CoinMarketCap data shows Dogecoin priced at $0.16, with a market cap of $23.18 billion as of April 10, 2025. The cryptocurrency has experienced mixed movements, gaining 6.8% over 24 hours but declining more than 53% over 90 days. Dogecoin’s market dominance stands at 0.90%, with a 24-hour trading volume of $2 billion.

The Coincu research team observes that the 21Shares filing could mirror the precedent set by Bitcoin and Ethereum ETFs, opening paths for regulated crypto products. Such financial and regulatory movements provide a glimpse into the evolving digital asset market landscape, potentially encouraging broader acceptance of crypto as legitimate investment avenues.