- The SEC approved options trading for spot Ethereum ETFs, signaling a major shift.

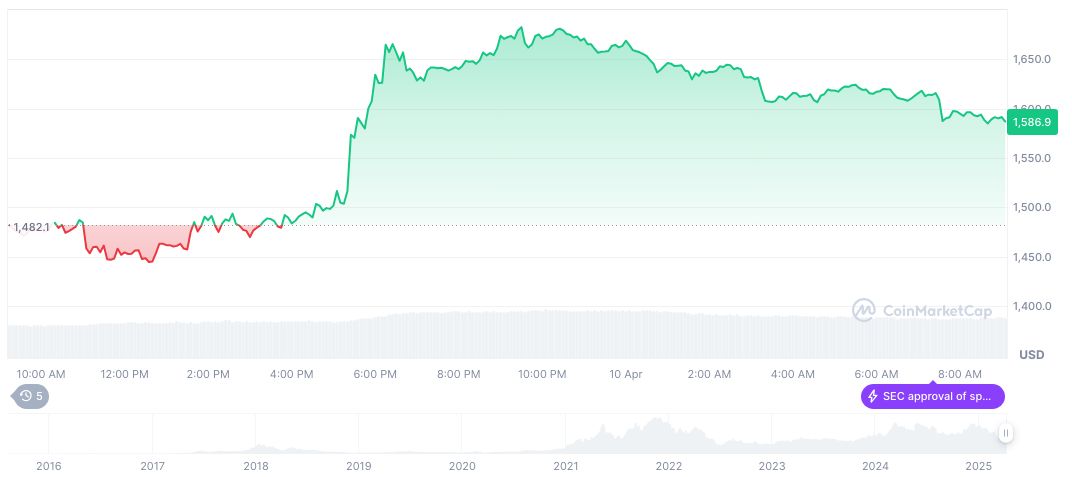

- Ethereum prices climbed to around $1,650.

- Institutions can now leverage advanced trading strategies with Ethereum ETFs.

The U.S. SEC has approved options trading for spot Ethereum ETFs, including BlackRock’s iShares Ethereum Trust ETF and Grayscale products, as announced on April 10, 2025.

This approval facilitates new strategic capabilities for Ethereum ETFs, boosting investor interest and market participation.

SEC Approval Alters Ethereum ETF Landscape

The SEC’s approval on April 10 for options trading involves BlackRock, Bitwise, and Grayscale ETFs. This marks a pivotal expansion in US crypto investment infrastructure. The SEC Rulemaking Document SR-ISE-2024-35 highlights accelerated approval, reflecting growing acknowledgment of Ethereum’s legitimacy in financial markets.

With options trading approved, ETF issuers can introduce covered-call strategies, enhancing investor appeal and product diversity. Such developments promise increased liquidity, drawing both institutional and retail interest.

Market reactions were swift, as Ethereum rose significantly, showing renewed optimism. James Seyffart, ETF analyst, noted this progression was expected.

“The approval was 100% expected. It was the next logical step in ETF market development.”

Nate Geraci predicted more innovative Ethereum products ahead, underscoring broad industry support.

Ethereum Hits $1,650 with Trading Volume Surge

Did you know? This marks a continuation from the SEC’s approval of spot Bitcoin ETFs in 2024, providing a template for Ethereum options trading.

According to CoinMarketCap, Ethereum (ETH) trades at $1,588.11, with a market cap of $191.65 billion. The 24-hour trading volume soared by 24.44% to $34 billion, as ETH showed a 7.25% gain in the last 24 hours compared with noticeable declines over longer periods.

The Coincu research team indicates that having options trading for Ethereum ETFs could accelerate institutional acceptance, potentially reshaping the regulatory landscape. Technological adoption and liquidity might see sustained growth, paralleling historical Bitcoin ETF impacts.