- Main event includes DWF Labs’ liquidity injection of $18M into USD1.

- USD1 paired with top tokens on Ethereum and BSC chains.

- Political ties raise speculation and market interest.

World Liberty Financial (WLFI), supported by the Trump family, has recently seen an $18 million liquidity injection for its USD1 stablecoin by DWF Labs on both Ethereum and Binance Smart Chain.

The deployment of liquidity across major blockchains signifies a growing interest in USD1’s potential within the DeFi landscape, drawing geopolitical attention due to its unique backers.

Trump Family-Backed USD1 Receives $18M Liquidity Boost

DWF Labs has introduced six liquidity pools worth $18 million to support the USD1 stablecoin project linked to the Trump family. The pools span Ethereum and Binance Smart Chain. Involving popular tokens like USDT, USDC, ETH, and BNB, these engagements aim to enhance trading opportunities. Further, USD1’s adoption has surged, achieving $44.9 million in trades since launch, as per CoinGecko.

Community responses remain mixed. Some express optimism about USD1’s liquidity pool deployment, while others emphasize potential risks associated with political ties. Andrei Grachev, Managing Partner at DWF Labs, hinted at further investments:

“The previously launched $250 million liquidity fund still has $184 million remaining, and projects needing funding injection and partners can continue to apply.”

Geopolitical Interest and DeFi Integration Boost USD1’s Profile

Did you know? The involvement of the Trump family in a crypto initiative like WLFI could significantly influence projects comparable to Tether’s market, potentially introducing additional scrutiny and layers of complexity in adoption.

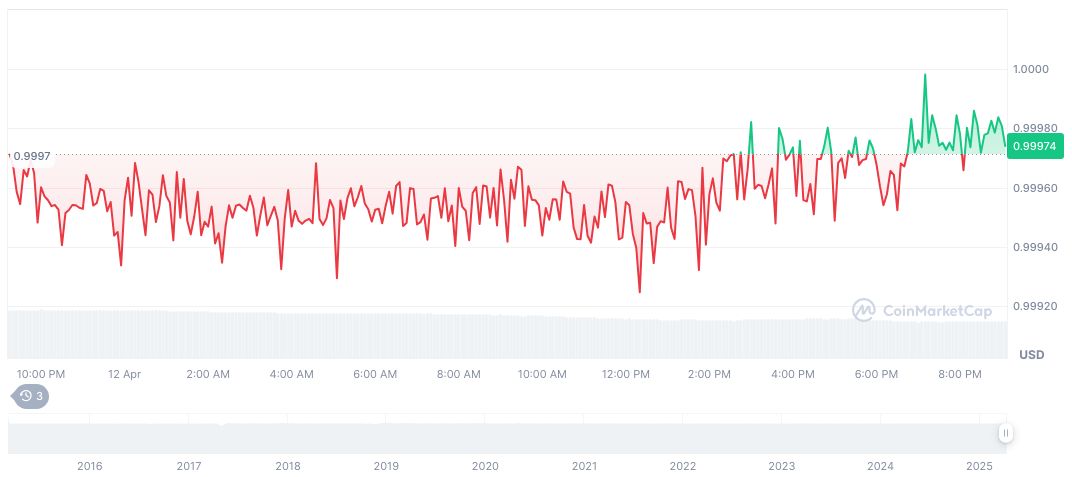

According to CoinMarketCap, Tether USDt (USDT), a leading stablecoin, maintains a value of $1.00 with a market cap of $144.37 billion, accounting for a 5.31% market dominance. Its current trading volume is at $53.84 billion, indicating a drop of 22.45% within the past 24 hours. Despite minor price changes over the past months, USDT continues to dominate the market.

The Coincu research team suggests the growing liquidity and integration of USD1 into DeFi could translate into broader financial activity, although raising regulatory and political queries, primarily due to its association with a politically influential family.