- OM token collapse investigated by OKX, triggering industry-wide concerns.

- Mantra DAO denies involvement, blames exchange activity.

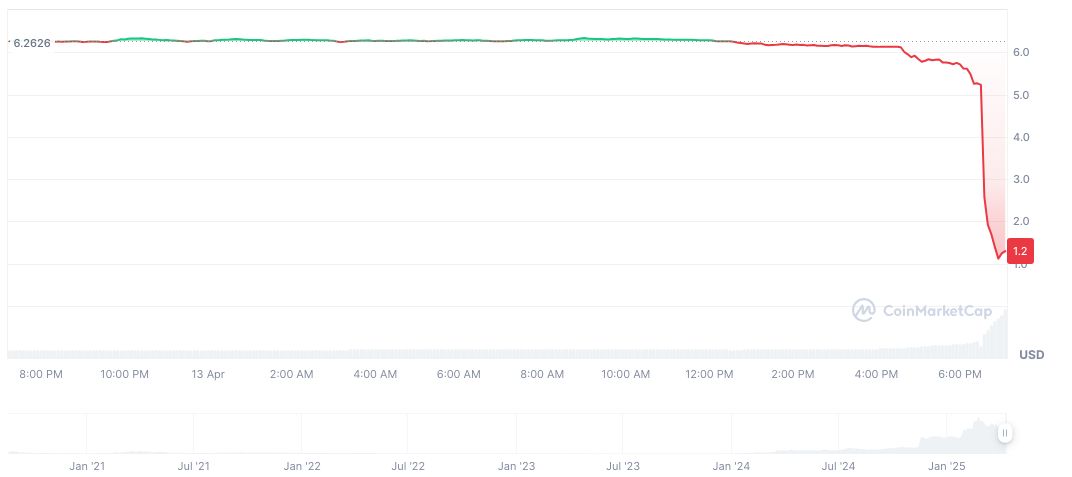

- OM’s market value drops 90% in one hour.

OKX CEO Star Xu has dubbed the recent collapse of the OM token on April 14 as a “major scandal,” prompting the exchange to prepare comprehensive reports. This event has attracted scrutiny over the practices of centralized exchanges during low-liquidity periods.

The rapid sell-off and subsequent 90% drop in the OM token’s value, erasing approximately 5.5 billion in market capitalization, have highlighted concerns over exchange risk management and tokenomics transparency.

OM Token Crash Prompts Detailed OKX Investigation

Star Xu, OKX’s CEO, announced that the exchange will release a detailed report on the OM token crash, emphasizing transparency and investigation into the transactions. “This is a major scandal for the entire cryptocurrency industry. All on-chain unlocking and recharge data has been made public, and the collateral and liquidation data of all mainstream exchanges may be investigated. OKX will prepare all reports.”

The Mantra DAO team denied any role in the sell-off, attributing it to forced liquidations by centralized exchanges during low-liquidity hours, according to CEO John Patrick Mullin in a statement on cryptocurrency trends. The team revealed that their tokens remained locked and not sold publicly.

The broader industry has reacted, with Binance CEO Changpeng Zhao expressing concerns over exchange risk management, noting, “Like everyone else, I’m wondering ‘what happened to this?’” Various analysis platforms pointed to significant preemptive token movements before the crash, casting doubt on exchange practices.

Increased transparency and improved regulatory frameworks could lead to enhanced protection for investors and stability in cryptocurrency markets. The Coincu research team suggests that the incident might prompt regulatory scrutiny over centralized exchanges and on-chain governance in tokenomic systems. Significant movements in blockchain technology have also been a point of discussion.

Industry Reactions and Regulatory Implications

Did you know? In just a single hour on April 14, the OM token’s market value plummeted by over 90%, reminiscent of the rapid decline seen during the LUNA fiasco. This highlights an ongoing vulnerability in crypto markets to exchange-driven liquidations.

Market data and trading volume have shown significant fluctuations following the OM token collapse, raising alarms among investors and analysts alike.

Experts suggest that the incident may lead to stricter regulations and a reevaluation of risk management practices within centralized exchanges to prevent future occurrences.