- Two Ethereum whales liquidated 16,923 ETH worth $27.88 million.

- Major ETH sales heighten market volatility.

- Market reactions reflect mixed investor sentiment.

Two significant Ethereum holders recently liquidated 16,923 ETH, amounting to around $27.88 million, through major exchange transactions.

This whale activity has intensified the pressure on Ethereum prices, contributing to increased market volatility and raising concerns about long-term implications for the digital currency.

Whales Offload Massive ETH Amidst Price Drop

A recent report by Lookonchain identified two significant whale addresses, which engaged in extensive Ethereum sales involving 16,923 ETH. The first address, starting with 0xc19D, deposited 8,922 ETH, worth $14.82 million, into Kraken. The second, opening with 0x4e7a, sold 8,001 ETH at $1,632, worth nearly $13.06 million.

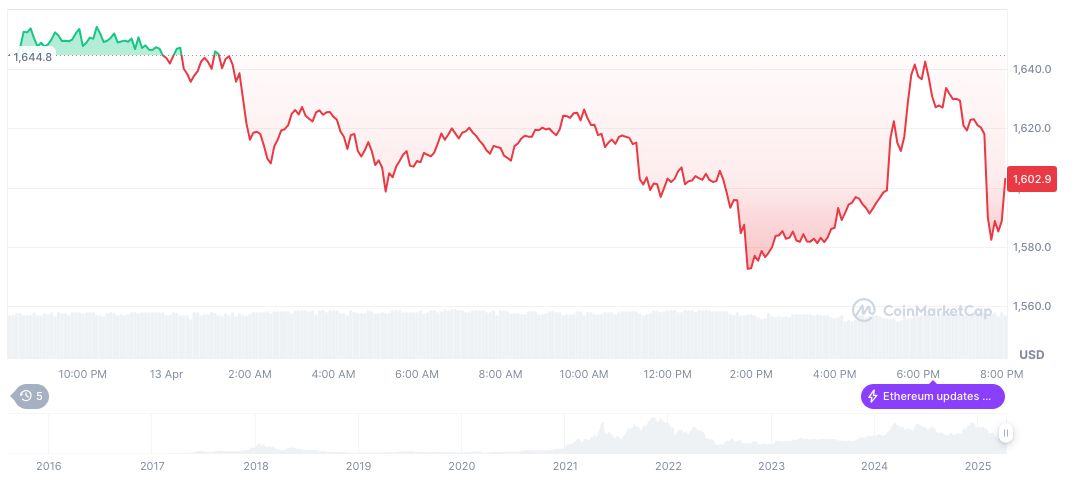

The sales have impacted market perception, putting downward pressure on Ethereum’s price, which is currently hovering around $1,623. With investor sentiments sensitive to large-scale crypto movements, the liquidations come amidst a year where ETH prices have already fallen significantly.

Crypto community discussions reflected mixed sentiments on platforms like Twitter and Reddit, with apprehensions over Ethereum’s viability juxtaposed against optimism for potential recoveries. Although no immediate market regulatory changes are visible, such large transactions tend to invite scrutiny regarding potential market manipulations.

Market Volatility and Potential Regulatory Responses

Did you know? Previously, in April 2023, similar whale sales by inactive wallets caused fluctuations in the crypto market, underscoring the influence of large holdings on cryptocurrency stability.

According to CoinMarketCap, Ethereum is priced at $1,630.67, with a market cap of approximately $196.81 billion, indicating market dominance of 7.37%. Recent trading volumes reached $18.96 billion despite a 69.11% volume change. During the past 90 days, ETH has lost 48.94% of its value, reflecting ongoing investor caution.

Insights from the Coincu research team suggest that continuing volatility could lead to tighter regulations in crypto markets. Historical data shows that such large-scale liquidations are often connected with broader bearish trends, despite optimism for long-term recovery tied to technological upgrades in Ethereum’s network.

Tomasz K. Stańczak, Co-Executive Director, Ethereum Foundation, emphasized the long-term importance of upgrades for scaling and usability: “The continued focus on scaling solutions is crucial for long-term viability.”