- US Bitcoin spot ETFs reported $171 million net outflow, BlackRock gained.

- Fidelity and ARK saw significant outflows, indicating investor shift.

- No direct statements or reactions from ETF executives on outflows.

On April 16, 2025, US Bitcoin spot ETFs recorded a net outflow of $171 million, impacting multiple funds like Fidelity and ARK.

This event signifies ongoing institutional caution in the crypto market, as illustrated by investor behavior and ETF performance over recent weeks.

$171 Million Outflow from Bitcoin Spot ETFs Highlights Investor Shift

The net outflow of $171 million from US Bitcoin spot ETFs on April 16 underscores changing investor sentiment towards cryptocurrencies. Funds such as Fidelity (FBTC) and ARK (ARKB) saw substantial outflows, losing $113.8 million and $113.2 million, respectively, while BlackRock (IBIT) and Bitwise (BITB) gained $30.6 million and $12.8 million.

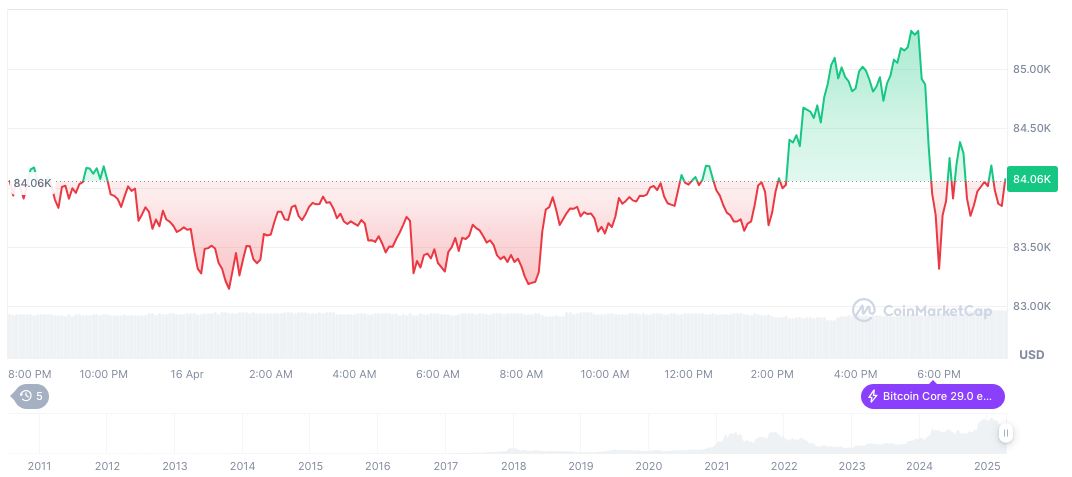

Investors are reconsidering their strategies amid macroeconomic uncertainties, with these changes in ETF flows potentially signifying a growing conservative sentiment. Despite these shifts, Bitcoin’s market price has remained stable above $84,000.

No major public statements came from key figures like Larry Fink of BlackRock or Cathie Wood of ARK concerning this event. Some community discussions reflect unease about long-term Bitcoin and crypto prospects, as noted by BlockBeats News via Twitter and Telegram.

“The current market dynamics showcase both resilience and caution among institutional investors, with our ETF seeing positive inflows amidst overall industry outflows.” – Larry Fink, CEO, BlackRock

Bitcoin ETFs Face Consistent Outflows Amid Economic Concerns

Did you know? In early April, Bitcoin ETFs experienced $812 million in net outflows, highlighting consistent institutional caution even amidst Bitcoin’s positive price trends.

As of April 17, 2025, Bitcoin (BTC) trades at $83,937.30 with a market cap of $1.67 trillion according to CoinMarketCap. The trading volume in the last 24 hours stands at $28.36 billion, showing a 0.24% increase. Overall market conditions reflect minor fluctuations, marked by a 2.68% gain over the past week but a 16.94% downturn over 90 days.

The Coincu research team suggests that recent outflows from ETFs mirror heightened sensitivity to external economic factors, impacting overall cryptocurrency market dynamics. Investor focus remains on regulatory announcements and technological advancements that might pivot future investment directions. These insights reflect strategic shifts aligned with broader market trends.