- Crypto firms back Trump inauguration, impacting regulation dynamics.

- Regulatory shifts favor crypto, curbing previous restrictions.

- Donations reflect increased political involvement from the sector.

Uniswap and Solana Labs contribute large sums to President Trump’s inauguration fund, alongside major corporate donors, post-2024 election results.

These contributions from crypto firms occur amidst regulatory shifts favoring the industry, with the SEC easing actions against major crypto players.

Crypto Donations Influence U.S. Regulatory Landscape

Uniswap CEO Hayden Adams donated over $245,000, while Solana Labs contributed $1 million to President Trump’s inauguration fund. These actions were part of a larger trend where crypto firms like Consensys, Coinbase, and Robinhood made contributions. FEC filings confirm these transactions of April 20, 2025.

Regulatory changes under the new administration include halted investigations by the SEC, benefiting firms like Uniswap and Consensys. Enforcement actions have been reduced, coupled with more favorable legislation for crypto firms, including potential legislation acceleration and the formation of a strategic U.S. Bitcoin reserve.

“Our contributions reflect a commitment to engaging with regulatory frameworks that support innovation in the crypto space.” – Hayden Adams, CEO, Uniswap

Reactions within the market show optimism, with key stakeholders eyeing improved regulatory conditions. Although no public statements by crypto executives surfaced immediately, the community remains hopeful about legislation fast-tracking and a potential role reversal in regulatory approaches.

Market Reactions and Future Projections Amid Shifts

Did you know? Near-record donations for the Trump’s 2025 inauguration soared past his previous 2017 total, reflecting growing financial influence from the crypto sector since past political fundraisers.

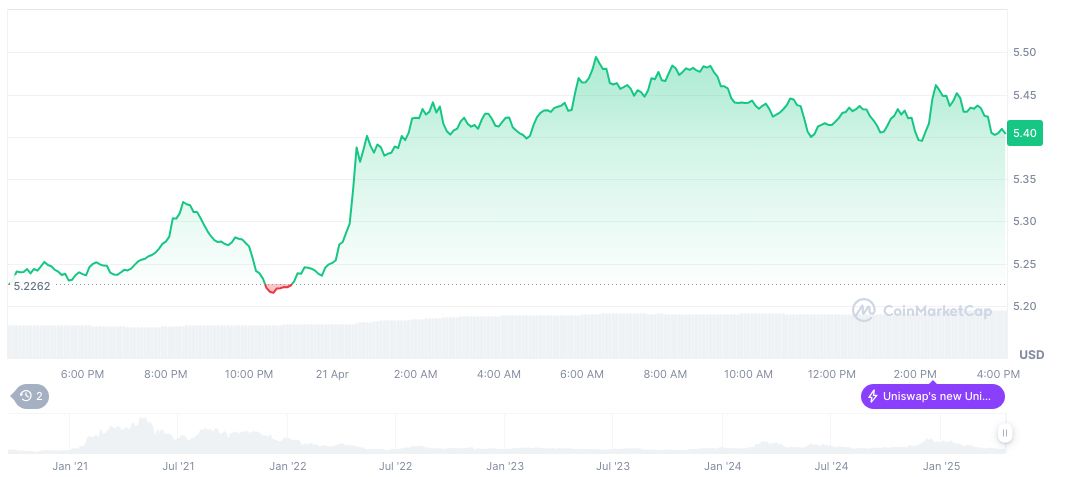

CoinMarketCap reports Uniswap (UNI) with a price of $5.24, a market cap of $3.29 billion, and a trading volume of $91.38 million. Over 90 days, UNI observed a -61.17% price change, showcasing market volatility amidst shifting regulations and investor sentiments.

Coincu research highlights potential reductions in regulatory hurdles, allowing more investment-friendly environments. Experts suggest that ongoing legislative amendments could expedite technological contributions and positioning within the global market. Data-driven optimism surrounds DeFi enhancements and blockchain mainstream integration.