- Zora launches on Binance, sparking notable trading activity and market interest.

- Zora trading volume surged by 165,774.43%.

- Funding rounds increase cross-chain staking integration potential.

Zora recently launched on Binance, rapidly drawing attention with a notable surge in trading activity. As this new listing unfolds, market participants are closely monitoring developments and reactions.

Binance’s listing of Zora marks a significant event in the digital asset space, bringing newfound visibility and trading opportunities to Zora. The official announcement by Binance Wallet on X (formerly Twitter) highlighted this strategic expansion, attracting investors keen to capitalize on new digital assets.

Zora’s Binance Debut: Trading Volume Skyrockets Over 165,000%

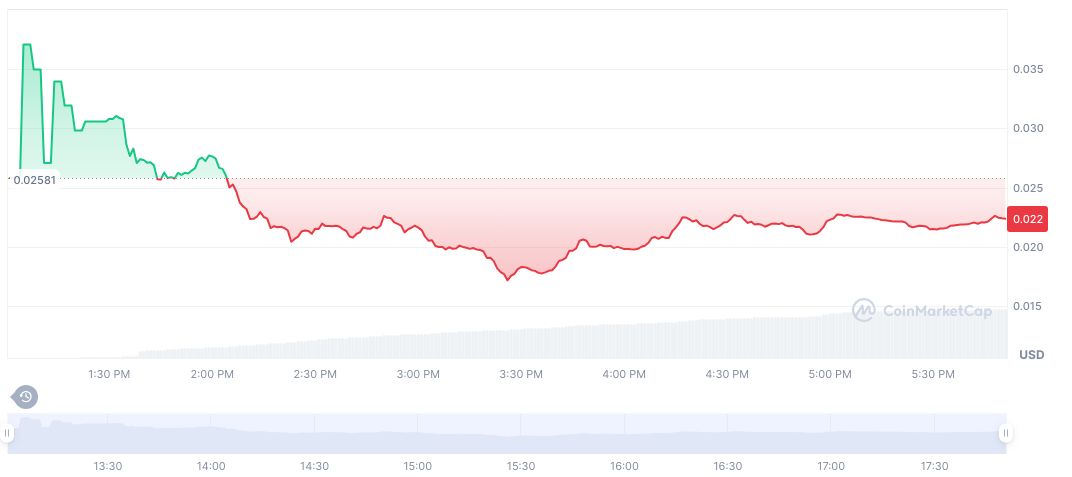

Notable market activity followed Zora’s debut, evidenced by a robust surge in trading volume. Over 165,774.43% growth in a 24-hour period reflects both investor interest and potential volatility sparked by the launch. Price volatility remains a prevalent theme, echoed by the 12.96% dip across the 90-day spectrum.

Despite the absence of high-profile endorsements or public statements from industry leaders like CZ of Binance, community discussions have shown heightened interest. Observers in industry forums await further insights, recognizing the potential influence such a high-profile listing may bring.

“View blockchain rationally, enhance risk awareness, and be cautious of various virtual token issuances and speculations. All content on this site is solely market information or related party opinions, and does not constitute any form of investment advice.” – ChainCatcher

Experts Weigh In: Implications of Zora’s Market Presence

Did you know? The introduction of new digital assets on top-tier exchanges like Binance frequently causes temporary price surges, reflecting historical patterns of speculative trading and investor enthusiasm across the cryptocurrency landscape.

As per CoinMarketCap, Zora is currently priced at $0.02, with a fully diluted market cap over $224.63 million. Recent price shifts indicate a consistent decline of 12.96% over various time scales, highlighting a potential volatility following its recent exchange listing.

Experts at Coincu underscore that large-scale listings on exchanges like Binance can foster increased mainstream adoption, potentially influencing regulatory scrutiny and prompting market diversification investments. With Zora’s situation, observers contend that the impact of its launch is unfolding amidst shifting regulatory landscapes and growing cryptocurrency acceptance.